Do Ag Banks View Risks Differently?

By Temple University Professor of Finance Jonathan A. Scott and CSBS Chief Economist Thomas F. Siems

Community banks that specialize in agricultural lending play a pivotal role in supporting the U.S. economy by providing financial services to farmers and ranchers that helps ensure a stable and reliable food supply. Comprising 26% of the overall population of the nation’s community banks, state-chartered agricultural banks (Ag banks) help satisfy seasonal borrowing needs and encourage investments in newer technologies and better practices that improve productivity and sustainability in the agriculture sector.

In this blog, we examine how responses from Ag banks, which made up 21% of the respondents to the 2023 CSBS Annual Survey of Community Banks, differ from non-Ag banks. While the top three risks for Ag banks are the same as those for non-Ag banks (net interest margins, the cost of funds, and core deposit growth), Ag banks view competition and loan demand as significantly more important risks than non-Ag banks, and it appears that location and liquidity drive these differences.

What is an Ag Bank?

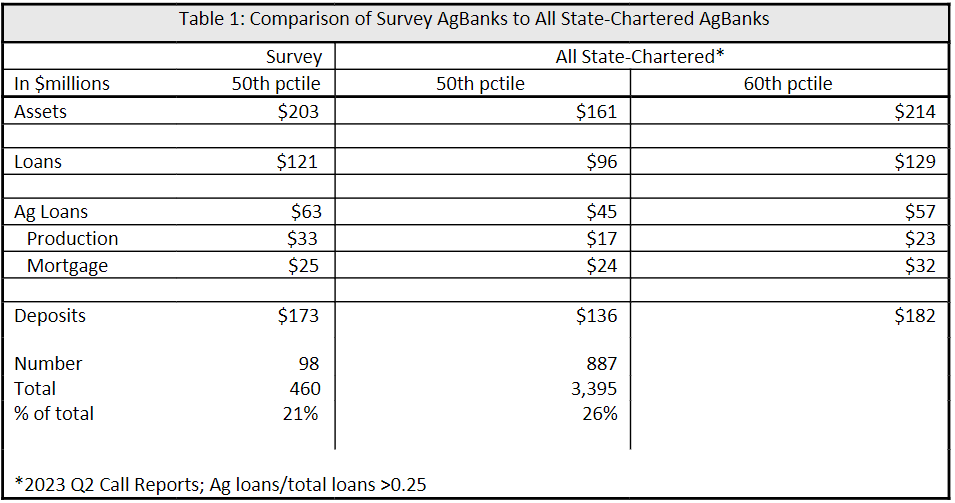

For this analysis, Ag banks are classified per the FDIC definition as having agricultural land and production loans-to-total loans greater than 25%. We also impose an additional restriction that the bank is a state-chartered institution. As shown in Table 1, Ag banks completing the 2023 CSBS Annual Survey are a good representation of the nationwide population of Ag banks.

Ag banks responding to the 2023 CSBS Annual Survey had median assets, loans, and deposits greater than the nationwide Ag bank population, but when broken down by deciles, the surveyed banks generally fell between the 50th and 60th deciles. Ag loans for the Survey respondents fell in the 65th percentile of all Ag banks, which was driven by Ag production lending that fell in the 75th percentile.

What External Risks Concern Ag Banks?

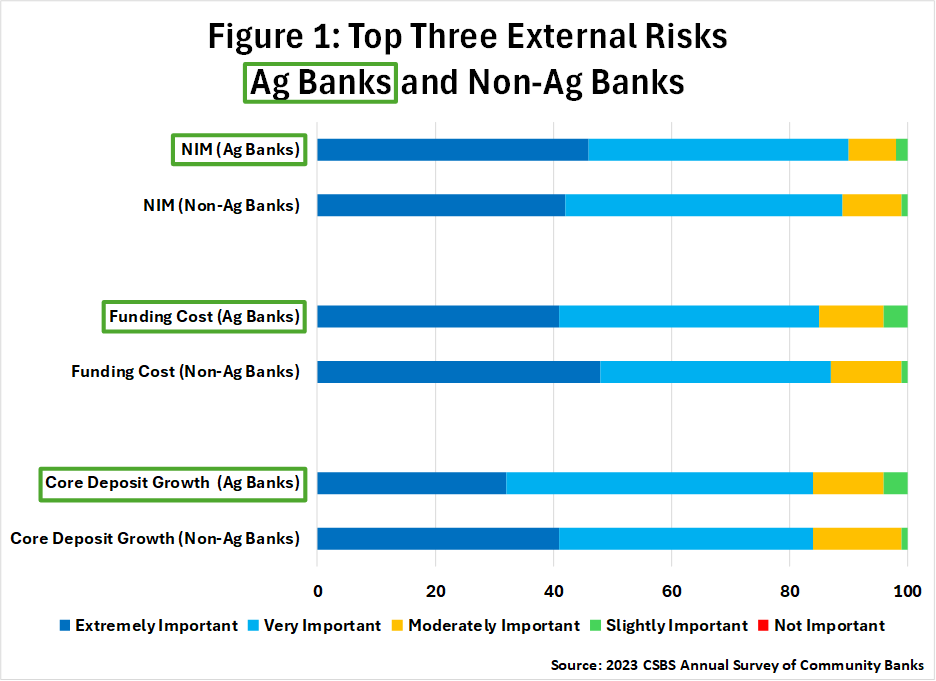

Figure 1 compares the top three external risks for Ag banks and non-Ag banks. The results for the sum of the “extremely important” and “very important” responses are nearly identical for both groups.

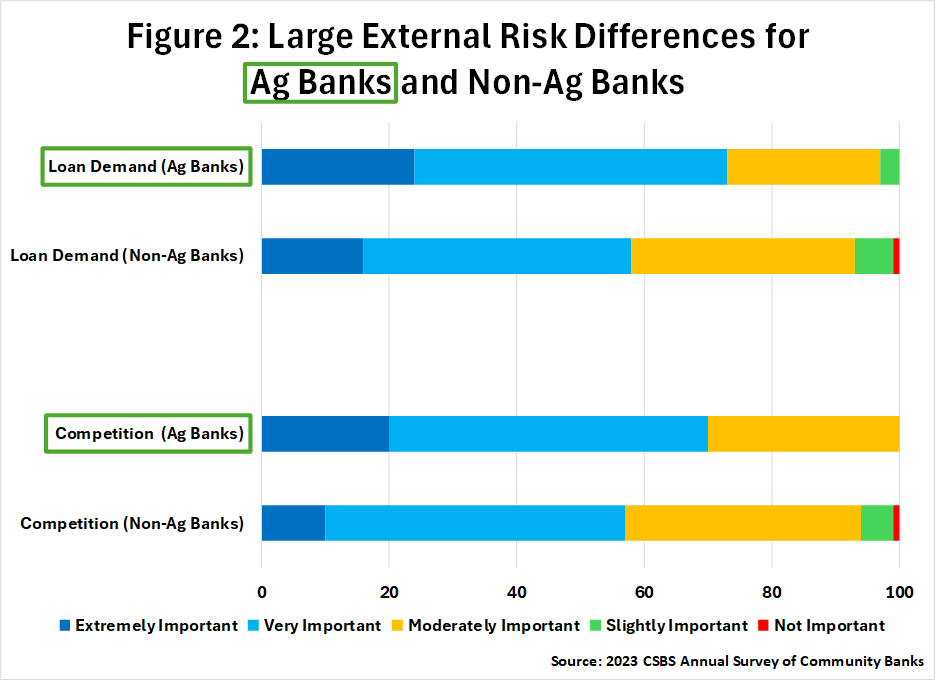

However, as shown in Figure 2, Ag banks reported much higher percentages of “extremely important” and “very important” responses for the Loan Demand and Competition risk categories. In fact, for the Loan Demand risk, Ag bank concerns are 15 percentage points greater. For Competition risk it is 13 percentage points higher.

With most Ag banks in smaller markets and presumably fewer market opportunities, it might seem curious that Ag banks would have more concern about competition than their non-Ag bank peers. However, it could be that the presence of the Farm Credit System serves as an important major competitor to community banks in many markets. For loan demand, the concern from Ag banks seems to make sense because their loan portfolios tend to be less diversified than non-Ag banks.

Ag Banks’ Concerns About Competition Depend on Location

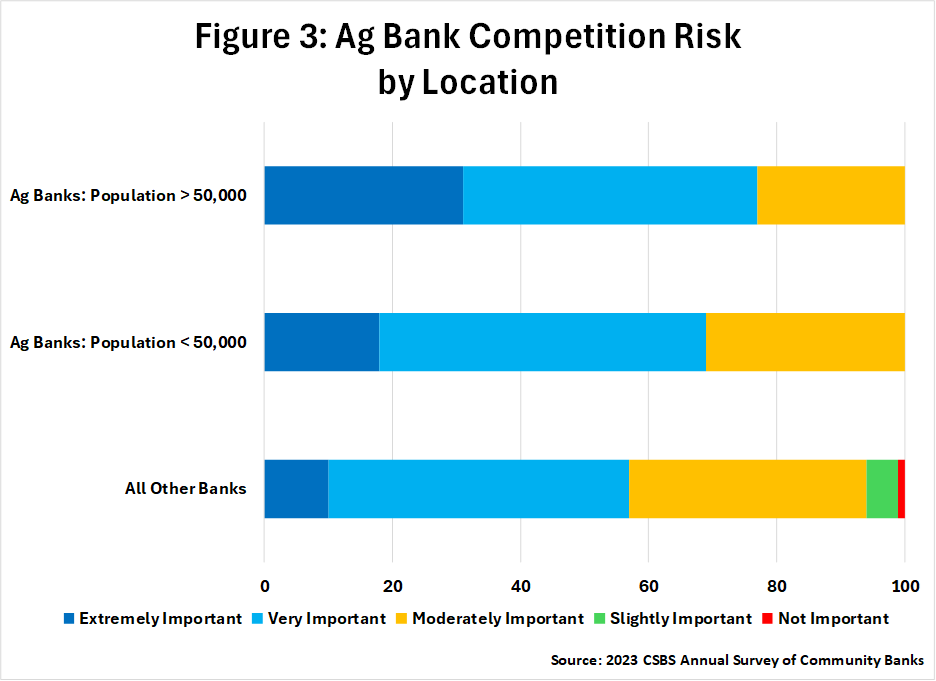

To dive deeper into these differences, we first examined the possible impact of population density on competition. Our hypothesis is that Ag banks in small town/rural markets, defined as populations under 50,000, should have less competition because the business opportunities are fewer, and that Ag banks in larger markets should experience more competition from other lenders.

The results shown in Figure 3 are consistent with this hypothesis: When adding together responses for “extremely important” and “very important,” we find that 77% of Ag banks in non-rural markets, which have a population more than 50,000, are more concerned about competition, compared to 69% of Ag banks in smaller markets. Moreover, Ag banks in smaller markets are more concerned about competition than non-Ag banks (58%), especially competition from other community banks. In the 2023 CSBS Annual Survey, Ag banks were more likely to list other community banks as their primary competitor for payment services, transactions and non-transactions deposits, 1-4 family mortgages, and commercial real estate loans.

Ag Banks’ Concerns About Loan Demand Depend on Liquidity

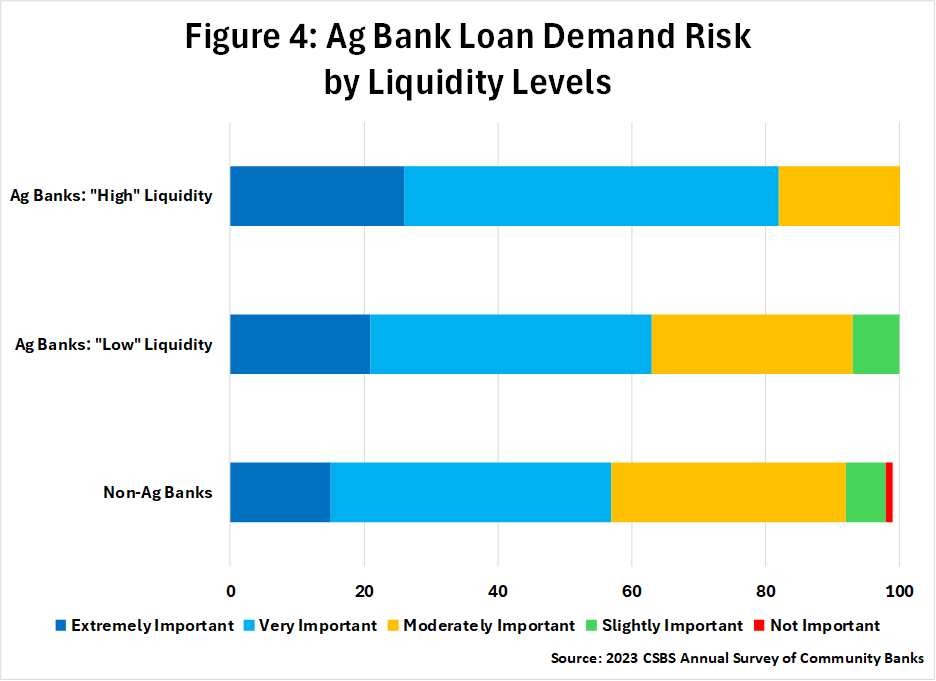

For loan demand risk, one factor that may be driving Ag banks’ concerns is the amount of liquidity these banks have. Banks with higher levels of liquidity might be more concerned with their ability to deploy these funds for a given level of demand for Ag production and mortgage loans. The loan/deposit ratio is used as a proxy metric for liquidity and Ag banks are segregated into two groups (“high” liquidity and “low” liquidity) using the median loan/deposit ratio of 0.75.

Figure 4 shows that 82% of Ag banks with higher liquidity levels report loan demand as an “extremely important” or “very important” external risk, compared to about 63% of the Ag banks with lower liquidity ratios. Additionally, Ag banks with lower liquidity ratios are not significantly different from the non-Ag banks’ concerns (57%) regarding loan demand risk.

Conclusion

We find that both Ag banks and non-Ag banks rank the same top three external risks identified in the 2023 CSBS Annual Survey: net interest margin, funding costs, and core deposit growth. However, the 2023 CSBS Annual Survey reveals that Ag banks exhibit distinct variations in risk perceptions for competition and loan demand risks, with concerns significantly higher than for non-Ag banks.

Digging deeper into the reasons for these differences, we find that Ag banks in rural areas (that is, smaller towns under 50,000 population) are more likely to report competition as an external risk, and those with higher liquidity are more likely to report loan demand as an external risk compared to non-Ag banks.

Ag banks are an important segment of the U.S. community banking ecosystem comprising more than one-quarter of the U.S. state-chartered banks. With a generally smaller footprint in terms of assets, loan diversification, and offices, the 2023 CSBS Annual Survey underscores the multi-faceted landscape of external risks facing state-chartered community banks, revealing the nuanced dynamics between Ag banks and non-Ag banks. Our findings emphasize both the importance of tailored risk management strategies for community banks to navigate their unique challenges and opportunities effectively, and for supervisors to regulate their institutions knowing these subtle differences.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter