Community Bankers Maintain Positive Economic Outlook

Washington, D.C. - Community bankers’ optimism on the future economy is holding steady, according to the 2025 second quarter results of the Community Bank Sentiment Index (CBSI).

Washington, D.C. - Community bankers’ optimism on the future economy is holding steady, according to the 2025 second quarter results of the Community Bank Sentiment Index (CBSI).

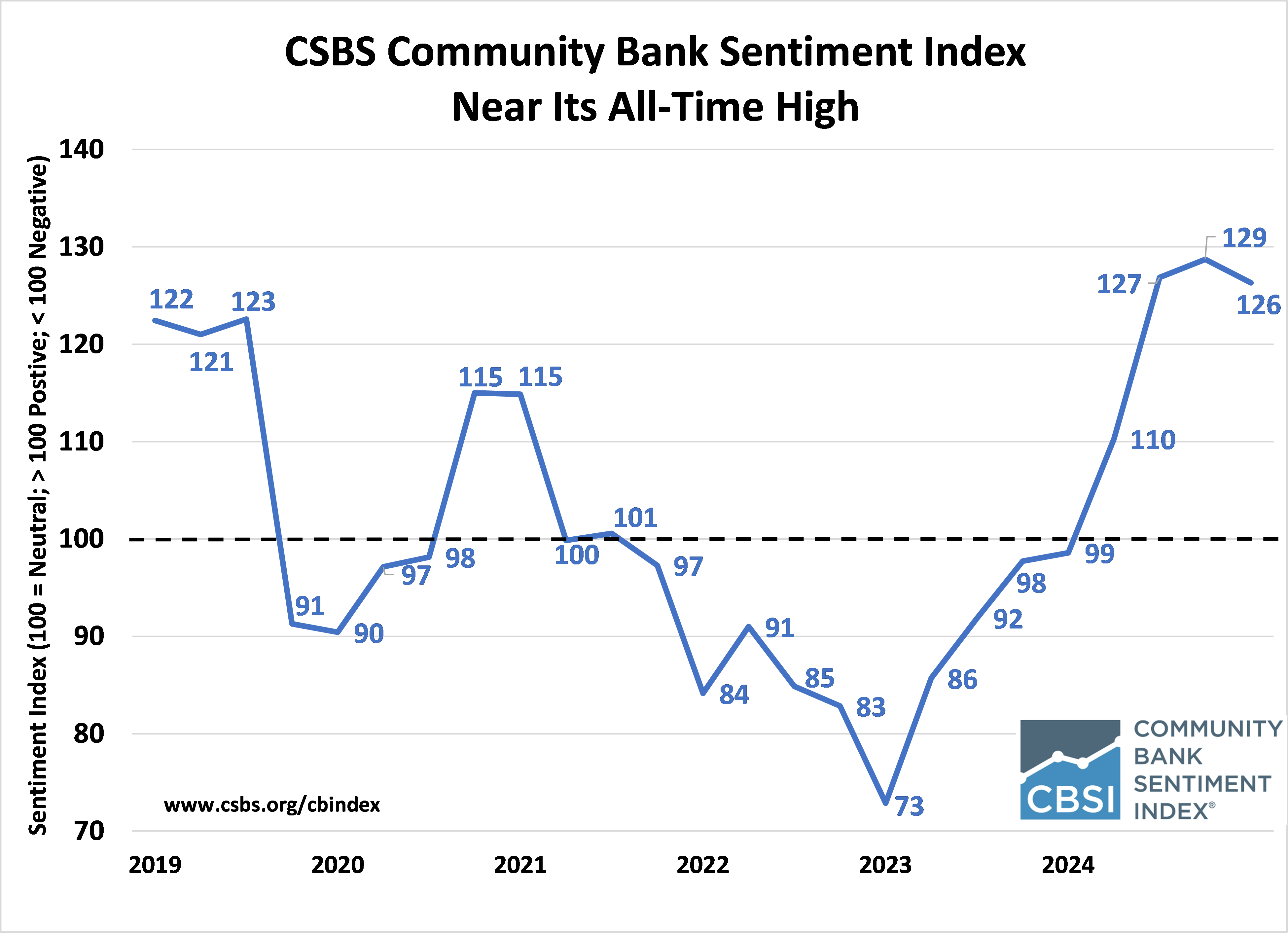

The CBSI dipped slightly to 126 from its peak value of 129 in the previous quarter, driven by a less optimistic outlook for a lighter regulatory environment and moderated expectations for higher expected profitability. However, the overall index remains well above the neutral level of 100 and is among the highest three readings recorded since its inception in 2019.

Additionally, the “I don’t know/unsure” responses for all seven components fell from 14 points to 23 as concerns over tariffs and inflation appear to have subsided somewhat.

“Even though the economic outlook still remains clouded by uncertainties arising from tariff talks, immigration reforms, and fiscal and monetary policy decisions, overall community banker sentiment remains mostly optimistic and similar to the last two quarterly surveys,” said CSBS Chief Economist Tom Siems.

The CBSI canvasses community bankers nationwide in the last month of each quarter to capture their thoughts on future economic conditions in seven areas. An index reading of 100 indicates a neutral sentiment. Anything above 100 indicates a positive sentiment, and anything below 100 indicates a negative sentiment. Quarterly results are included in the Federal Reserve Economic Data, the online database maintained by the Federal Reserve Bank of St. Louis known informally as the FRED.

A total of 250 community bankers from 43 states responded to the second quarter 2025 CBSI survey. The profitability, operations, and franchise value indicators fell slightly but are at near record high levels. Expected future business conditions was the only component to drag the index lower for the second straight quarter, although this component improved slightly to 91 from last quarter’s reading of 86.

The regulatory burden component had the greatest quarterly change, falling 16 points to 114 from the first quarter survey. However, it stayed above 100 for only the second time in the survey’s history and is up 94 points from one year ago.

At 114, the monetary policy component improved 8 points from 106 last quarter and remains in positive territory for the fifth straight quarter.

Sixty-one percent of community bankers believe the U.S. economy is at the start of or already in a recession, up slightly from 59% last quarter. Community bankers rated their top concerns as cyberattacks, bank fraud, the federal debt/deficit, the cost and availability of labor, and competition.

For more information, visit www.csbs.org/cbindex.

Contact: Susanna Barnett, 202-407-7156, [email protected]

X: @CSBSNews

The Conference of State Bank Supervisors (CSBS) is the national organization of financial regulators from all 50 states, American Samoa, District of Columbia, Guam, Puerto Rico, and U.S. Virgin Islands. State regulators supervise 79% of all U.S. banks and a variety of non-depository financial services. CSBS, on behalf of state regulators, also operates the Nationwide Multistate Licensing System to license and register non-depository financial service providers in the mortgage, money services businesses, consumer finance and debt industries.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Blog post

Can Community Banker Optimism and Greater Economic Uncertainty Coexist?

Apr 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter