What Economic Sectors Concern Community Bankers the Most?

By Thomas F. Siems, Ph.D., CSBS Senior Economist and Director of Research

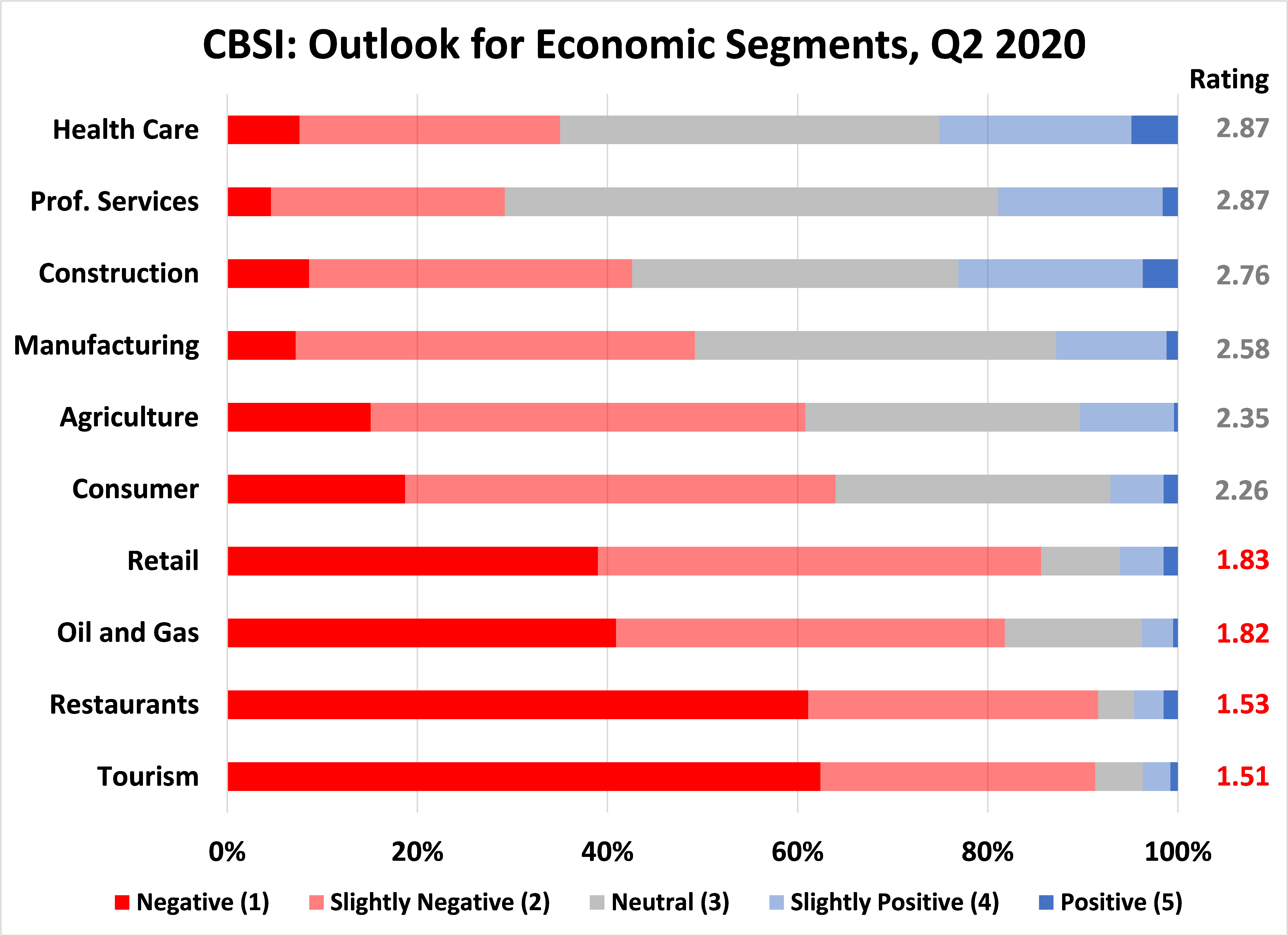

The latest CSBS Community Bank Sentiment Index (CBSI) quarterly survey included a special question for bankers to provide an outlook, ranging from 1 (negative) to 5 (positive), for each of 10 economic sectors. The overall scores, using a 5-point Likert scale, are shown in the nearby chart, with the sectors ranked from the highest, or best outlook, to the lowest, or worst outlook.

Not surprisingly, community bankers are most concerned about future economic activity in the “high-touch” service industries like tourism (1.51) and restaurants (1.53). More than 60% of respondents rated the tourism and restaurant industry outlooks as “negative.” Indeed, according to the U.S. Bureau of Labor Statistics (BLS), job losses since the beginning of the COVID-19 pandemic and subsequent economic lockdown in March have been most severe in these industries. The June 2020 BLS report conveys that total payroll employment is down about 8.5% on a year-over-year basis. But in the leisure and hospitality industry, jobs are 27% fewer than a year earlier. For food services and drinking places, jobs are off 36%. And given the current state of uncertainty regarding COVID-19 and its potential impact on reopening and operating businesses in these industries, it may be a long time before these jobs fully recover.

That is, consumers may need to feel more comfortable before entering establishments where large crowds typically gather, like restaurants and bars, casinos, sports venues, and the like. In fact, for many consumers, “getting back out there” will require a vaccine or treatment that meets their individual definition for herd immunity. And for the economy to bounce back in a meaningful way, many consumers and businesses will need to learn new ways to cope with the risk of the virus in our midst, which will come with a better understanding of who the virus is targeting and why.

The three economic sectors with the most optimistic outlooks are health care (2.87), professional services (2.87) and construction (2.76). However, it is worth noting that the average rating for each of these sectors is below 3.0, implying that the outlook in each of these sectors also lean negative. So overall, as bankers weigh the heavy economic implications of the COVID-19 pandemic on business lockdowns and strategies to reopen, they assess all 10 economic sectors covered in our survey to have a negative outlook.

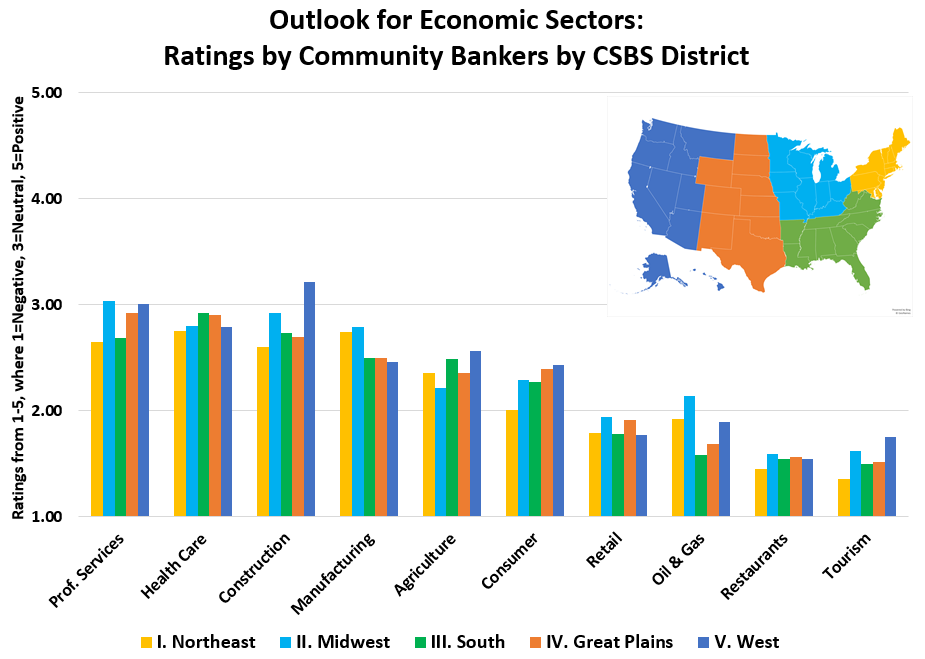

When examining the CBSI survey responses across CSBS Districts, community bankers’ concerns are remarkably similar, as shown in the nearby chart. The economic outlook for the health care and professional services sectors ranks in the top three for all five CSBS Districts. The outlook for the construction industry, while ranking third nationally, ranks first in the West and fourth in the Northeast and has the largest dispersion of average District response ratings, ranging from 2.59 to 3.21. The outlook for the oil and gas sector also has a fairly wide range of responses, from 1.58 in the South to 2.13 in the Midwest. For the tourism, restaurant, and retail sectors, all five CSBS Districts rated the outlook between negative and slightly negative.

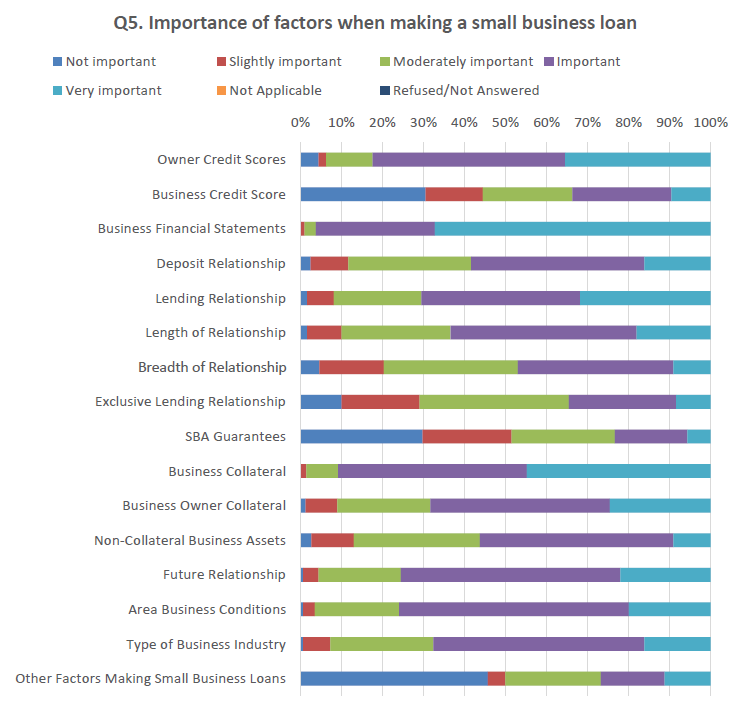

As relationship lenders, community bankers care deeply about consumers and small businesses in their local communities. In the 2018 National Community Bank Survey that was released during the 2018 Community Banking in the 21st Century Research and Policy Conference co-sponsored by CSBS, the Federal Reserve System and the FDIC, some questions were included for community bankers to rate factors they consider when making a small business loan. As shown in the chart below, community bankers stress the importance of relationships and desire to work closely with small businesses to provide sound financial advice that will increase the value of each enterprise.

While relationship lending is foundational and fundamental to the business of community banking, through the federal government’s Paycheck Protection Program created as part of the CARES Act in late March 2020, financial institutions across the nation have shown their value to America. Over the past four months, lenders have distributed more than $500 billion to almost 5 million businesses. Of the nearly 5,500 lenders, almost 98% have been institutions with less than $10 billion in assets, mostly community banks in smaller communities.

Community banks are the lifeblood for main street businesses across this great land. And while they are concerned about the economic outlook for a myriad of industries, particularly those involving close human-to-human contact, their close relationships with small businesses will help their communities navigate out of this crisis.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter