Regulatory Capital Rule: Capital Simplification for Qualifying Community Banking Organizations

Download the Full Letter [PDF]

Robert E. Feldman, Executive Secretary

Attention: Comments/Legal ESS

Federal Deposit Insurance Corporation

550 17th Street, NW

Washington, DC 20429

RIN 3064-AE91

Office of the Comptroller of the Currency (OCC)

400 7th Street SW., Suite 3E-218, Mail Stop 9W-11

Washington, DC 20219

RIN 1557-AE59 [Docket ID OCC-2018-0040]

Ann E. Misback, Secretary

Board of Governors of the Federal Reserve System

20th Street and Constitution Avenue, NW

Washington, DC 20551

RIN 7100-AF29 [Docket No. R–1638]

Re: Regulatory Capital Rule: Capital Simplification for Qualifying Community Banking Organizations

Dear Sir or Madam,

The Conference of State Bank Supervisors (“CSBS”) appreciates the opportunity to comment on

the Notice of Proposed Rulemaking issued by the Office of the Comptroller of the Currency (the “OCC”), the Federal Reserve Board (the “Board”), and the Federal Deposit Insurance Corporation (the “FDIC”) (collectively, the “agencies”) titled “Regulatory Capital Rule: Capital Simplification for Qualifying Community Banking Organizations” (the “proposed rule” or “proposal”).

The proposed rule implements Section 201 of the Economic Growth Regulatory Relief and Consumer Protection Act of 2018 (“EGRRCPA” or the “Act”). Section 201 directs the agencies to develop a community bank leverage ratio (“CBLR”) to serve as a simple measure of capital adequacy which, if exceeded by certain community banks1, would exempt them from the current regulatory capital rules and associated reporting requirements. Section 201 was intended to provide community banks appropriate regulatory relief from the complexities and burdens of the current regulatory capital rules while ensuring that these organizations maintain a high quality and quantity of capital consistent with that required under the current rules. CSBS believes that Section 201 can be implemented in a manner that fulfills this intent.

However, the proposed CBLR Framework fails to provide community banks the regulatory relief intended by Section 201 primarily because of how the Framework is designed, including how the proposed Framework interacts with the current capital rules and the treatment of a community bank that falls below the CBLR. State bank regulators believe that the establishment of a separate Prompt Corrective Action (“PCA”) Framework within the CBLR Framework, as is proposed, is a fundamental obstacle to achieving the regulatory relief intended by Section 201.

Accordingly, state bank regulators have written this letter primarily to discuss the design of the proposed CBLR Framework and outline how we believe the CBLR Framework could be designed to provide appropriate regulatory relief. Following up on this initial letter, we intend to submit a subsequent letter detailing other policy issues raised by the proposed rule, including issues related to the eligibility for the CBLR Framework (e.g., the definition of certain qualifying criteria), the calibration of the CBLR, and the appropriate role for state bank regulators in the operation of the CBLR Framework. However, state bank regulators felt it necessary to submit an initial letter highlighting our disagreements with the way the proposed CBLR Framework is designed.

In the sections that follow, CSBS discusses the following points:

- The establishment of a new, separate PCA Framework within the CBLR Framework, as is proposed, is not necessary or intended under Section 201 and is not necessary or warranted as a matter of capital policy.

- Instead of establishing a new, separate PCA Framework, the CBLR Framework should require a community bank that falls below the CBLR to immediately begin reporting capital ratios under the current capital rules.

- To ease the operational burdens of transitioning out of the CBLR Framework and for other regulatory and supervisory reasons, the CBLR should be defined as a Tier 1 leverage ratio.

Overview of Section 201 of EGRRCPA and the Proposed CBLR Framework

In directing the agencies to establish a CBLR Framework, Section 201 of the Act defines the components and potential levels of the CBLR, limits eligibility for compliance with the CBLR, and, sets out regulatory consequences for compliance with the CBLR.

Section 201(a) sets out criteria governing eligibility for compliance with the CBLR by defining a “qualifying community bank” as a bank with total consolidated assets of less than $10 billion and by authorizing the agencies to establish other qualifying criteria governing eligibility for the CBLR based on a consideration of the risk profile of qualifying community banks. A bank that meets all of the qualifying criteria is a “qualifying community bank” under Section 201(a) and thus eligible for the CBLR if it exceeds the level of the CBLR established by the agencies under Section 201(b).

The regulatory consequences of a qualifying community bank exceeding the CBLR are set forth in Section 201(c). This subsection provides that a qualifying community bank that complies with the CBLR shall be considered to have met: (1) the generally applicable leverage and risk-based capital requirements under the current capital rules; (2) the capital ratio requirements in order to be considered well capitalized under the applicable PCA Framework; and (3) any other applicable capital or leverage requirements.

To implement these provisions, the agencies have proposed “qualifying criteria” to limit eligibility for the CBLR to qualifying community banks and have proposed to permit such banks to opt into the CBLR framework provided they have a CBLR greater than 9 percent. As proposed, a qualifying community bank that opts into the CBLR framework (CBLR bank) will be exempt from current regulatory capital reporting requirements so long as it maintains a CBLR above 9 percent.

Notably, Section 201 does not set forth the regulatory consequences for a CBLR bank failing to exceed the CBLR with respect to compliance with the current capital requirements, including those under PCA and the generally applicable capital rules. However, Section 201(b) does direct the agencies to establish procedures for the treatment of a CBLR bank that fails to exceed the CBLR. In designing these procedures, the agencies have decided to establish a new, separate PCA Framework within the CBLR Framework that would apply to CBLR banks (the “CBLR PCA Framework”). Additionally, the agencies have proposed to permit CBLR banks to opt out of CBLR framework at any time by using the generally applicable capital requirements and completing the associated reporting requirements.

Under the proposed CBLR PCA Framework, the CBLR level required for qualifying community banks to be eligible to elect to use the CBLR, namely, greater than 9 percent, would be the well capitalized threshold for CBLR banks. Furthermore, the CBLR levels of 7.5 or greater, less than 7.5 percent, and less than 6 percent would serve as “proxies” for the adequately capitalized, undercapitalized, and significantly undercapitalized PCA thresholds, respectively. So, a CBLR bank that has a CBLR equal to 9 percent will, if it does not opt out of the CBLR framework, be less than well capitalized for PCA purposes due to the CBLR PCA Framework.

As discussed in the following sections, state bank regulators do not believe Section 201 requires or was intended to require the establishment of this CBLR PCA Framework and the establishment of such a Framework is unwarranted.

The establishment of a new, separate PCA Framework within the CBLR Framework, as is proposed, is not necessary or required under Section 201 and is not warranted as a matter of capital policy.

State bank regulators believe that designing the CBLR Framework to include a new, separate PCA Framework is not necessary under or intended by Section 201. In setting forth the consequences of CBLR compliance, Section 201(c) does not state or imply that a CBLR bank that fails to exceed the CBLR shall be considered less than well capitalized as a result. Construing Section 201 as requiring or implying this conclusion would be illogical given that the denial of a consequent condition (being considered well capitalized) does not follow from the denial of the antecedent condition (exceeding the CBLR).

Moreover, Section 201 likely references the capital ratio requirements to be well capitalized under the PCA Framework simply to achieve the goal of capital simplification. Specifically, in order to exempt CBLR banks from the current capital rules and associated reporting requirements through Section 201, it was necessary to reference the capital requirements imposed under PCA as well as the generally applicable capital requirements because these capital rules are made applicable to community banks under separate and independent statutory provisions.

In addition to not being required under Section 201, the establishment of a PCA Framework within the CBLR Framework is not warranted or advisable as a matter of capital policy. State bank regulators have a long history of supporting capital rules that require banks to maintain a high quality and quantity of capital. With respect to the CBLR, one concern is that the CBLR would be designed in a manner that leads to significant gaps in PCA coverage or otherwise enables community banks to hold a lower quantity or quality of capital than would be permissible under the current capital rules. However, these concerns are ameliorated by the high quantity of capital required under the CBLR relative to the current capital rules.

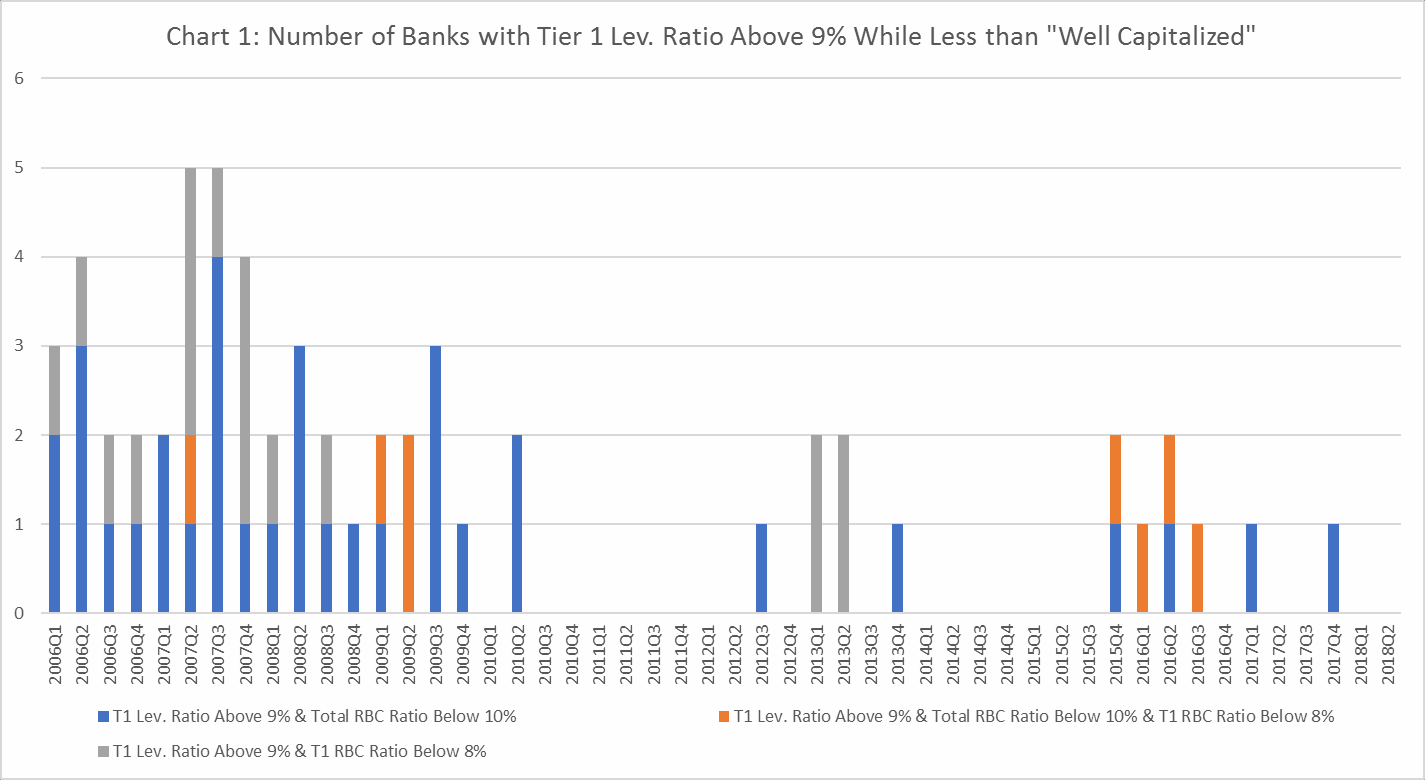

For instance, in the second quarter of 2018, among banks with less than $10 billion in assets, there is not one bank with a CBLR or Tier 1 leverage ratio greater than or equal to 9 percent that fails to maintain the capital ratios required to be well capitalized under the PCA Framework. Additionally, over the past 50 quarters, there are only 59 reported instances in which a bank has had a Tier 1 leverage ratio greater than or equal to 9 percent while failing to maintain the tier 1 and/or total risk-based capital ratios currently required to be well capitalized under the PCA Framework. See Appendix, Chart 1.

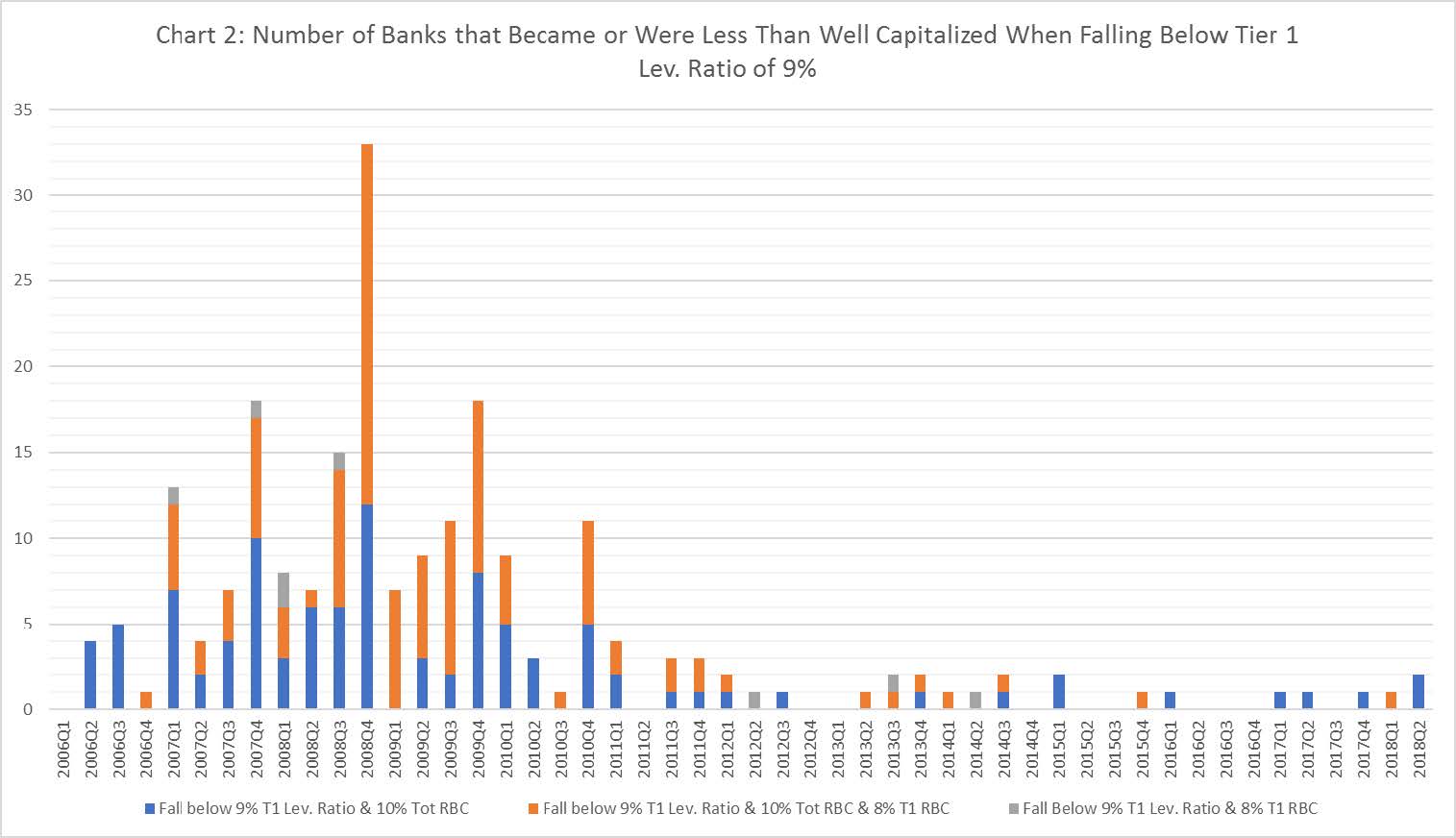

Likewise, it is very uncommon for a bank to fall below a Tier 1 leverage ratio of 9 percent and to fall below in the same quarter or to have already fallen below in a preceding quarter the capital ratio requirements to be well capitalized. Indeed, over the past 50 quarters, the maximum number of banks in any quarter to have fallen below a Tier 1 leverage ratio of 9 percent and have fallen below in the same quarter or have already fallen below in a preceding quarter the current tier 1 and/or total risk-based capital ratio requirements to be well capitalized under the PCA Framework was 33 banks in the fourth quarter of 2008. See Appendix, Chart 2.

Thus, exempting a CBLR bank from the current capital rules and associated reporting requirements and requiring the CBLR bank to begin reporting capital ratios under the current capital rules in the same quarter that it falls below a CBLR of 9 percent would not lead to significant gaps in PCA coverage or otherwise enable CBLR banks to hold a lower quantity or quality of capital than would be permissible under the current capital rules.

The proposed rule states that the agencies decided to establish a CBLR PCA Framework because a CBLR bank may find it difficult to begin complying with the more complex risk-based capital reporting requirements at the same time that the bank is experiencing a decline in its CBLR. Additionally, the proposed rule reasons that an “alternative approach” that requires a CBLR bank to begin reporting capital ratios under the current capital rules as a consequence of falling below the CBLR would be too inflexible compared to the proposed approach of establishing a CBLR PCA Framework.

We understand that a bank that has used the CBLR for a significant period of time may encounter difficulties in transitioning back into compliance with current rules either because it may not have maintained the resources or capacity needed to satisfy reporting requirements or because the generally applicable capital requirements have been substantially revised over this period of time. Given this potential scenario, some may conclude that it would be more appropriate to allow such a bank to comply with a CBLR PCA Framework rather than requiring such a bank to comply with the current capital and PCA requirements.

However, we believe it is precisely this scenario which cautions against establishing a CBLR PCA Framework. For if a CBLR bank is unable to opt out of the CBLR Framework because new, potentially more complex rules and reporting requirements have been incorporated into the generally applicable capital rules, then the CBLR will have effectively become a mandatory capital requirement for qualifying community banks. Ultimately, state bank regulators are concerned that the “flexibility” that the proposed approach may currently seem to afford could, in the future, result in the CBLR functioning as the new, de facto minimum capital requirement for CBLR banks.

In any event, CSBS believes that the operational difficulties of transitioning into compliance with the current regulatory capital rules is far outweighed by the funding and liquidity difficulties that would be created by deeming a CBLR bank that falls below the CBLR less than well-capitalized. As discussed above, the imposition of such funding restrictions is unnecessary given that a CBLR bank with a CBLR at or near 9 percent would, if given the opportunity, be well capitalized under the current PCA Framework.

State bank regulators are sympathetic to concerns that requiring the reporting of capital ratios under the current capital rules immediately upon falling below the CBLR would entail some degree of operational burden. However, as discussed in the following sections, we believe that certain alternative procedures and other amendments to the proposed rule, if adopted, would ease the operational difficulties of transitioning back into compliance with the current capital rules.

Before discussing these alternative approaches, it should be noted that the entire reason that the operational burdens are so daunting here is the unduly burdensome and overly complex nature of the Basel III capital requirements. We should not lose sight of the fact that the entire impetus for enacting Section 201 was the complexity and burden inherent the Basel III capital rules—rules which are not tailored or sensitive to the risk profile of community banks. So if “flexibility” in the implementation of the CBLR is truly what is sought, then this should be provided, not by establishing significantly higher PCA requirements, but rather by comprehensively simplifying the generally applicable capital requirements for community banks, particularly the standardized approach for risk weighting assets. But to simply establish a new, separate PCA Framework for qualifying community banks would be to penalize these banks because rules which were not designed to apply to them are too complex for them to administer. This is not an outcome that state bank regulators can support.

In sum, state bank regulators believe the creation of a PCA Framework within the CBLR Framework is not warranted and that appropriate regulatory relief in line with the intent of Section 201 is not afforded under the proposed CBLR Framework in light of this design.

The proposed CBLR Framework should require a community bank that falls below the CBLR to immediately begin reporting capital ratios under the current capital rules.

Given that the benefit of the CBLR Framework for community banks is gaining an exemption from the current capital reporting requirements, the consequence for a community bank failing to comply with the CBLR should be the re-imposition of the current capital reporting requirements. We believe that a CBLR bank that falls below the CBLR should be given the opportunity to demonstrate that it is well- capitalized under the current PCA Framework.

Accordingly, a CBLR bank that falls below the CBLR should, as a consequence, become subject to the generally applicable risk-based and leverage capital rules and the current PCA Framework. Specifically, when a qualifying community bank falls below the CBLR, the bank should, in the same quarter, be required to report all information necessary to assess its compliance with the current risk-based and leverage capital requirements during that quarter, including information needed to calculate requisite capital components and risk-weighted assets. Under a CBLR Framework designed in this manner, a community bank that falls below the CBLR would be less than well-capitalized for PCA purposes only if it fails to maintain the capital ratios required to be maintained to be well-capitalized under the current PCA Framework.

While state bank regulators are sensitive to concerns regarding the operational burdens associated with transitioning into compliance with current capital reporting requirements in a relatively, short period of time, we also believe that a community bank should maintain an awareness of its capital ratios throughout every quarter, rather than simply at quarter-end and therefore should be prepared at quarter-end to comply with the appropriate reporting requirements. Nevertheless, we believe that there are certain adjustments and amendments to the proposed CBLR Framework that can reduce the operational burden of transitioning out of the CBLR Framework.

One adjustment that could be made to the proposed CBLR Framework to reduce the operational burden of transitioning back into compliance with current regulatory capital rules would be to employ Tier 1 capital as the numerator of the CBLR and thereby make the CBLR a Tier 1 leverage ratio. As discussed in the following section, making the CBLR a Tier 1 leverage ratio would not only enhance the design of the CBLR Framework but would have additional ancillary benefits as well

To ease the operational burdens of transitioning out of the CBLR Framework and for other regulatory and supervisory reasons, the CBLR should be defined as a Tier 1 leverage ratio.

Section 201 allows the agencies to define the numerator of the CBLR as Tier 1 capital is currently defined under the regulatory capital rules and, consequently, the CBLR could simply be a Tier 1 leverage ratio.

We believe making Tier 1 capital the numerator of the CBLR would reduce burdens in transitioning into and out of the CBLR Framework, because the constituent and supplementary capital components reported under the current capital rules could be broken out and reported at the point when the current capital reporting requirements become effective.

While we appreciate the intent of the agencies to provide a simpler definition of capital in the form of CBLR tangible equity, it should be noted that many of the complex deductions and adjustments required in order to calculate Tier 1 capital are simply incorporated into the qualifying criteria for the CBLR Framework rather than the definition of CBLR tangible equity. Accordingly, relying on Tier 1 would not create undue complexity in the CBLR Framework and would actually allow simplification of the CBLR qualifying criteria by enabling the elimination of the criteria pertaining to mortgage servicing assets (MSAs) and deferred tax assets (DTAs).

Some who are altogether opposed to requiring the deduction of MSAs in the calculation of Tier 1 capital might be inclined to support the adoption of CBLR tangible equity because MSAs are not required to be deducted in calculating CBLR tangible equity. But it should be noted that the Tier 1 capital calculation at least permits the partial inclusion of MSAs even where a bank has MSAs above a certain percentage of capital, while, under the proposal, the same bank would be permitted to include, at most, the same amount of MSAs but be disqualified from using the CBLR where it has MSAs above the amount permitted to be included in Tier 1 Capital. Since CBLR tangible equity and Tier 1 capital permit the same amount of MSAs to be included, but CBLR tangible equity links eligibility with the limits on MSAs, Tier 1 capital should be viewed as the more preferable measure by any opposed to requiring the deduction of MSAs.

Additionally, since community banks are already well-acquainted and familiar with the calculation of Tier 1 capital and the Tier 1 leverage ratio, creating a new, simpler leverage ratio would likely result in more burden in the form of changes to internal processes than relief provided in the form of reduced complexity. Indeed, if a Tier 1 leverage ratio is employed in the CBLR Framework, only minimal changes to current reporting processes would be required.

The typical reporting process would be as follows: a qualifying community bank would simply report the information necessary to calculate its Tier 1 capital on Schedule RC-R of the Call Report and divide its Tier 1 capital by its adjusted average total consolidated assets to calculate its Tier 1 leverage ratio. If its Tier 1 leverage ratio exceeds 9 percent, then the bank would be finished reporting Schedule RC-R, but if its Tier 1 leverage ratio is equal to or below 9 percent, then the bank would be required to complete the remainder of Schedule RC-R, including the calculation of capital components other than Tier 1 and the calculation of risk-weighted assets. Accordingly, under this approach, implementation of the CBLR Framework could occur primarily through revisions to the current Call Report instructions and only minimal changes to other regulations would be necessary.

State bank regulators share the agencies’ goals that the CBLR should be calibrated to not reduce the quality or quantity of capital currently held by qualifying community banks while ensuring that the CBLR Framework is available to a meaningful number of community banks. Importantly, however, using the Tier 1 leverage ratio as the CBLR will have no significant impact on either eligibility for the CBLR or the quality of capital required to be held under the CBLR Framework.

With respect to eligibility, among banks with less than $10 billion in total consolidated assets, we estimate that 7 banks have a CBLR below 9 percent and a Tier 1 leverage ratio above 9 percent—and thus would be rendered eligible under this approach—whereas 20 banks have a CBLR above 9 percent and a Tier 1 leverage ratio below 9 percent—and thus would be rendered ineligible under this approach.2 With respect to the quality of capital, for 77 percent of banks with less than $10 billion in total consolidated assets, CBLR tangible equity is equal to Tier 1 capital, and, among the remaining 23 percent of banks, CBLR tangible equity differs from Tier 1 capital by no more than 0.4 percent of the total aggregate CBLR tangible equity of all banks with less than $10 billion in total consolidated assets.3

Finally, employing Tier 1 capital as the numerator of the CBLR would have other benefits in addition to enhancing the design of the CBLR Framework. Specifically, the use of a Tier 1 leverage ratio will preserve the ability of bank supervisors to compare capital adequacy across community banks within the CBLR Framework and those outside the Framework. Moreover, relying on Tier 1 capital within the CBLR Framework will avoid necessitating revisions to state banking laws that reference Tier 1 capital, including but not limited to state law lending limits.

In sum, we believe CBLR should be defined as a Tier 1 leverage ratio in order to more expeditiously accomplish the agencies’ goals of providing meaningful reduction in complexity and burden and thereby achieve the regulatory relief intended with the enactment of Section 201.

Conclusion

State bank regulators appreciate the opportunity to comment on the proposed CBLR Framework. This letter was intended to lay out the more significant concerns we have regarding the design of the proposed CBLR Framework, including the establishment of a CBLR PCA Framework. As mentioned above, we intend to submit a subsequent letter to cover other policy issues implicated by the proposed rule.

However, state bank regulators felt compelled to submit a separate, initial letter early on in the public comment process to outline our concerns with the direction the agencies are headed with CBLR implementation.

State bank regulators share the agencies’ goal of ensuring the CBLR provides appropriate regulatory relief to qualifying community banks. We believe Section 201 can and should be implemented in a manner that provides such relief. While we feel the design of the proposed CBLR Framework falls short of achieving this goal, we are confident that, if the recommendations in this letter are adopted, this goal can be achieved.

Sincerely,

John Ryan

President & CEO

1 In this letter, we use the terms “bank” and “community bank” to refer to both depository institutions and depository institution holding companies.

2 Source: FFIEC Call Reports. Data as of 2018Q2.

3 Source: FFIEC Call Reports. Data as of 2018Q2.

Appendix

- Podcasts

Inside the Debate on Capital Standards and Community Bank Competitiveness with the Federal Reserve Board

Nov 5, 2025

- Blog post

Adjusting Outdated Regulatory Thresholds Helps Community Banks

Sep 25, 2025

- Comment Letter

Adjusting and Indexing Certain Regulatory Thresholds

Sep 24, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter