Community Bankers Expect a Challenging 2023

By CSBS Chief Economist Thomas F. Siems, Ph.D.

The CSBS fourth quarter 2022 Community Bank Sentiment Index (CBSI) indicates that community bankers are more pessimistic than they were in the previous quarter and near its lowest level recorded in the second quarter of 2022. Alarmingly, 96% of community bankers responding to a special question in this quarter’s survey believe the U.S. economy is in a recession, with 79% signaling that the recession started at the end of 2022.

The CSBS fourth quarter 2022 Community Bank Sentiment Index (CBSI) indicates that community bankers are more pessimistic than they were in the previous quarter and near its lowest level recorded in the second quarter of 2022. Alarmingly, 96% of community bankers responding to a special question in this quarter’s survey believe the U.S. economy is in a recession, with 79% signaling that the recession started at the end of 2022.

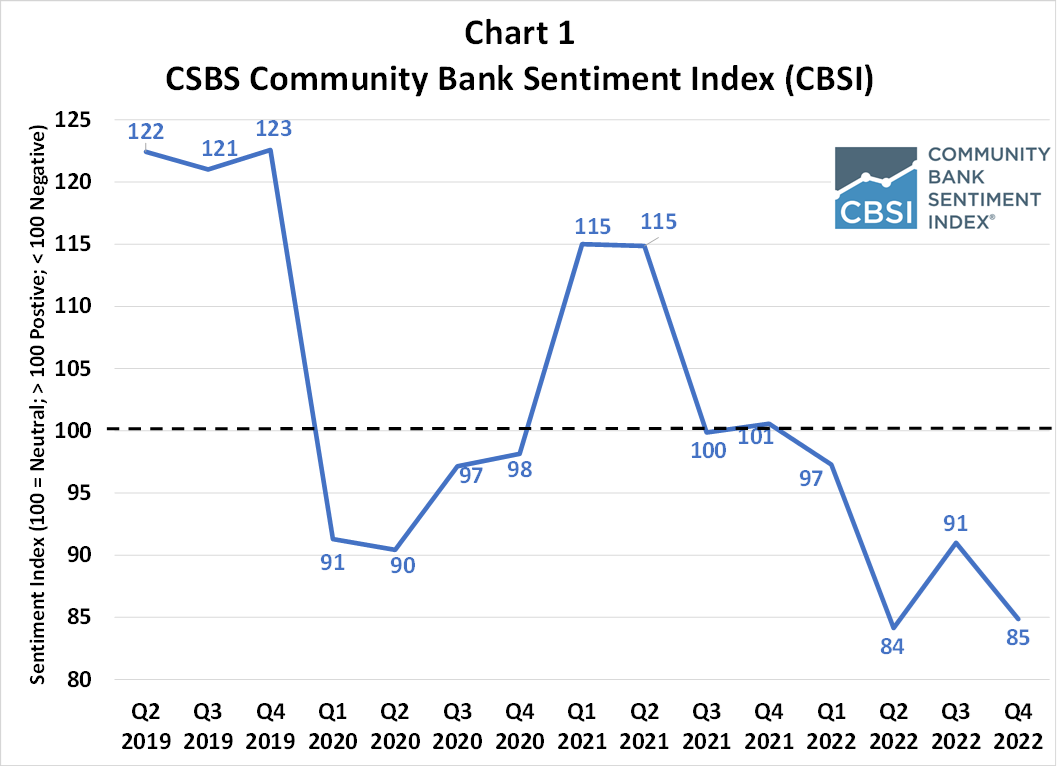

As shown in Chart 1, the headline number from the fourth quarter 2022 CBSI was 85. All of the quarterly survey readings in 2022 were below the neutral level of 100, indicating community bankers held a pessimistic outlook throughout the year. The second and fourth quarter assessments, however, were the two lowest readings of the CBSI in its four-year history.

Three components of the seven indicators that comprise the CBSI consistently drove the overall index lower in 2022: regulatory burden, monetary policy and business conditions. While the regulatory burden indicator has been below 30 for eight consecutive quarters, the monetary policy and business conditions indexes both fell sharply in the second quarter of 2022. From the first quarter to the second quarter, the monetary policy indicator fell from 95 to 33 (and is still at 33), and the business conditions component dropped from 83 to 38 (and is now at 37).

So, what’s going on?

It is likely no coincidence that the decline in both the monetary policy and business conditions indices roughly corresponds to Consumer Price Index inflation hitting 9% annually, the beginning of the Federal Reserve’s aggressive interest rate increases to combat rising inflation and signals that Gross Domestic Product for both the first and second quarters of 2022 were negative.

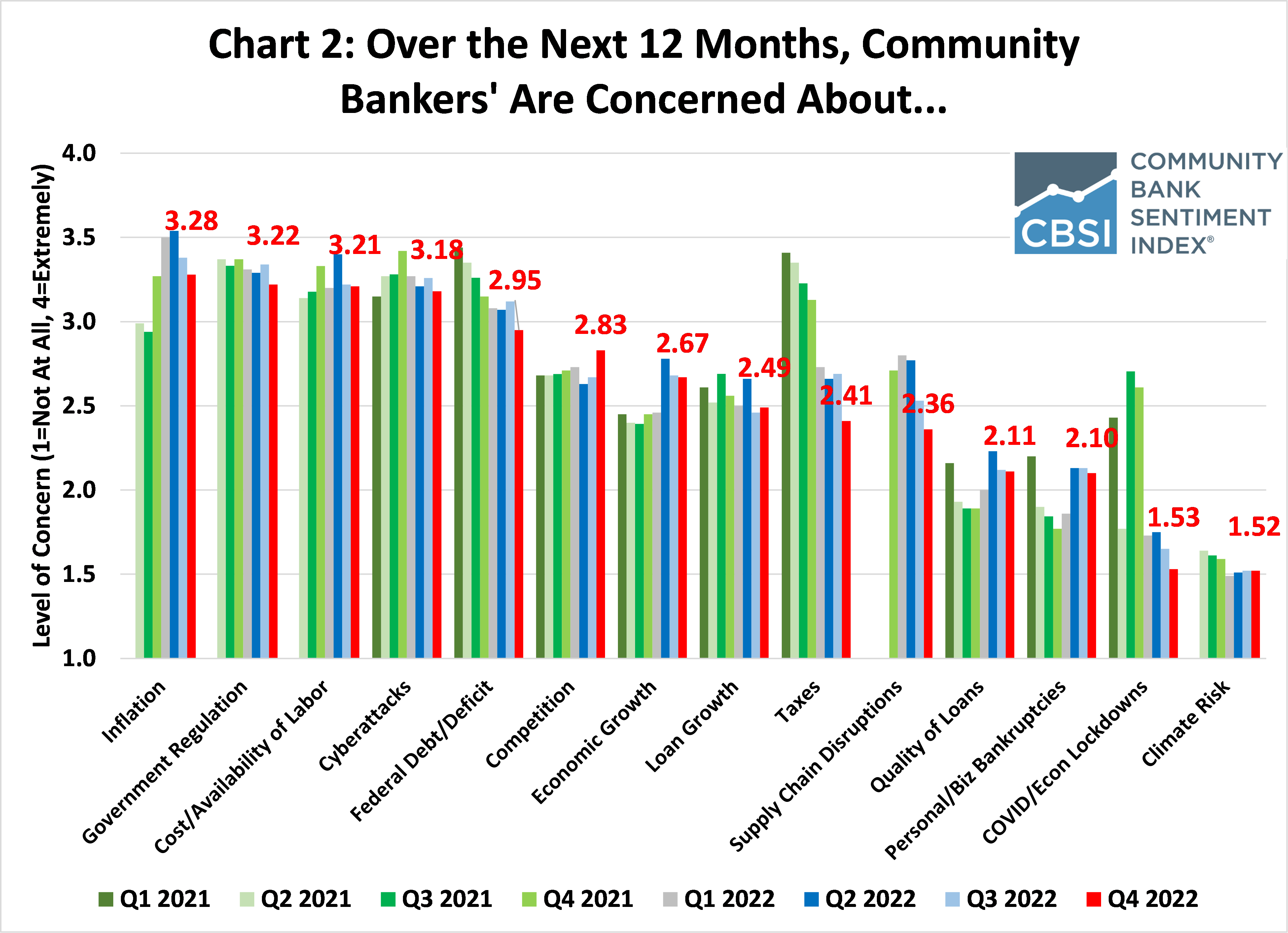

As shown in Chart 2, community banker concerns about inflation surged at the end of 2021 and was the top concern among respondents in all four quarters of 2022. Other concerns near the top of the list throughout 2022 include government regulation, the cost/availability of labor, cyberattacks and the federal debt/deficit.

In open-ended comments at the end of the CBSI survey, many community bankers warned of a nationwide economic recession. And with high inflation and recent rapid increases in interest rates, they fear a difficult financial environment ahead for banks. One banker said, “deposit rates are increasing at an incredible speed.” Another said, “our interest expense has nearly doubled in the past four months, and we expect our Net Interest Margin to contract into next year…liquidity is going to be a far bigger challenge for us in the next 12 months.” And a third added, “the thing we are most concerned about are the rising deposit rates in the market.”

Indeed, interest rates have risen rapidly since the Federal Reserve began the current tightening cycle in March 2022. As examples, the Federal Funds Rate, Freddie Mac’s Federal Cost of Funds Index and the bank prime lending rate are all at their highest level since before the 2008-2009 financial crisis.

In summary, community bankers expect 2023 to be a difficult and challenging year. Rising interest rates and an economic environment characterized by tepid economic growth and high inflation have many bankers concerned about deposit levels and liquidity constraints that could impact profitability and capital.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter