Does Community Bank Profitability or Size Impact Views on Risks?

By Temple University Professor of Finance, Jonathan A. Scott and CSBS Chief Economist, Thomas F. Siems

Net interest margins, the cost of funds and core deposit growth ranked as the top three most important external risks facing state-chartered community banks, according to the 2023 CSBS Annual Survey of Community Banks, released last month. But when community banks are partitioned by profitability or by asset size, do they view these risks the same way? We find that community banks generating higher levels of profitability are less concerned about these top three risks than their less profitable peers. We also find that smaller community banks are generally less likely to view these top three risks as more important than their larger counterparts.

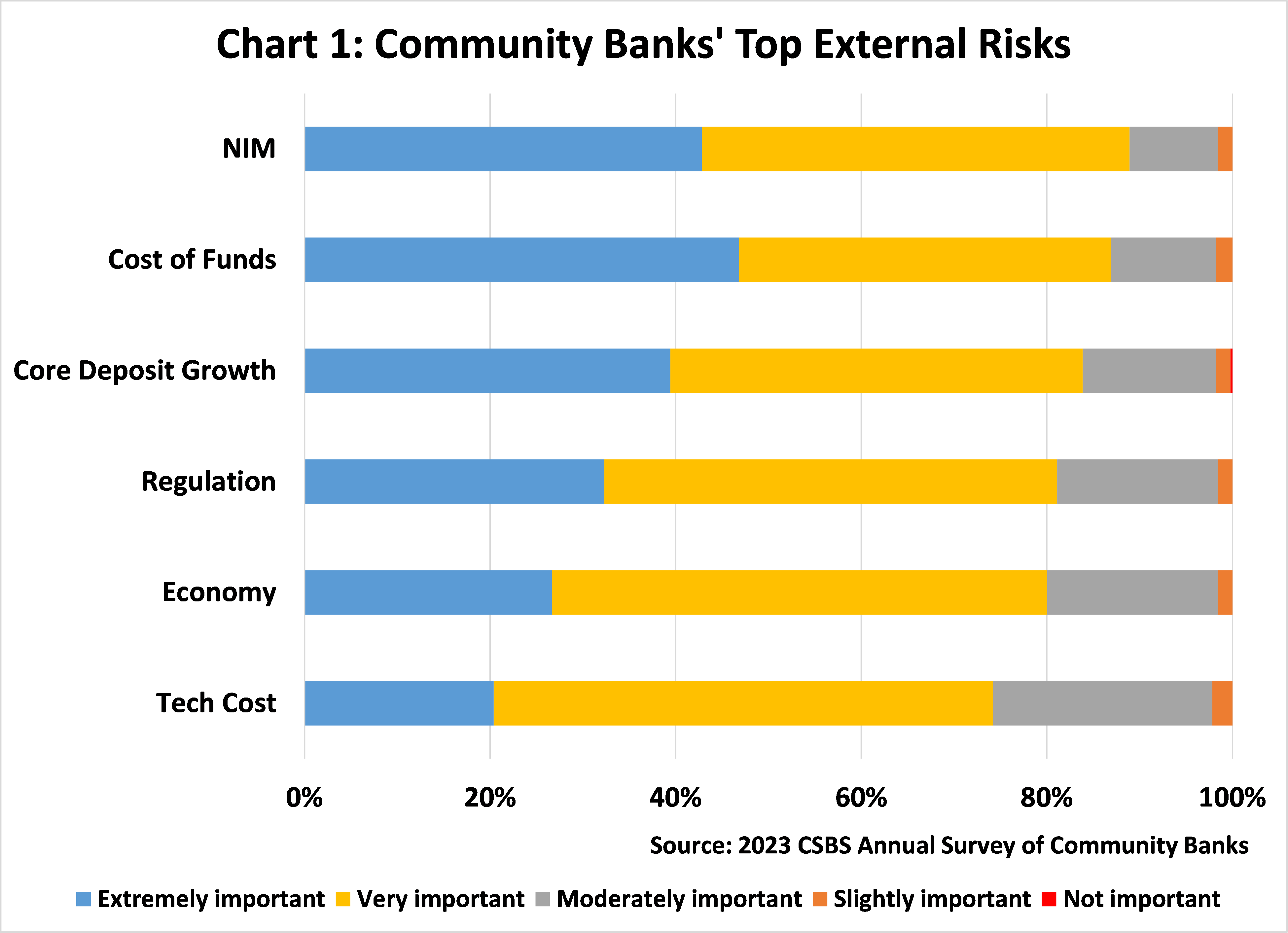

Chart 1 shows how banks ranked the importance of net interest margins (NIM), cost of funding, and core deposit growth as external risks in 2023. Nearly 89% of respondents reported NIM as either “extremely important” or “very important,” whereas only 1.5% said NIM was “slightly important” or “not important.”

As noted in the 2023 CSBS Annual Survey of Community Banks, this year’s results for NIM are virtually unchanged from 2022, but the percentage of bankers reporting cost of funds and core deposit growth increased sharply from last year’s survey. The percentage of community bankers reporting cost of funds as either “extremely important” or “very important” moved from 48% last year to 87% in 2023, and the percentage reporting core deposit growth as an “extremely important” or “very important” risk went from 38% last year to 84% in 2023.

Net Interest Margins

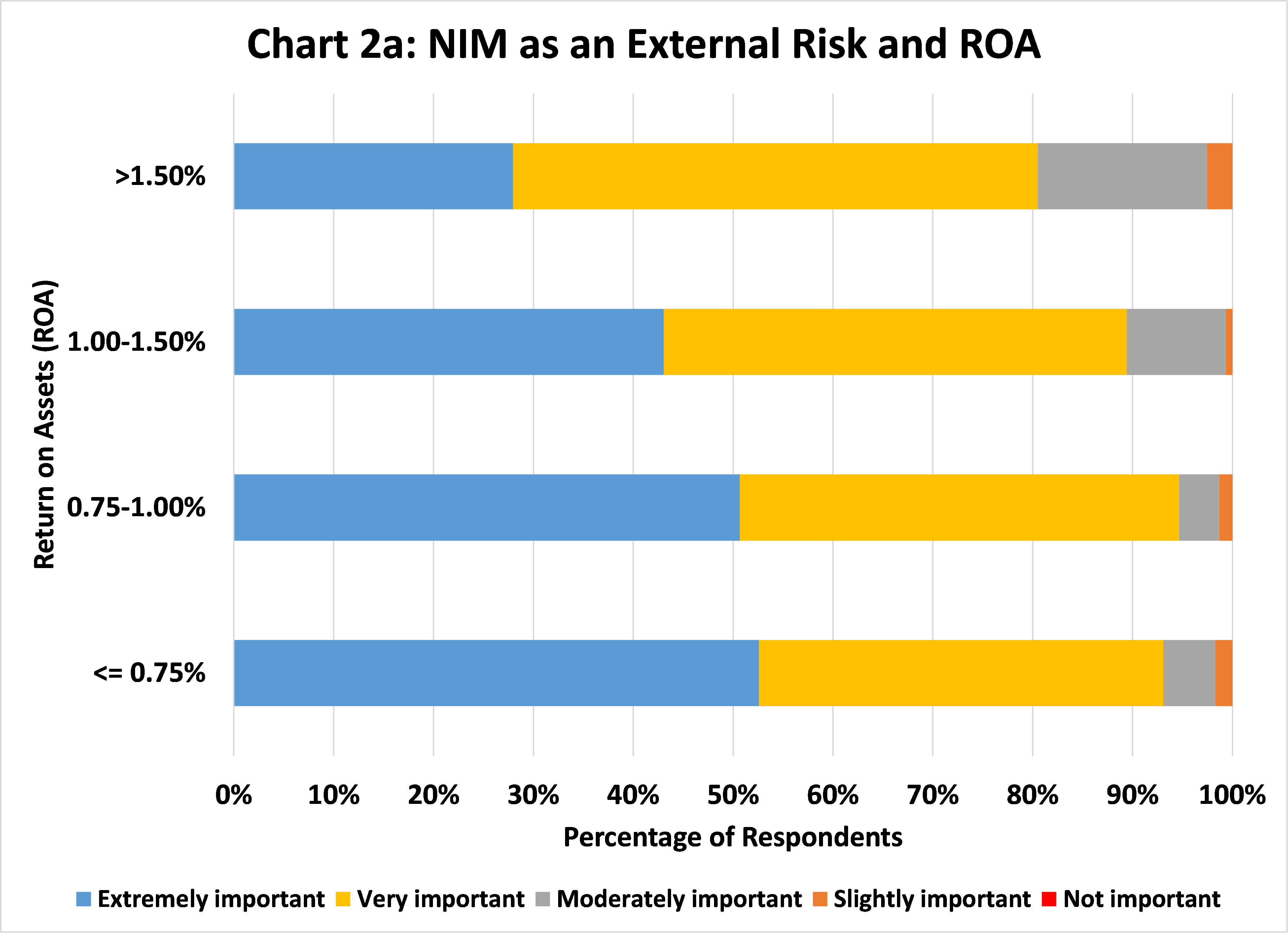

The correlation between the responses to NIM as an important external risk and a bank’s return on assets (ROA) is a significantly negative -0.23. Chart 2a shows that the most profitable banks (ROA >1.50%) are less likely to report NIM as an “extremely important” external risk (blue bars) and more likely to report it as a “moderately important” risk (grey bars). The converse is true for the least profitable banks (<0.75% ROA).

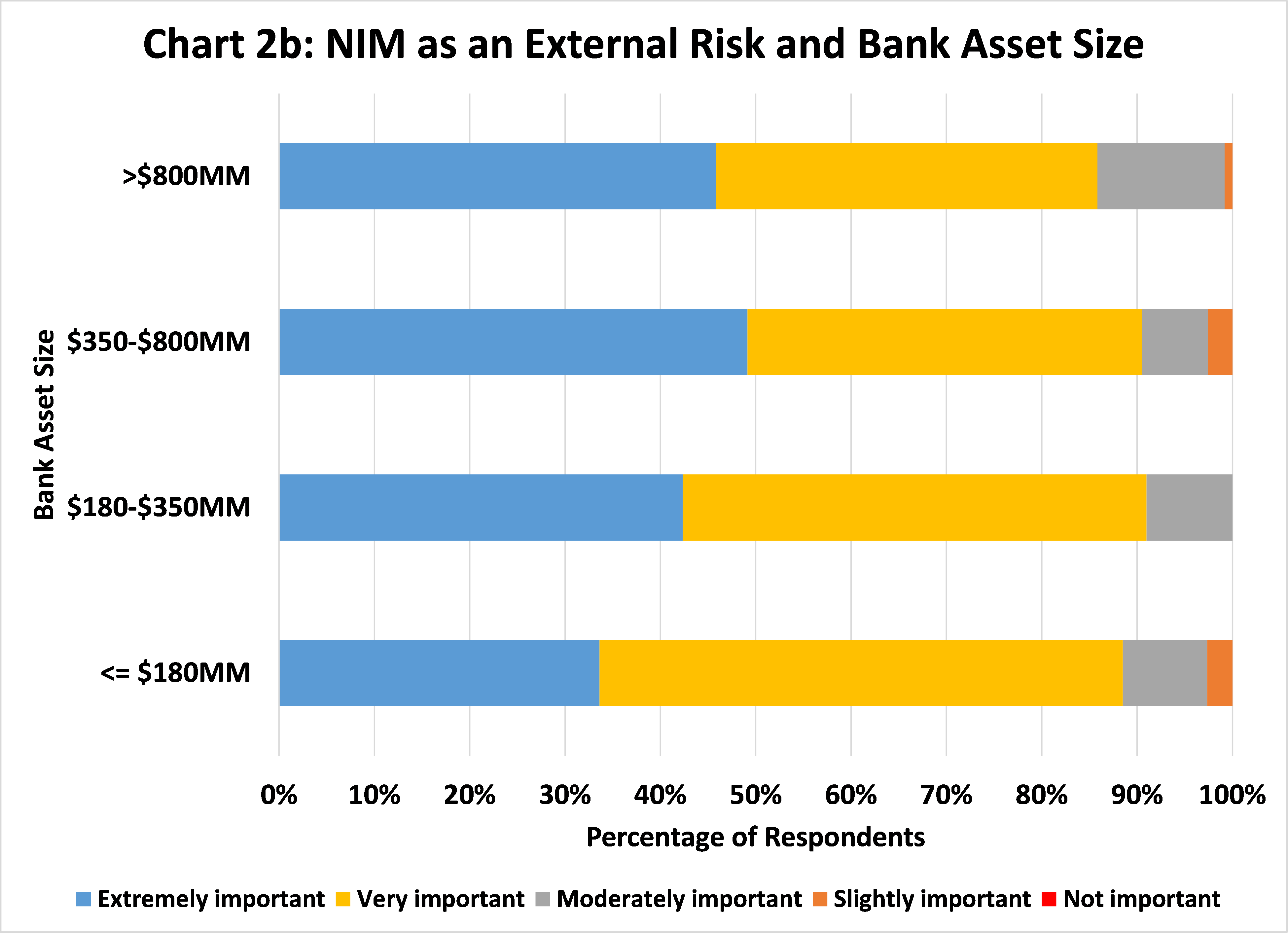

The correlation of NIM as an external risk with asset size is not significant, although it is positive. Chart 2b shows that larger banks (the top two quartiles above the median of $350 million) more frequently report NIM as an “extremely important” risk (blue bars), but there is virtually no difference across asset size quartiles when combining these responses with those indicating NIM as a “very important” risk (sum of blue and yellow bars).

Cost of Funds

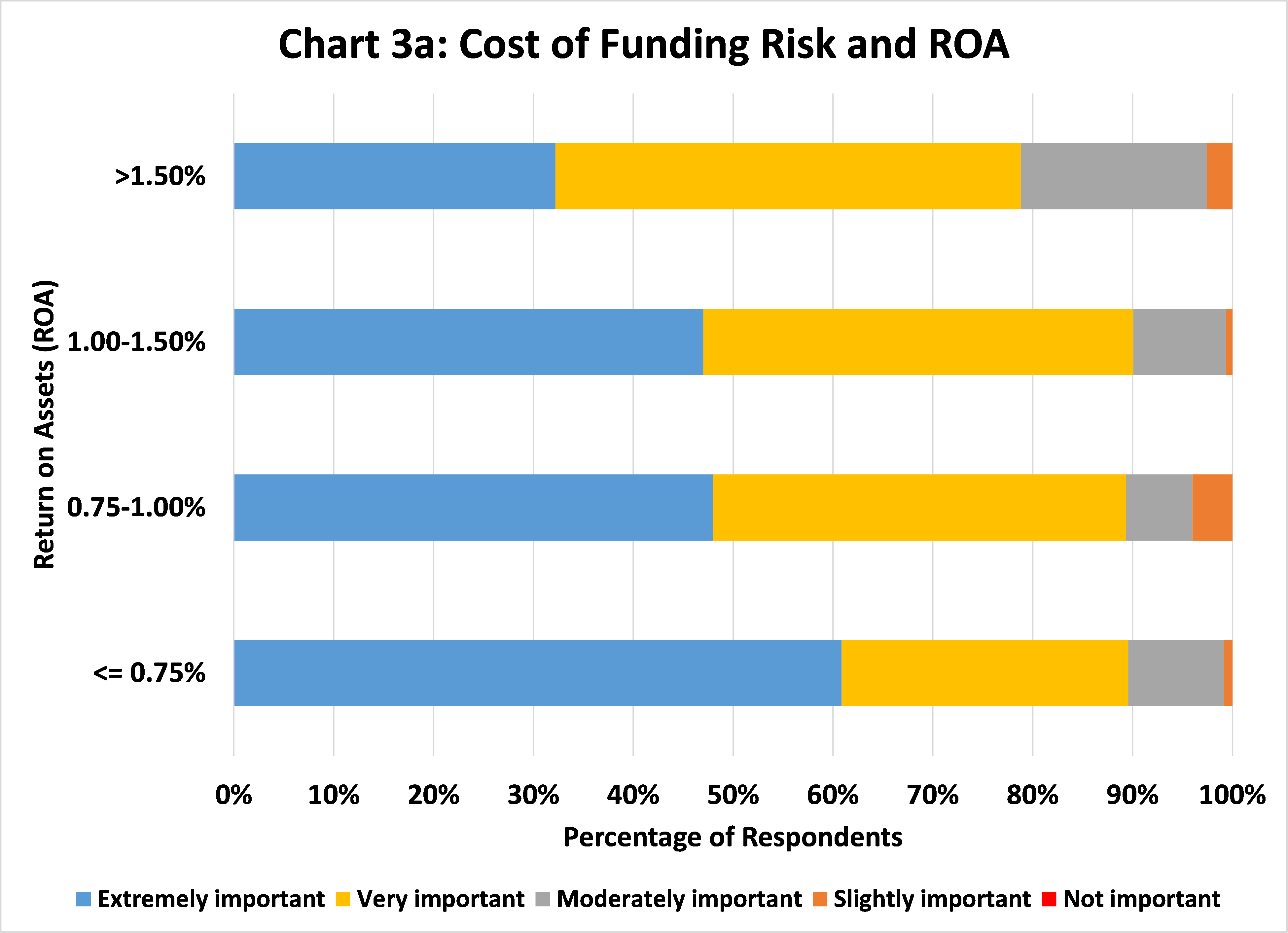

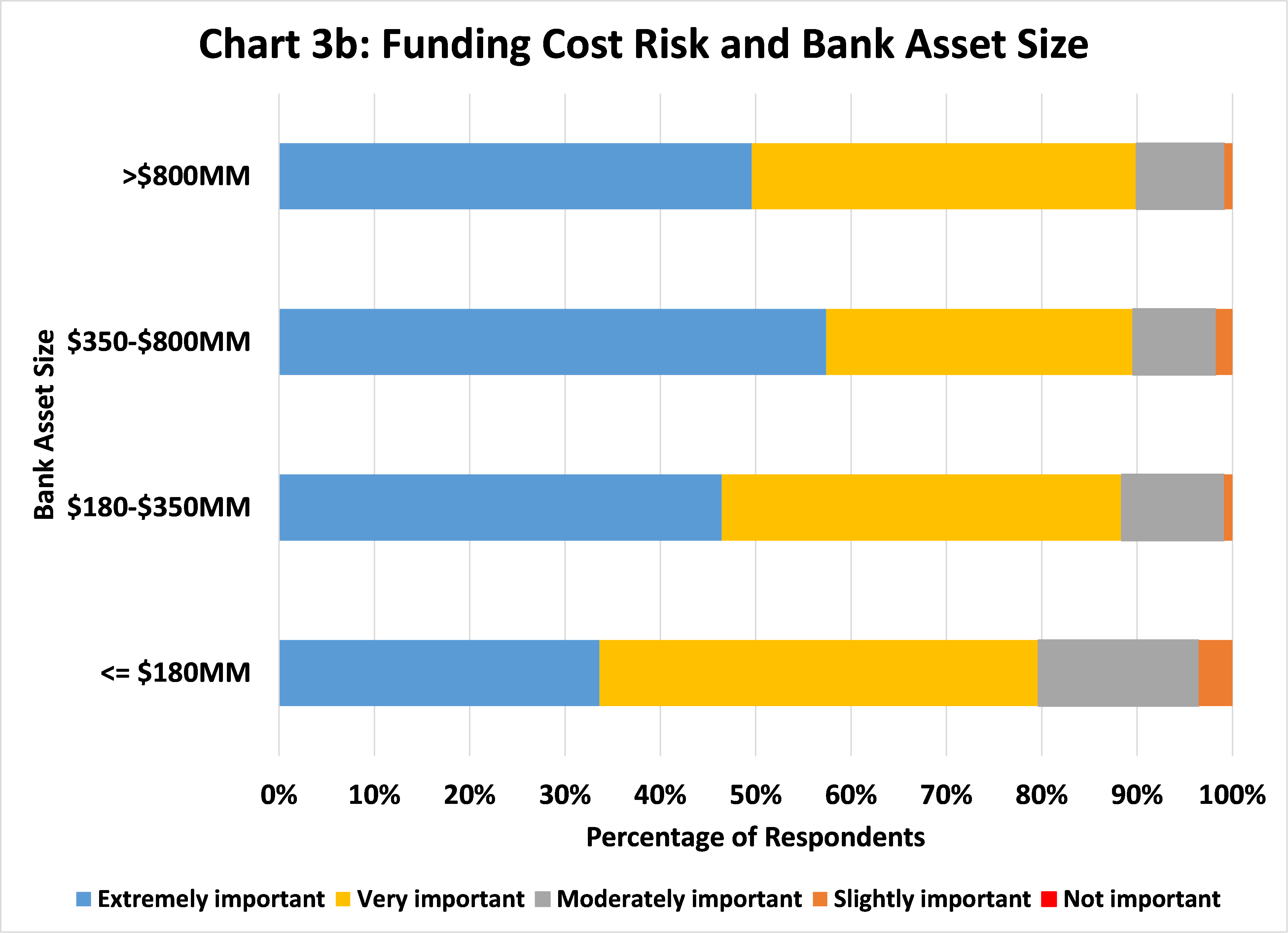

The correlation between the cost of funds as an external risk and ROA is a significant -0.18. Chart 3a shows that like NIM risk, banks reporting higher ROAs (>1.50%) less frequently report funding cost risk as “extremely important” (blue bars) and more frequently report this risk as “moderately important” (grey bars). The least profitable banks (ROA <.75%) more frequently report funding cost risk as “extremely important” (blue bars).

Chart 3b shows that the positive relationship between funding cost risk and bank size is driven by the smaller banks. Smaller banks more frequently report the cost of funds as a “moderately important” external risk (grey bars) and less frequently report it as “extremely important” (blue bars). There is a significant positive correlation of 0.15 between asset size and the cost of funds as an external risk.

Core Deposit Growth

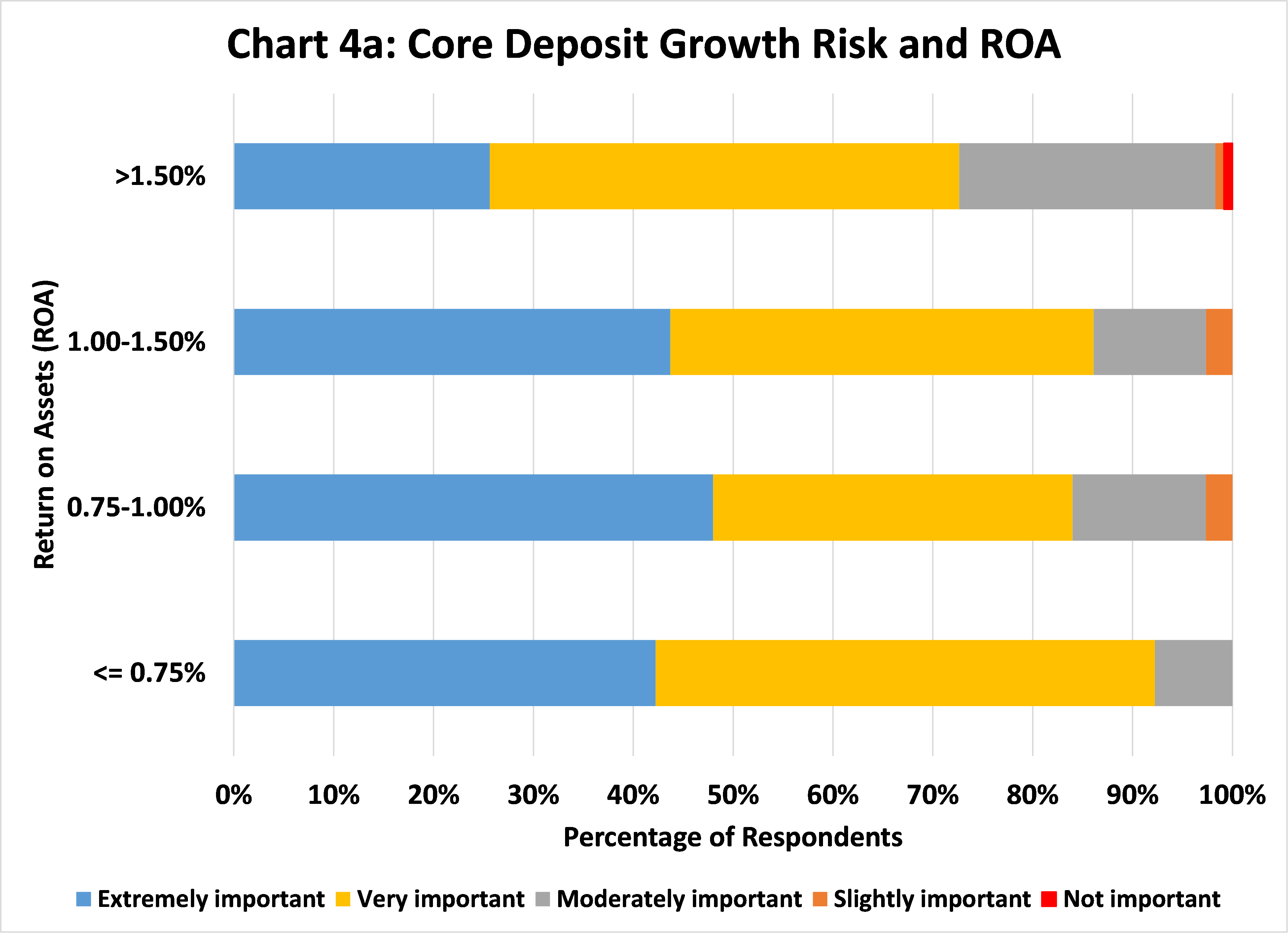

Like the cost of funds, core deposit growth as an external risk has a significantly negative correlation with ROA of -0.17. As shown in Chart 4a, the most profitable banks (ROA>1.5%) less frequently report core deposit growth as an “extremely important” risk (blue bars) and more frequently report it as a “moderately important” risk (grey bars); whereas the least profitable banks (ROA<0.75%) are less likely to report core deposit growth as a “moderately important” risk (grey bars).

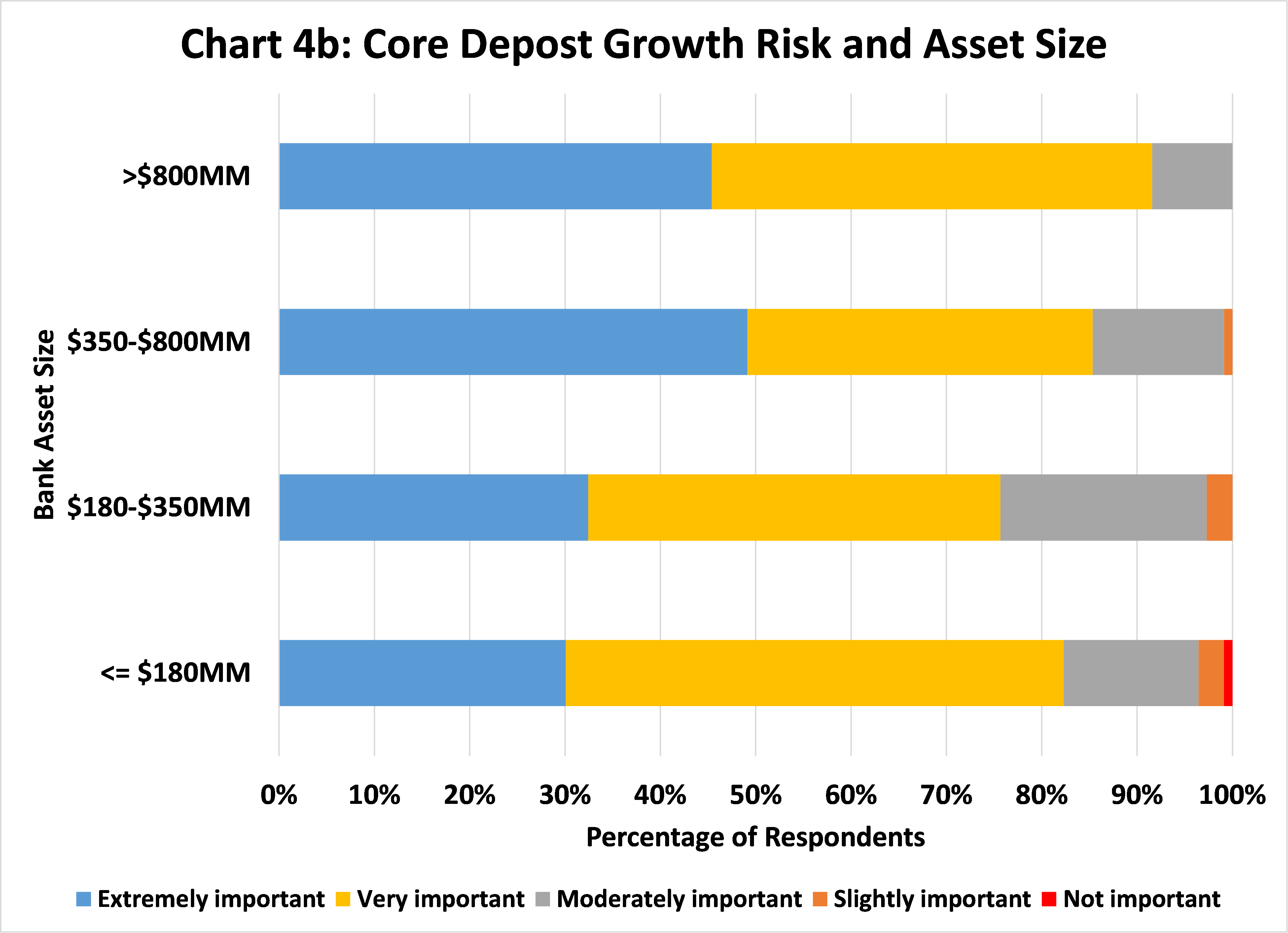

Chart 4b shows that the correlation between core deposit growth as an external risk and bank size was a significantly positive 0.17 and was driven by larger banks less frequently reporting core deposit growth as a “moderately important” risk (grey bars) and smaller banks less frequently reporting it as an “extremely important” risk (blue bars).

Conclusion

The 2023 CSBS Annual Survey of Community Banks revealed that community bankers are most concerned about net interest margins, the cost of funds and core deposit growth as their top three external risks. Clearly, the Federal Reserve’s aggressive monetary policy tightening that started in March 2022 has had an impact on elevating these risks. But when we divide banks by levels of profitability, we find that community banks with higher levels of profitability are less concerned with these risks. And when community banks are differentiated by asset size, we find that smaller community banks are also less concerned with these risks.

The quarterly CSBS Community Bank Sentiment Index shows that community banker sentiment has generally fallen over the past two years as interest rates have increased. With the rapid rise in interest rates across most maturities, loan demand has fallen, deposit competition has stiffened, and funding costs have intensified. Yet, despite these challenges, results from the most recent CSBS Annual Survey of Community Banks suggest that smaller community banks, as well as those with higher levels of profitability, are more confident in managing their net interest margins, cost of funds and core deposit growth.

- Blog post

Too Small to Scale: What 10 Years of Data Say About Community Bank Compliance Costs

Nov 13, 2025

- Press Releases

Net Interest Margins Bump Reg Burden as Top Community Bank Concern

Oct 7, 2025

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter