Community Banker Optimism Reaches New High

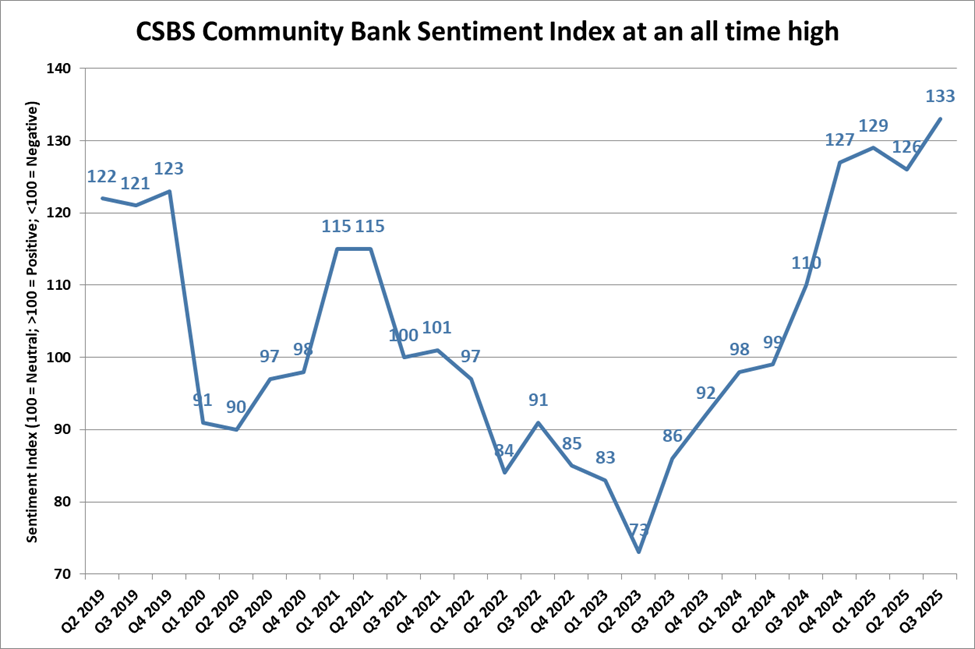

Washington, D.C. – Community banker sentiment reached a peak in the third quarter results of the Conference of State Bank Supervisors (CSBS) Community Banking Sentiment Index (CBSI).

The latest CBSI gained seven points from last quarter to 133 points, a record high since the survey’s inception in 2019. The monetary policy indicator also reached an all-time high, improving 16 points to 130. Expected future business conditions was the only component pulling the index down, although this measure improved seven points from last quarter and now sits just below the neutral level of 100.

The Uncertainty Index, computed by the summation of “I don’t know/unsure” responses, rose mostly in the monetary policy and future business conditions indicators.

“The overall index’s boost is largely due to expectations that the Federal Reserve’s monetary policies would result in better market conditions,” said CSBS Chief Economist Tom Siems. “While overall community banker sentiment has been surprisingly robust this year, uncertainty is rising again as future business conditions and interest rate movements remain cloudy.”

The CBSI surveys community bankers nationwide in the last month of each quarter to capture their thoughts on future economic conditions in seven areas. An index reading of 100 indicates a neutral sentiment. Anything above 100 indicates a positive sentiment, and anything below 100 indicates a negative sentiment.

In the open-ended comments, community bankers mentioned concerns driving their outlook: tariffs, immigration, low agricultural prices, labor shortages, rising insurance costs, potential inflation, geopolitical risks, and competition from nonbanks.

A total of 255 community bankers from 44 states responded to the survey. Quarterly results are included in the Federal Reserve Economic Data, the online database maintained by the Federal Reserve Bank of St. Louis, known informally as the FRED.

Contact: Susanna Barnett, 202-407-7156, [email protected]

X: @CSBSNews

The Conference of State Bank Supervisors (CSBS) is the national organization of financial regulators from all 50 states, American Samoa, District of Columbia, Guam, Puerto Rico, and U.S. Virgin Islands. State regulators supervise 79% of all U.S. banks and a variety of non-depository financial services. CSBS, on behalf of state regulators, also operates the Nationwide Multistate Licensing System to license and register non-depository financial service providers in the mortgage, money services businesses, consumer finance, and debt industries.

- Press Releases

Net Interest Margins Bump Reg Burden as Top Community Bank Concern

Oct 7, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter