Adapting to the Digital Age: Community Bankers’ Perspectives on Technology

Blog 1 of 7: Macroeconomic Forces

By CSBS Chief Economist Thomas F. Siems, Temple University Professor of Finance and CSBS Adjunct Research Scholar Jonathan A. Scott and Federal Reserve Bank of St. Louis Supervision Policy, Research and Analysis Manager Meredith A. Covington

Adapting to the Digital Age Series

- Blog 1: Macroeconomic Forces

- Blog 2: Competitive Forces

- Blog 3: Tech Usage

- Blog 4: Is Tech an Opportunity or a Threat?

- Blog 5: How are Core Services Providers Viewed?

- Blog 6: Tech Investment and Mergers and Acquisitions

- Blog 7: Community Bankers’ View of Technology

In this seven-part blog series, we explore how community banks are adapting to a changing digital landscape by analyzing banking and technology questions from the 2021 CSBS National Survey of Community Banks. Survey results are presented each fall at the annual Community Banking in the 21st Century Research and Policy Conference, sponsored by CSBS, the Federal Reserve and the Federal Deposit Insurance Corp.

The first installment in this series sets the stage by putting the most recent survey responses within the context of current macroeconomic conditions.

Current Macroeconomic Conditions

The 2020 recession―caused by the COVID-19 pandemic and subsequent economic lockdowns―changed customer behaviors and provided an opportunity for community banks to reevaluate their digital banking strategies. Many banks accelerated their plans for full-service digital banking to give their customers more control over their banking relationships. Internally, community bankers also evaluated how their digital strategy can support high levels of security, improved workflow and process automation, and the use of data analytics for both marketing and risk management. In summary, since early 2020, community bankers learned to quickly adapt to a remote work environment that necessitated meeting customer needs using new technologies and/or embracing ones that were previously underused.

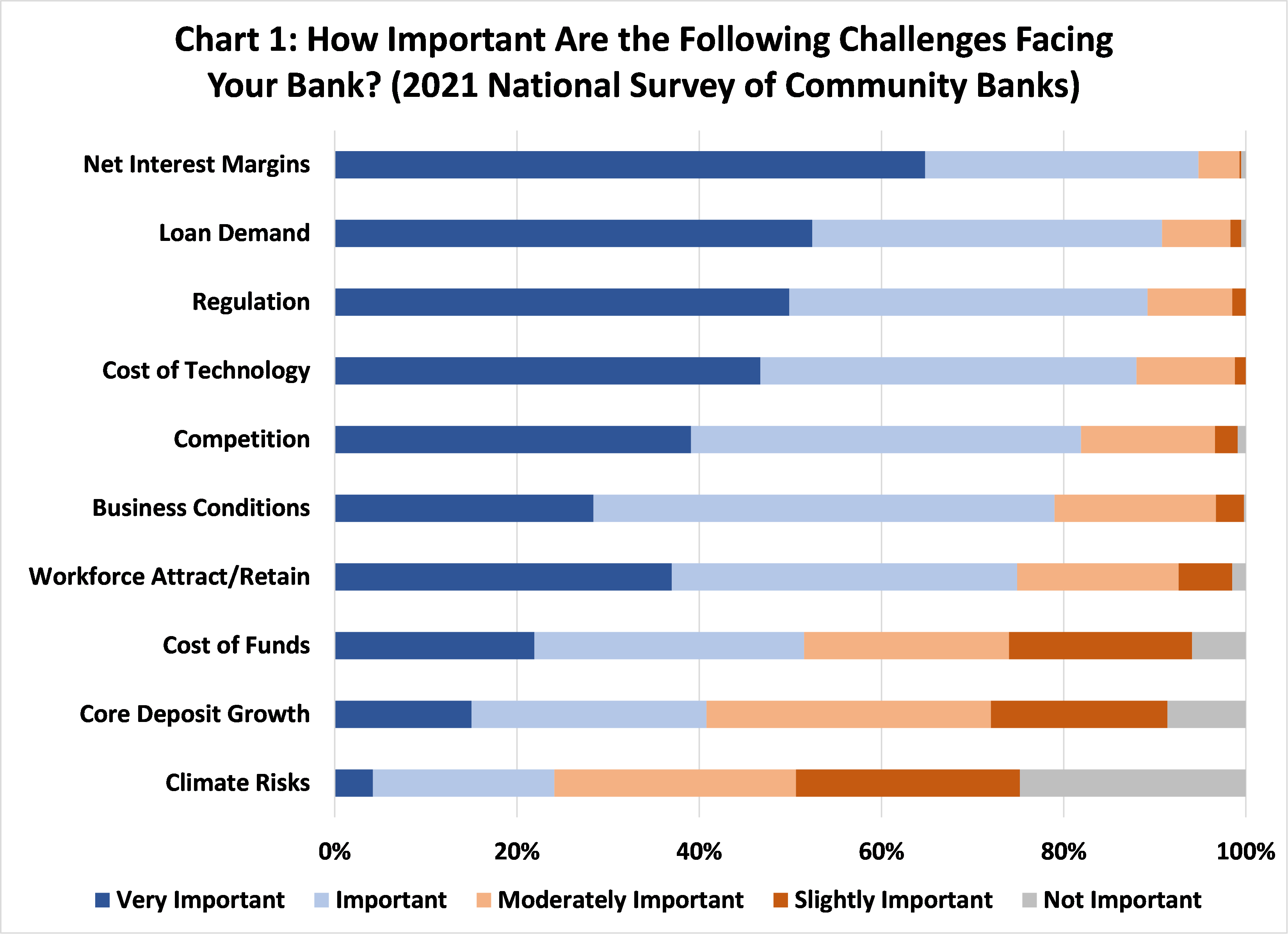

One of the key findings in the 2021 CSBS National Survey of Community Banks is that maintaining and growing net interest margins (“NIMs”) was community bankers’ top challenge. Among 10 possible responses to the question, “How important are the following external challenges facing your bank today?” Chart 1 shows that compressed NIMs was on top with 65% of respondents saying it is “very important.” The next most important challenge was declining loan demand with 52% of community bankers citing it as a “very important” challenge. In 2020, community bankers said that “business conditions” was their single greatest challenge, while a year earlier (2019) community bankers identified “core deposit growth” as the single greatest challenge.

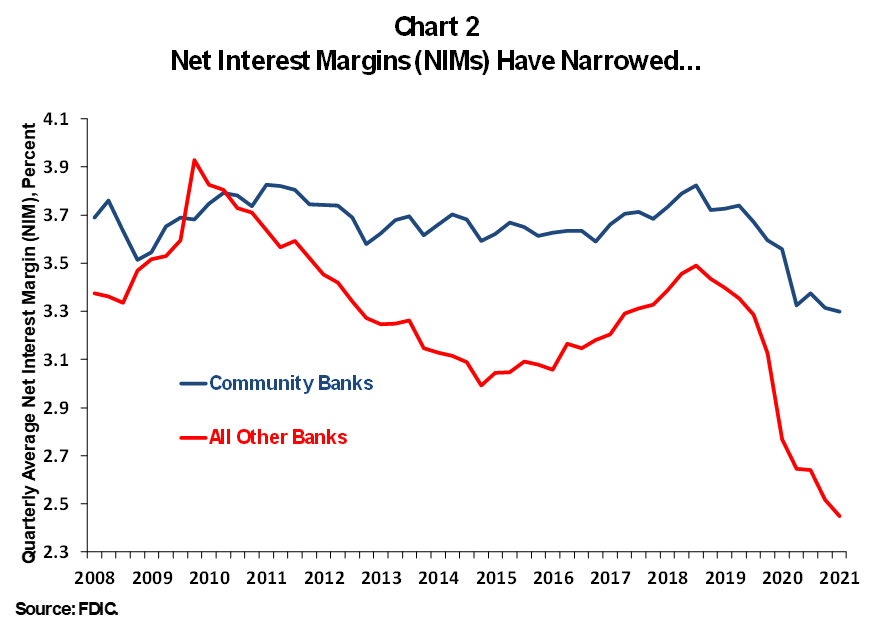

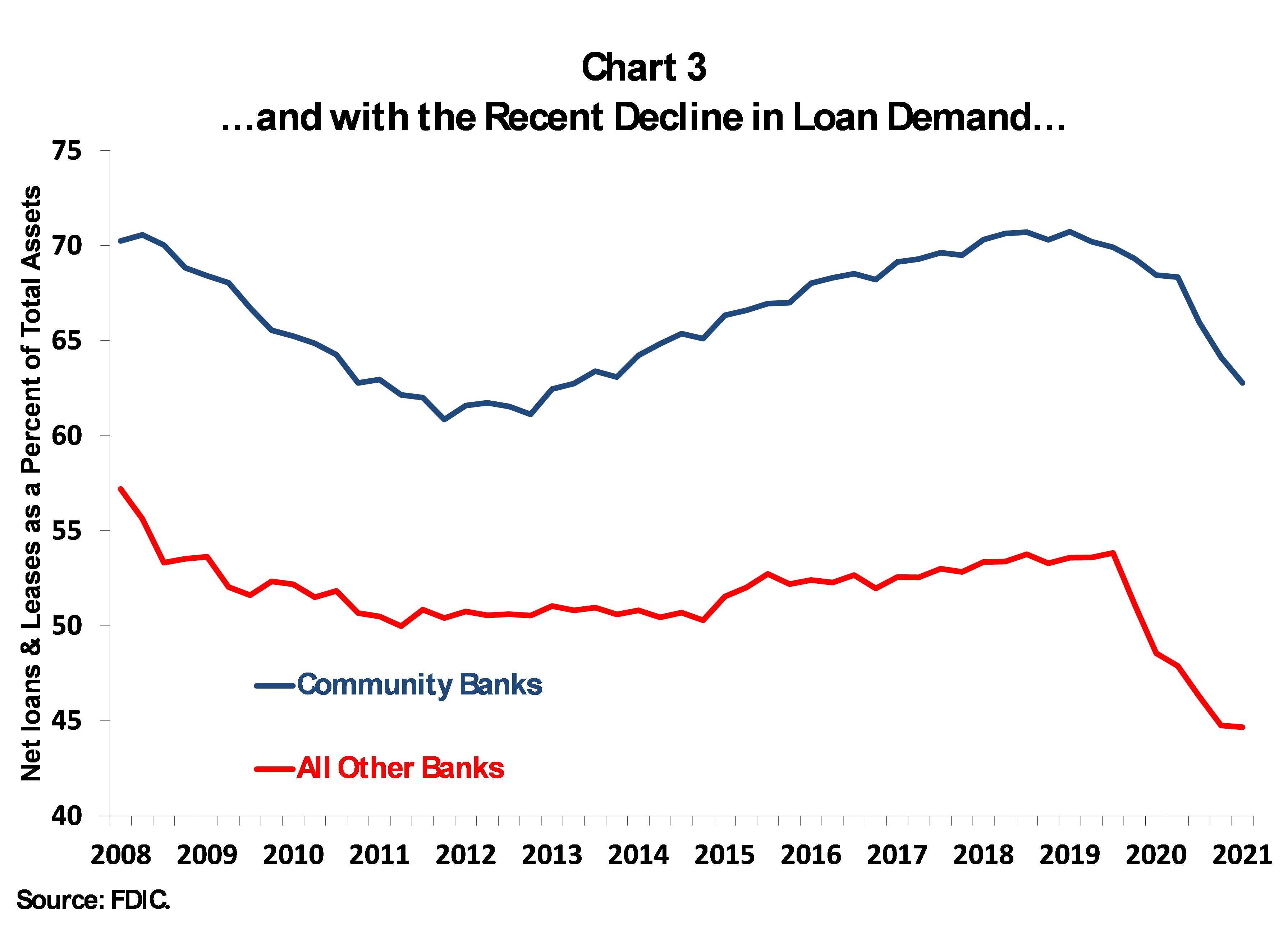

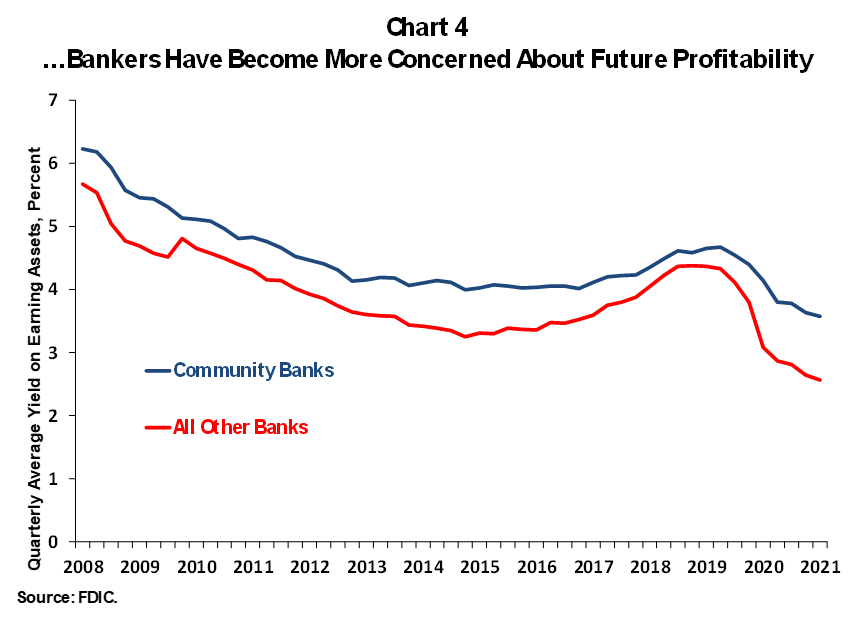

The banking environment and associated challenges have changed dramatically since the start of the pandemic. In the 2021 Survey, 52% of community bankers cited declining loan demand as a “very important” challenge. And indeed, Chart 2 shows how much NIMs have narrowed, while Chart 3 indicates that recent loan demand has declined significantly. The result of lower rates, declining loan demand, and abundant liquidity has led to lower bank profitability on earning assets (Chart 4). Outside of identifying new sources of loan demand, one of the few levers left to offset lower profitability pressures is to improve efficiency, potentially through adoption of digital technologies that drive down operating costs and/or generate new revenue streams.

Conclusion

In this introduction to our seven-part series on Adapting to the Digital Age: Community Bankers’ Perspectives on Technology, we show that community banks are in a challenging economic environment characterized by declining loan demand, abundant liquidity, and narrower net interest margins. One possible path to reverse the declining trend in profitability is through investments in technology.

Some of the important questions we hope to answer in future blogs in this series include: How are community bankers using tech-enabled products and to what extent? How important is the adoption of new technologies to community bankers, and what are their views on existing technologies and future innovation as either an opportunity or as a threat? How do community bankers evaluate the effectiveness of their spending on new and existing technologies, including spending for core service processors and other third-party tech vendors?

Next week, we will examine how community bankers assess their main areas of competition.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter