Adapting to the Digital Age: How are Core Services Providers Viewed?

Blog 5 of 7: How are Core Service Providers Viewed?

By CSBS Chief Economist Thomas F. Siems, Temple University Professor of Finance and CSBS Adjunct Research Scholar Jonathan A. Scott and Federal Reserve Bank of St. Louis Supervision Policy, Research and Analysis Manager Meredith A. Covington

Adapting to the Digital Age Series

- Blog 1: Macroeconomic Forces

- Blog 2: Competitive Forces

- Blog 3: Tech Usage

- Blog 4: Is Tech an Opportunity or a Threat?

- Blog 5: How are Core Services Providers Viewed?

- Blog 6: Tech Investment and Mergers and Acquisitions

- Blog 7: Community Bankers’ View of Technology

In this seven-part blog series, we explore how community banks are adapting to a changing digital landscape by analyzing banking and technology questions from the 2021 CSBS National Survey of Community Banks. Survey results are presented each fall at the annual Community Banking in the 21st Century Research and Policy Conference, sponsored by CSBS, the Federal Reserve and the Federal Deposit Insurance Corp.

In the fifth installment in this series, we examine how community bankers view their core service providers.

In today’s technology-driven banking environment, a community bank’s relationship with its core service provider should be a strategic partnership that supports its business objectives. In our previous blog post, we found that community banks view future technological innovation more as an opportunity than a threat, particularly for high tech-usage banks and larger banks. So, how satisfied are community banks with their core service provider?

Tech Spending

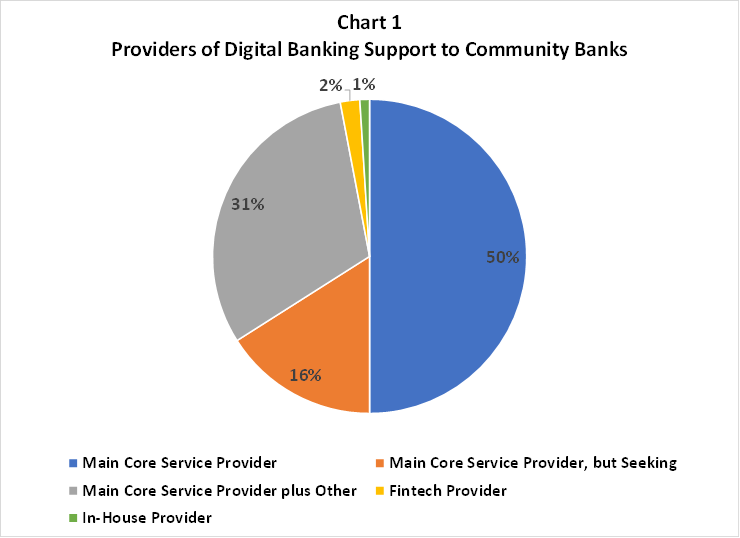

The 2021 CSBS National Survey of Community Banks (Survey) provides a unique look at how community banks view their relationship with their CSPs. As shown in Chart 1, of the 213 banks that responded to a question about their provider of digital banking support, over half reported relying exclusively on their traditional core service provider (e.g., Jack Henry, FISERVE, or FIS). Over 30% reported they relied on their current core service provider and other providers, which likely includes vendors that provide specialized applications for mobile banking that “bolt on” to the core service provider platform (e.g., Q2). About 16% of those responding to the question reported they rely on their current core service provider but are seeking a fintech relationship, perhaps for a banking-as-a-service partnership. Only four respondents (two percent of those answering the question) reported that a fintech firm was their source of digital banking support and two responded that they use no external provider (presumably in-house only).

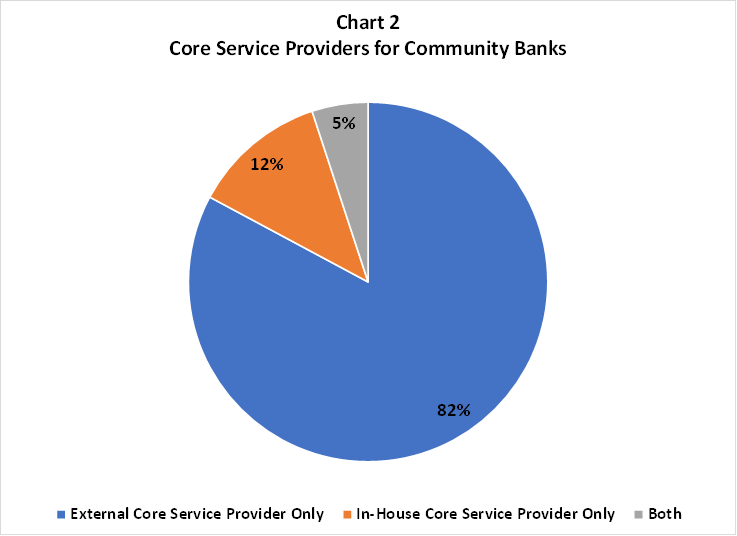

A more detailed perspective of the tech ecosystem comes from questions about service satisfaction with both outside and in-house core processing. The dimensions of satisfaction include cost, speed of innovation, tech sophistication, ability to roll out new products, customer service, compatibility with other vendors and contract flexibility. Unlike the question about provision of digital banking services, most of the survey respondents answered these questions. Using the responses to both sets of questions (outside versus in-house), Chart 2 shows that approximately 82% rely primarily on an external core processor only, 12% rely on in-house core processing only, and 5% use both.

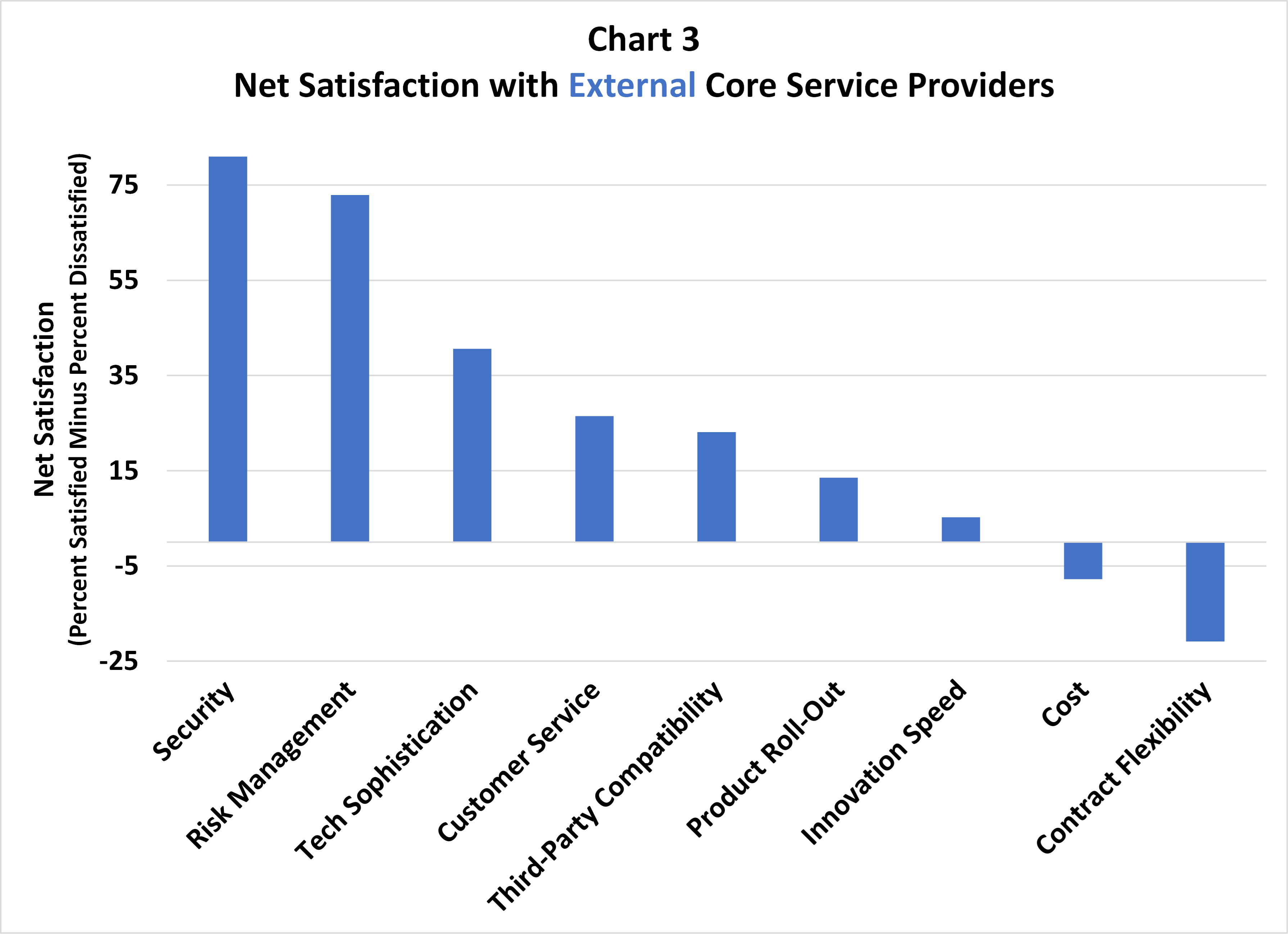

For banks relying on external core service providers only, Chart 3 shows net satisfaction (defined here by subtracting the percentage of responses for “very satisfied and “satisfied” from the percentage that are “dissatisfied” and “very dissatisfied”) for each of the nine service dimensions included in the Survey. External core service providers were ranked highest for risk management (81%), security (73%), and tech sophistication (41%) and lowest for contract flexibility (-21%), cost (-8%) and innovation speed (5%).

No strong association was found with tech usage (see our earlier blog for a definition of tech usage) and net satisfaction with external core service providers. Interestingly, satisfaction with innovation speed is higher for smaller community banks under $150 million in assets (52% versus 43% overall), while larger banks over $725 million in assets are more dissatisfied (50% versus 38% overall). These institutions may be facing more competition from banks that are more tech-enabled in their product offerings.

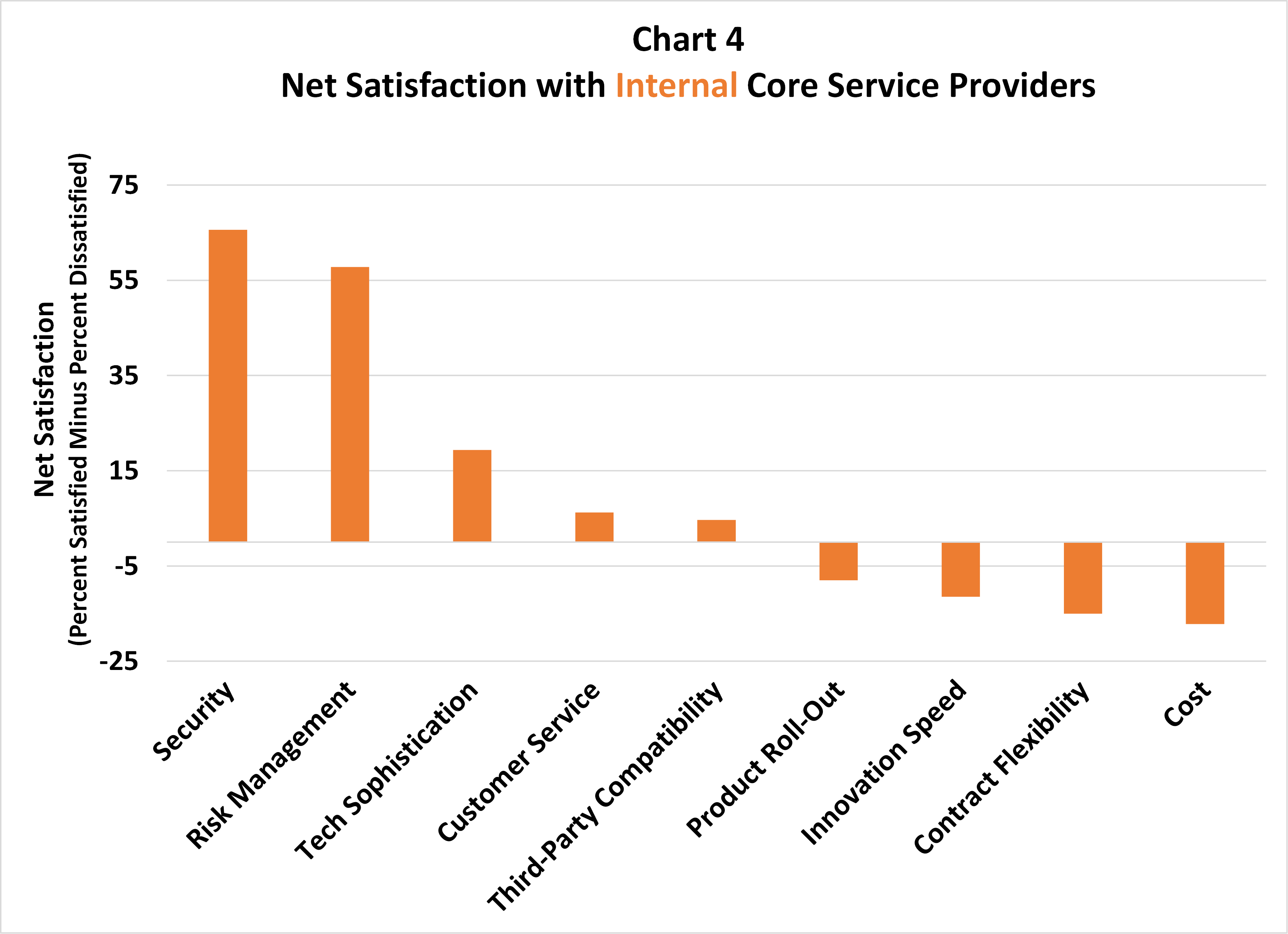

Net satisfaction for internal core service providers differs in some notable ways, as shown in Chart 4. Although it is a much smaller sample of banks, across all dimensions, net satisfaction is lower for internal processing versus external core service providers, including cost and contract flexibility. Internal core service providers were ranked highest for security (66%), risk management (58%), and tech sophistication (19%) and lowest for cost (-17%), contract flexibility (-15%), and innovation speed (-11%).

Conclusion

Using the 2021 Survey, we are able to take an initial look at community bankers’ use of core service providers and satisfaction with their services. Over half of the respondents rely exclusively on their core service providers, while almost one-third have a partnership with another vendor in addition to their primary core service provider. For both external and in-house core service providers, community bankers were most satisfied with security, risk management, and tech sophistication and least satisfied with innovation speed, cost, and contract flexibility.

For many community banks, the ability to stay competitive requires both a responsive core service provider and the ability to improve efficiency and provide more revenue streams. To achieve these gains from efficiency or enhanced revenue streams, banks need to be able to scale their technology investment. One way to quickly achieve platform scale is through mergers and acquisitions, the subject of our next blog.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter