Community Bankers Adapting to Higher Interest Rates

By Thomas F. Siems, Ph.D., CSBS Chief Economist

The CSBS fourth quarter 2023 Community Bank Sentiment Index (CBSI) indicates that community bankers are less pessimistic than they were in the previous two quarters, but concerns persist. The Federal Reserve’s aggressive monetary tightening over the past 22 months has significantly raised interest rates, resulting in lower loan demand, greater deposit competition, and an inverted yield curve. With narrower net interest margins, community bankers’ challenge will be to assiduously manage their banks’ assets and liabilities to maintain profitability.

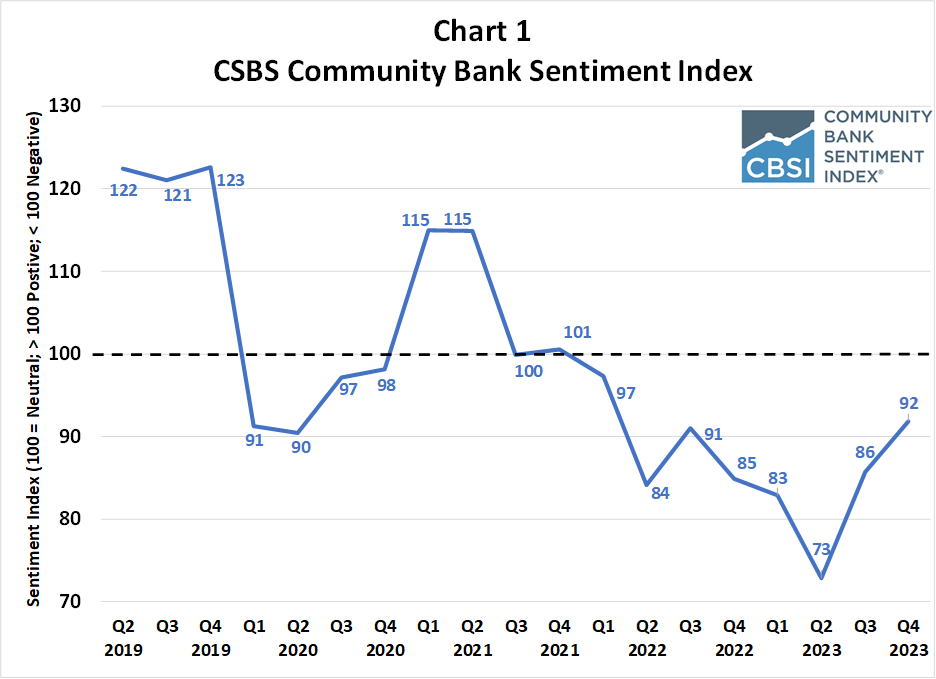

At 92 points, the CBSI remains below its neutral level of 100 but is 19 points higher than its historic low of 73 from just six months ago, signaling community banker pessimism is not as bleak as it has been all year. Even so, the most recent survey underscores that community bankers continue to be deeply concerned about future business conditions, profitability, and regulatory burdens.

Chart 1 shows that the CBSI has been below the neutral level of 100 — which signals that community bankers have a pessimistic outlook — since the start of 2022. However, the most recent reading is the highest level in seven quarters, indicating that community banker sentiment is not as dismal as previously.

In fact, there are four components (of the seven indicators that comprise the CBSI) that have consistently dragged the overall index lower in 2023, but have all improved from their lows from six months ago even though they remain in “contraction” or “pessimism” territory below the neutral level of 100:

- Regulatory burden improved from 18 to 25.

- Business conditions improved from 43 to 73.

- Profitability improved from 78 to 81.

- Monetary policy improved from 33 to 96.

While all of these improvements are noteworthy, the most significant uptick was the monetary policy indicator, which rose 63 points from the second quarter of 2023.

In March 2022, the Federal Reserve’s monetary policymakers began to aggressively increase the target on the short-term Fed Funds Rate to combat rising inflation. By the end of 2022, they had boosted the overnight rate by 425 basis points, resulting in the yield curve inverting in July 2022 as short-term interest rates went higher than longer-term interest rates. Not coincidentally, the CBSI monetary policy component fell from 95 points at the beginning of 2022 to 33 by the end of 2022.

In early 2023, the Fed continued to raise the Fed Funds rate by another 100 basis points. But since their meeting in July, the Fed has paused on additional rate increases, holding the Fed Funds target rate in a range of 5.25%-5.50%. And since then, the CBSI monetary policy component has rebounded back to 96, just below the neutral level of 100, even as the yield curve has stayed inverted.

Could it be that community bankers are starting to think the Fed might pull off an economic soft-landing and avoid a recession? Perhaps, but not according to one of the CBSI survey’s special questions.

Eighty-one percent of the respondents to the fourth quarter 2023 CBSI survey indicated that the U.S. economy is at the start of, or already in, a recession. The good news—and maybe a hint of “soft landing” news—is that that percentage of community bankers thinking the economy is in a recession is down from 87% last quarter and 95% from six months ago.

So, what’s going on?

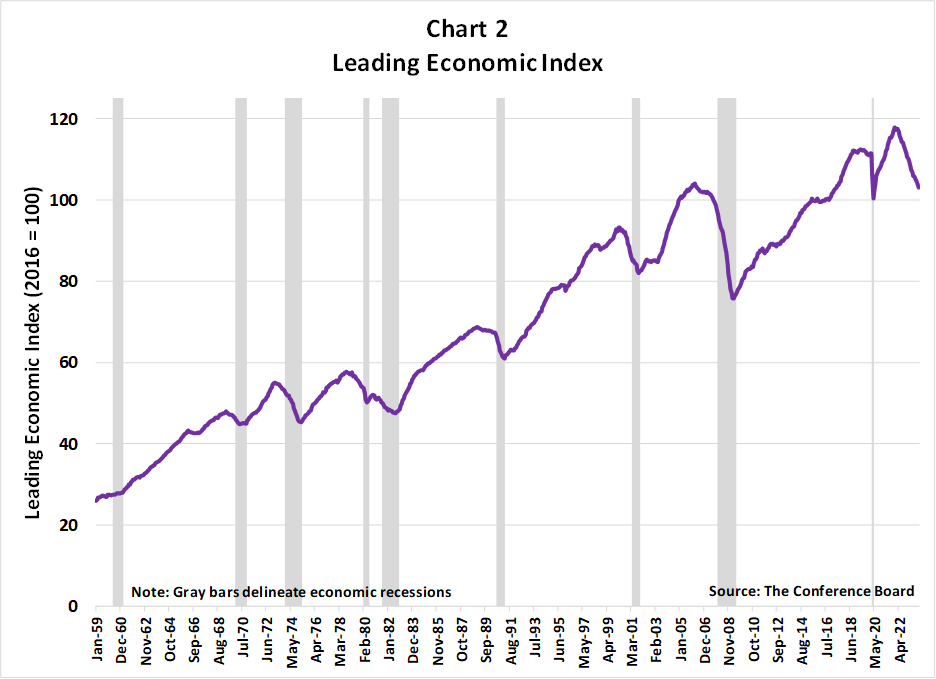

Recession-minded prognosticators’ fears of a downturn have not materialized primarily because of the strength of monthly payroll employment gains and a low unemployment rate that has been at, or below, 4% since December 2021. Even so, recession probabilities remain elevated because many leading indicators are showing signs of economic malaise. Chart 2 shows that The Conference Board’s Leading Economic Index (LEI), comprised of 10 forward-looking metrics, has fallen for 20 consecutive months.

Historically, whenever the LEI drops by at least seven consecutive months, it has accurately signaled that an economic recession is forthcoming. Based on the most recent LEI data (November 2023) and an analytics model constructed to compute the odds of a recession, the probability of a recession in the next twelve months is 57.4%.

The forward-looking variable in the LEI that has moved the most since the Fed began raising rates in March 2022 is the yield curve, or interest-rate spread between the 10-year Treasury note and the Fed Funds rate. The implied recession probability based on the spread at the end of December 2023 was 80.4%, near its peak level of 86.4% in May 2023 and much higher than its low of 38.8% from mid-October 2023 when the 10-year Treasury rate hovered around 5%.

Moreover, despite solid economic growth and relatively strong consumer spending in 2023, most consumer and business confidence indices remain well below their long-run averages and continue to signal pessimism. The November 2023 University of Michigan Consumer Sentiment Index was 61.3, not much higher than the November 2022 reading of 56.7 and down from 67.4 two years ago, 76.9 three years ago, and 96.8 just before the 2020 pandemic/lockdown recession. Likewise, the National Federation of Independent Business (NFIB) Small Business Optimism Index was 90.6 in November 2023, roughly equivalent to the 91.9 reading in November 2022 and down from 98.4 two years ago, 101.4 three years ago, and 104.7 in November 2019.

The CBSI shows a similar pattern. The most recent reading of 92 is better than last year’s value of 85, but lower than the readings of two years ago (101), three years ago (98), and, like the Consumer Sentiment Index, much lower than four years ago (123).

But community bankers arguably have a better crystal ball than most consumers and businesspeople in divining the future of the economy. As relationship lenders, community bankers can perceive future economic conditions well in advance of backward-looking and often-revised statistics that are typically used to assess the economy. Bankers know when lenders might be in trouble before credit quality wanes and loan default rates worsen. Bankers know when businesses might have plans to hire or fire employees well before “help wanted” ads or “pink slips” appear.

And right now, community bankers seem to be concerned that the U.S. economy has not yet felt the full force of the Fed’s aggressive tightening. For bankers, financial performance is more challenging when rates change quickly: net interest margins are stressed, liquidity is squeezed, securities values plummet, loan demand declines, and credit quality can deteriorate. Additionally, higher interest rates and greater economic and geopolitical uncertainty often mean that plans to boost capital spending and/or expand operations are postponed or cancelled altogether.

Indeed, this appears to be happening now for community bankers. Higher interest rates seem to be taking a toll on expanding operations and boosting capital spending. In the fourth quarter 2023, these two CBSI indicators both plunged significantly when they have historically propelled the index higher. The operations expansion component fell 10 points from the third quarter to 119 and is at its lowest level since the survey premiered in 2019. Similarly, the capital spending indicator slumped 14 points from the third quarter to 118 and is at its lowest point since the end of 2020.

While both the operations expansion and capital spending indicators are still above 100 and signal expansion, they did not contribute as much as they typically do to boosting the overall index higher. In fact, these two components of the CBSI are the only two indicators to fall from the previous quarter. If they had maintained their previous values, the overall index would have been three points higher.

In open-ended comments at the end of the CBSI survey, many community bankers noted their concerns about the potential impact from higher rates. One banker said, “Raising interest rates eleven times in the past 15 to 16 months has hurt all banks and the housing market.” Another said, “Dramatically higher interest rates, raised at an unprecedented speed, have negatively impacted all aspects of the business cycle, with significantly lower loan demand and significant uncertainty regarding business cycles.” And another banker added, “Community banks do not operate well in an inverted yield curve environment.”

Using the interactive dashboard on the CBSI website, we find that the aggregated CBSI for the 43% of community bankers expecting lower profitability was 70, compared to 120 for the 24% expecting higher profitability. While both groups of bankers hold a pessimistic view on future business conditions, the bankers expecting lower profitability were significantly more pessimistic with a reading of 55 versus 94 for bankers expecting higher profitability.

For sure, 2024 will likely prove to be another challenging year for community bankers. How bankers maintain profitability in a higher interest rate environment with an inverted yield curve will likely be the main key to success.

- Podcasts

Positive Negativity - Community Banker Sentiment Rises to Start 2024

Apr 23, 2024

- Press Releases

Community Bankers’ Economic Outlook Still Pessimistic but Shows Upswing

Apr 8, 2024

- Blog post

Do Ag Banks View Risks Differently?

Mar 19, 2024

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts