Back to Dismal? Community Banker Sentiment Rebounds but Remains Gloomy

By Thomas F. Siems, Ph.D., CSBS Chief Economist

The CSBS third quarter 2023 Community Bank Sentiment Index (CBSI) rebounded sharply from last quarter’s record low, with all seven components that comprise the index advancing. At 86, the index remains well below the neutral level of 100, but community banker pessimism on the outlook for the U.S. economy appears to have climbed out of a dark abyss. In the latest survey, 87% of community bankers say the U.S. economy is in a recession, compared to 95% at mid-year.

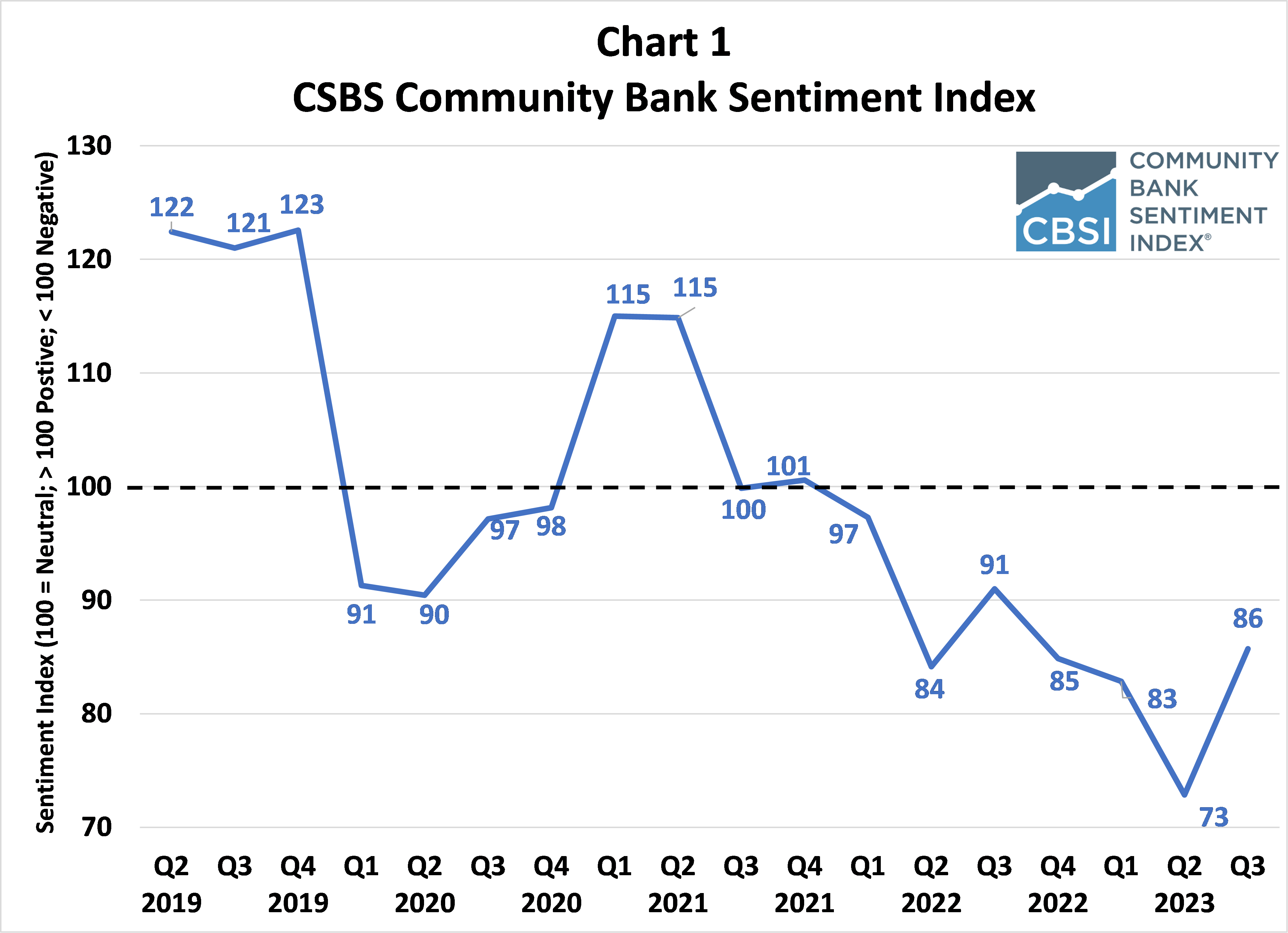

Chart 1 shows that the headline number from the third quarter 2023 CBSI was 86, increasing 13 points from the second quarter 2023 record low of 73 and 5 points lower than one year ago. The index has been below the neutral level of 100 for seven straight quarters. Values below 100 tend to indicate community bankers hold a negative sentiment and values above 100 signal a positive outlook.

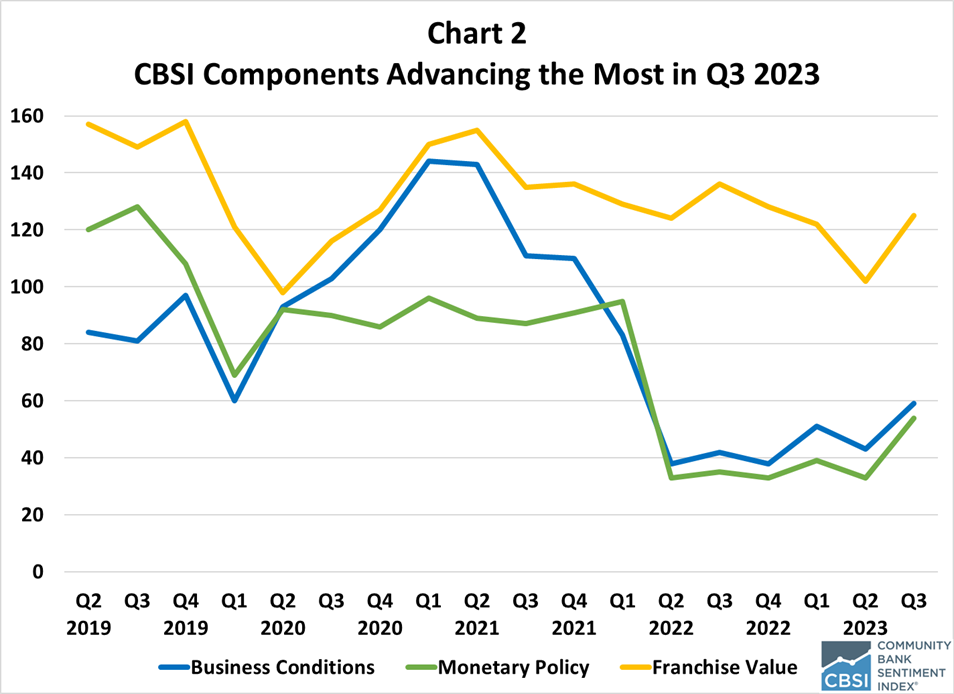

While all seven components of the CBSI improved, Chart 2 shows the three indicators that helped the most to propel the index to its highest level since the third quarter of 2022. Future franchise value gained 23 points to 125 and is now back near its average reading during the previous five quarters.

The component that assesses the impact of monetary policy rose 21 points to 54 after being in the 30s during the previous five quarters. During the third quarter, the Federal Reserve raised their target range for the Fed Funds Rate by 25 basis points, compared to hikes totaling 75 basis points the first half of 2023 and 425 basis points in 2022.

The future business conditions indicator rose 16 points to 59 after hitting a low of 38 twice in 2022. Stronger than expected employment growth may have contributed to improved banker sentiment. Monthly payroll employment advanced an average of 266,000 jobs in the third quarter compared to 201,000 in the second quarter.

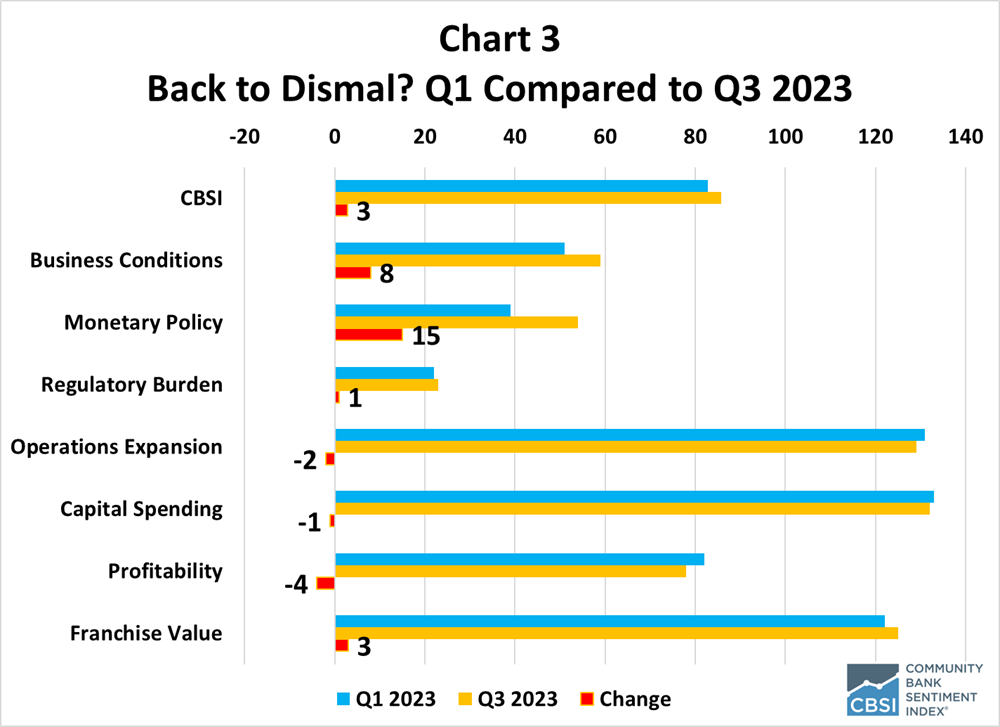

Even with these improvements, two of these three indicators remain well below the neutral level of 100 and continue to have a negative impact on the index. A better comparison with this quarter’s CBSI might be its levels from two quarters ago (the first quarter 2023 CBSI), which we referred to as being in the doldrums at the time and as being dismal in last quarter’s analysis.

Chart 3 shows that most of the indicators moved little over the last six months. The monetary policy component had the greatest change, increasing 15 points from 39 to 54, and the future business conditions indicator rose 8 points from 51 to 59. Overall, the composite index rose from 83 in the first quarter to 86 in the third quarter. Back to dismal? Maybe. Or a little better.

- Podcasts

Positive Negativity - Community Banker Sentiment Rises to Start 2024

Apr 23, 2024

- Press Releases

Community Bankers’ Economic Outlook Still Pessimistic but Shows Upswing

Apr 8, 2024

- Blog post

Do Ag Banks View Risks Differently?

Mar 19, 2024

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts