Community Banker Sentiment in the Doldrums

By CSBS Chief Economist Thomas F. Siems, Ph.D.

The CSBS first quarter 2023 Community Bank Sentiment Index (CBSI) indicates that community bankers are more pessimistic than at any time since the survey’s creation in 2019. Consistent with the 2022 quarterly CBSI surveys, three of the seven components plunged the index sharply lower: future regulatory burden, monetary policy expectations, and the outlook for business conditions. And like last quarter, 94% of community bankers believe the U.S. economy is currently in a recession.

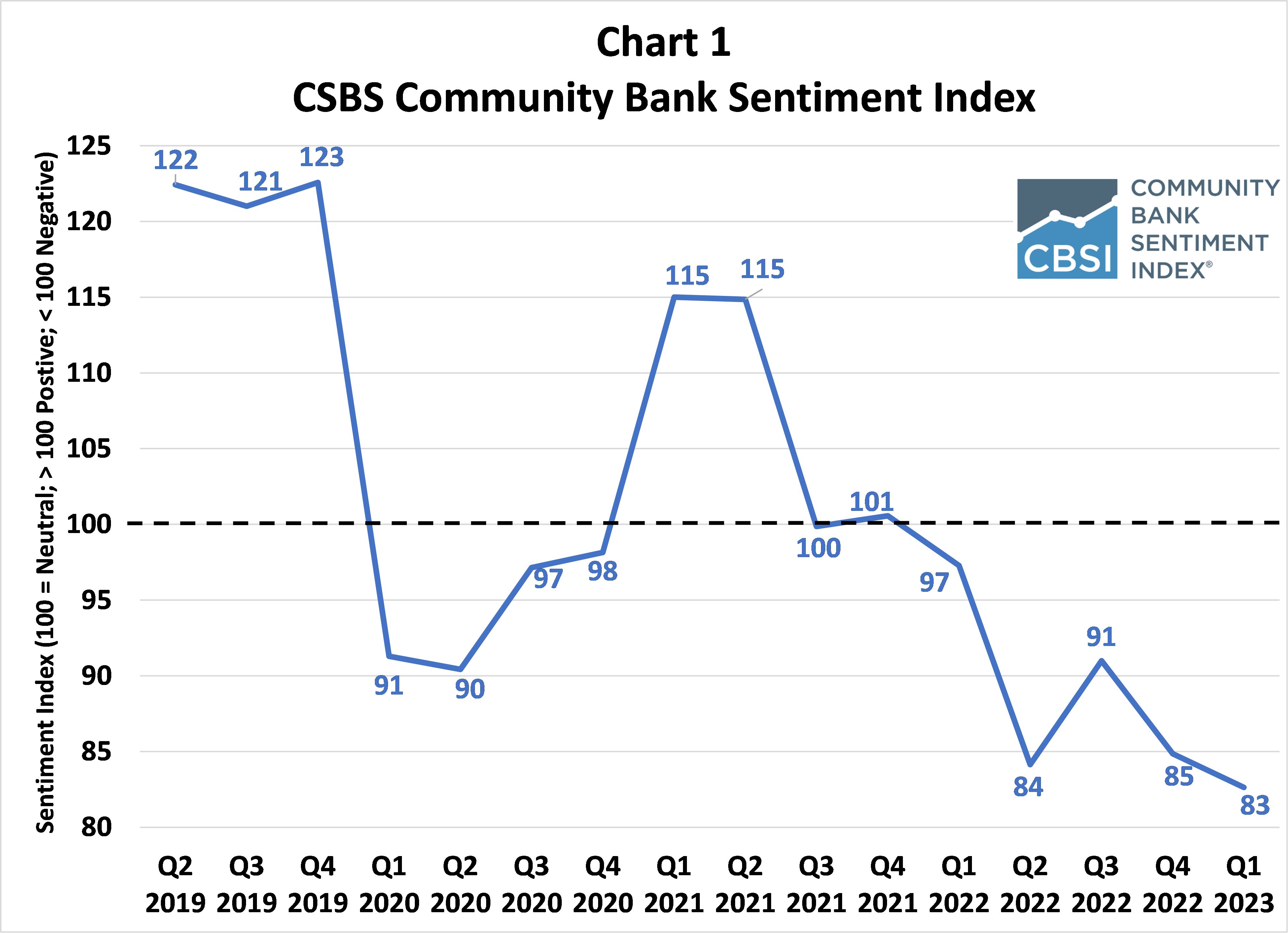

Chart 1 shows that the headline number from the first quarter 2023 CBSI was 83, down two points from the fourth quarter 2022 survey and 14 points lower than one year ago. The neutral level is 100, with values below 100 indicating community bankers hold a negative sentiment and values above 100 signaling a positive outlook. The first quarter 2023 reading is the fifth consecutive quarterly reading below 100 as higher inflation, rapidly rising interest rates, and weaker economic growth dominate headlines in describing the U.S. economy.

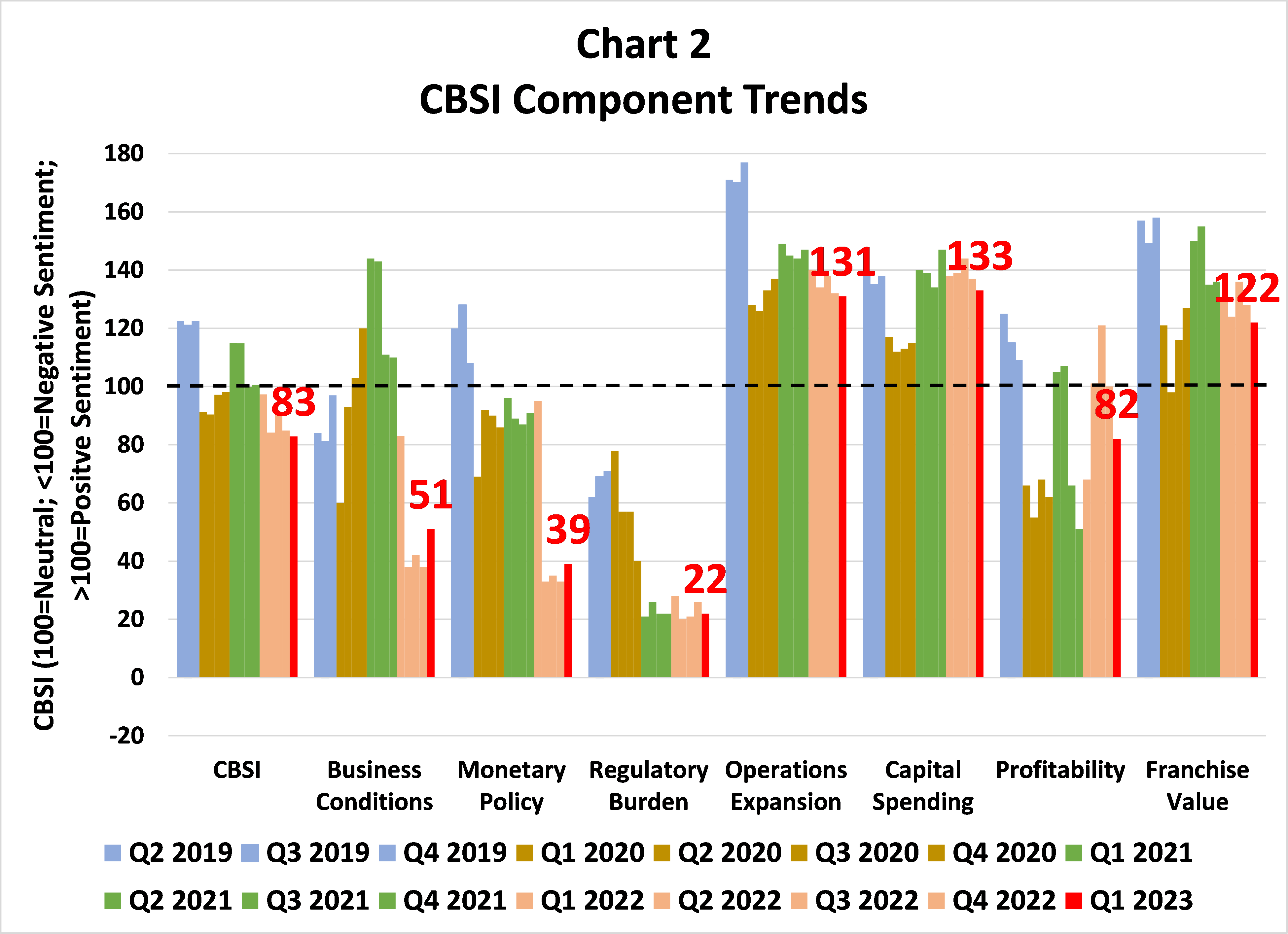

Chart 2 shows the component trends for the seven indicators that comprise the CBSI. Five of the seven components moved lower compared to the fourth quarter 2022 values, with the future profitability metric declining the most from 100 last quarter to 82 this quarter. Using the interactive dashboard on the CBSI website, we find that the aggregated CBSI for the 50% of bankers expecting lower profitability was 61, compared to 113 for the 31% expecting higher profitability. While both groups of bankers hold a pessimistic view on future business conditions and the future impact from monetary policy actions, the bankers expecting lower profitability were significantly more pessimistic (reading of 34 versus 70 for future business conditions and 27 versus 60 for the monetary policy component).

Indeed, following the sudden liquidity concerns and bank failures in mid-March, more attention is now focused on the Federal Reserve. The central bank must continue its fight against inflation, and now also deal with greater financial instability. This perceived policy conflict increases uncertainty regarding the speed and magnitude of future interest rate changes and appears to have raised the probability of a recession.

According to the CSBS first quarter 2023 survey, 94% of community bankers already believe the economy is in a recession. In open-ended comments, several bankers warned about deteriorating credit quality from the rapid interest rate increases and a slowing economy. One banker said, “Rising interest rates cause us to worry about future loan problems.” Another added, “If rates continue to rise and put more cash flow pressure on businesses, U.S. loan asset quality could start to deteriorate.”

Last quarter, our conclusion from the CBSI was “Rising interest rates and an economic environment characterized by tepid economic growth and high inflation have many bankers concerned about deposit levels and liquidity constraints that could impact profitability and capital.” Now that liquidity concerns have been breached, it will be important to be on the lookout for deteriorating credit quality and their impact on financial and economic conditions.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter