What Do Community Bankers Expect for 10 Economic Sectors?

By CSBS Senior Economist and Director of Research Thomas F. Siems, Ph.D.

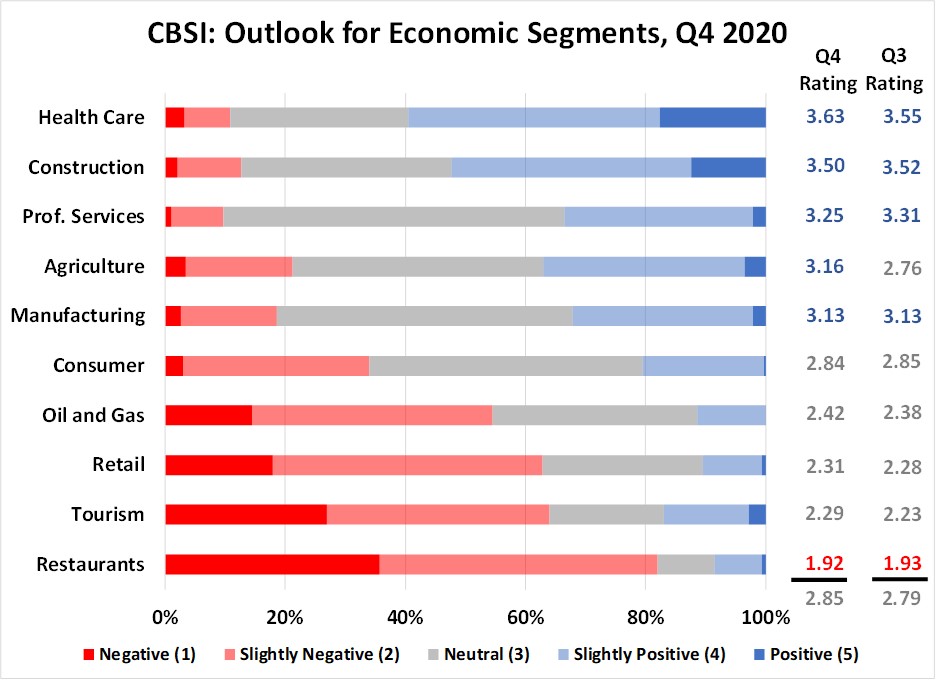

The outlook for 10 economic sectors is little changed from last quarter, according to the fourth quarter 2020 Community Bank Sentiment Index (CBSI) survey of community bankers. Based on 284 survey responses from community bankers across the United States, health care, construction and professional services continue to be the sectors with the most favorable prospects. The sectors with the greatest concerns continue to be restaurants, tourism, retail, and oil and gas.

The chart below shows the results of the fourth quarter 2020 survey and presents a ranking of the 10 sectors calculated using a weighted-average 5-point Likert scale with 1 equal to a “negative” outlook and 5 as a “positive” outlook. Five sectors have weighted-average ratings above the neutral level of 3.0, up from four sectors in the third quarter 2020 survey. The outlook for the agriculture sector improved the most, rising from 2.76 last quarter to 3.16 in the fourth quarter 2020 survey.

The overall fourth quarter 2020 rating for the 10 sectors is 2.85, a tad below the neutral level of 3.0 and up slightly from 2.79 recorded in the previous quarter. The slight uptick is in line with other consumer confidence and business sentiment indices that show little change from the third quarter 2020 to the fourth quarter 2020. Indeed, for our CBSI, there was a one-point increase to its current value of 98, putting it two-points below its neutral level of 100.

For sentiment and economic outlooks to improve, business leaders and consumers must be more able and willing to engage and transact, and job growth needs to improve. Fears surrounding the COVID-19 pandemic and economic lockdowns continue to weigh heavily on bankers’ expectations for all sectors, but especially for restaurants, tourism and retail. Restrictions regarding social distancing measures have forced many of these high-touch, service-sector businesses to lay-off workers, reduce customer capacities and explore new revenue alternatives. Since our first quarter survey, the outlook for these three sectors have all ranked among the bottom four sectors (along with oil and gas).

Economic output reports show that consumption makes up about 70% of the U.S. economy. The employment data also show that about 70% of nonfarm payroll workers are employed in the service sector. For economic growth to rebound to levels of a year ago, it is crucial that the restaurant, tourism, and retail sectors return to some sense of normalcy. And for that to happen, herd immunity is likely needed where fears of the virus come to an end and many social distancing restrictions are no longer necessary.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter