Adapting to the Digital Age: Tech - Opportunity or Threat?

Blog 4 of 7: Is Tech an Opportunity or a Threat?

By CSBS Chief Economist Thomas F. Siems, Temple University Professor of Finance and CSBS Adjunct Research Scholar Jonathan A. Scott and Federal Reserve Bank of St. Louis Supervision Policy, Research and Analysis Manager Meredith A. Covington

Adapting to the Digital Age Series

- Blog 1: Macroeconomic Forces

- Blog 2: Competitive Forces

- Blog 3: Tech Usage

- Blog 4: Is Tech an Opportunity or a Threat?

- Blog 5: How are Core Services Providers Viewed?

- Blog 6: Tech Investment and Mergers and Acquisitions

- Blog 7: Community Bankers’ View of Technology

In this seven-part blog series, we explore how community banks are adapting to a changing digital landscape by analyzing banking and technology questions from the 2021 CSBS National Survey of Community Banks. Survey results are presented each fall at the annual Community Banking in the 21st Century Research and Policy Conference, sponsored by CSBS, the Federal Reserve and the Federal Deposit Insurance Corp.

In the fourth installment in this series, we examine how community bankers view technology.

Introduction

Community banks use various technologies to increase revenues and improve efficiency to remain competitive. In our previous blog, we defined community bank tech usage and found that banks reporting the highest tech-usage tend to be larger (as measured by total assets), headquartered in more populated areas, and appear to have better economies of scale (based on a simple efficiency ratio of data processing costs divided by total assets).

What drives these differences in community bank tech-usage? How do community bankers view tech spending and investment? Do they view existing technologies and future innovations as an opportunity or as a threat? And do the responses differ by the asset size of the bank, the degree of technology usage, or other factors such as market size, geographic location or profitability?

We explore answers to these questions by examining responses from the CSBS 2021 National Survey of Community Banks (“Survey”).

Tech Importance and Opportunities

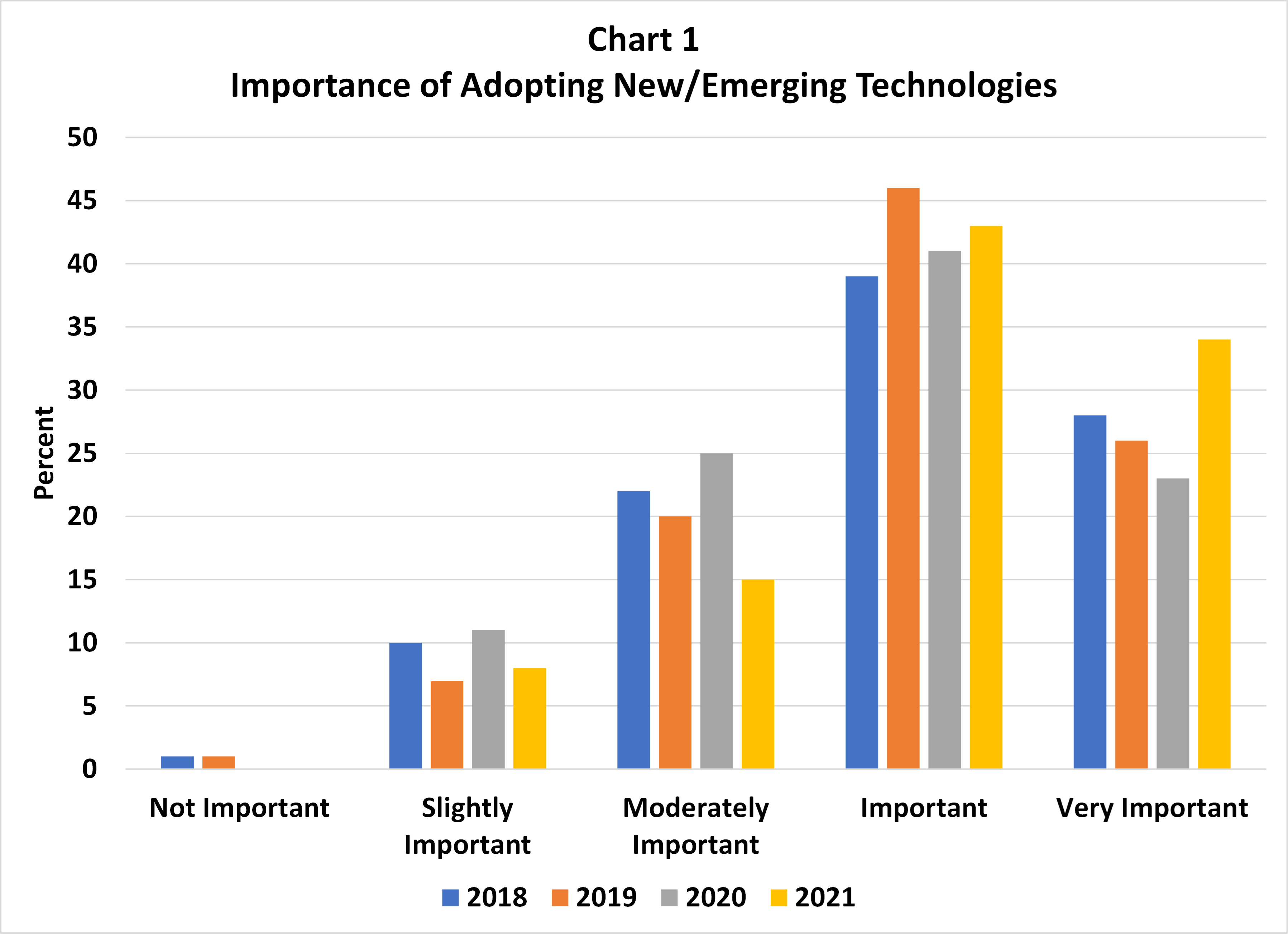

In 2021, more than 77% of respondents to the Survey reported that it was “very important” or “important” to adopt new or emerging technologies, a full 10 percentage point increase from the first time the question was asked in 2018 (see Chart 1). High tech-usage firms, at 46%, more frequently reported that it was “very important” to adopt new or emerging technologies versus 19% for low tech-usage firms. Likewise, larger banks (those in the highest asset quartile) more frequently reported (50%) that it was “very important” to adopt new or emerging technologies versus 26% for the smallest banks. However, no association was found between bank views on new/emerging technology adoption and market size, location, or profitability.

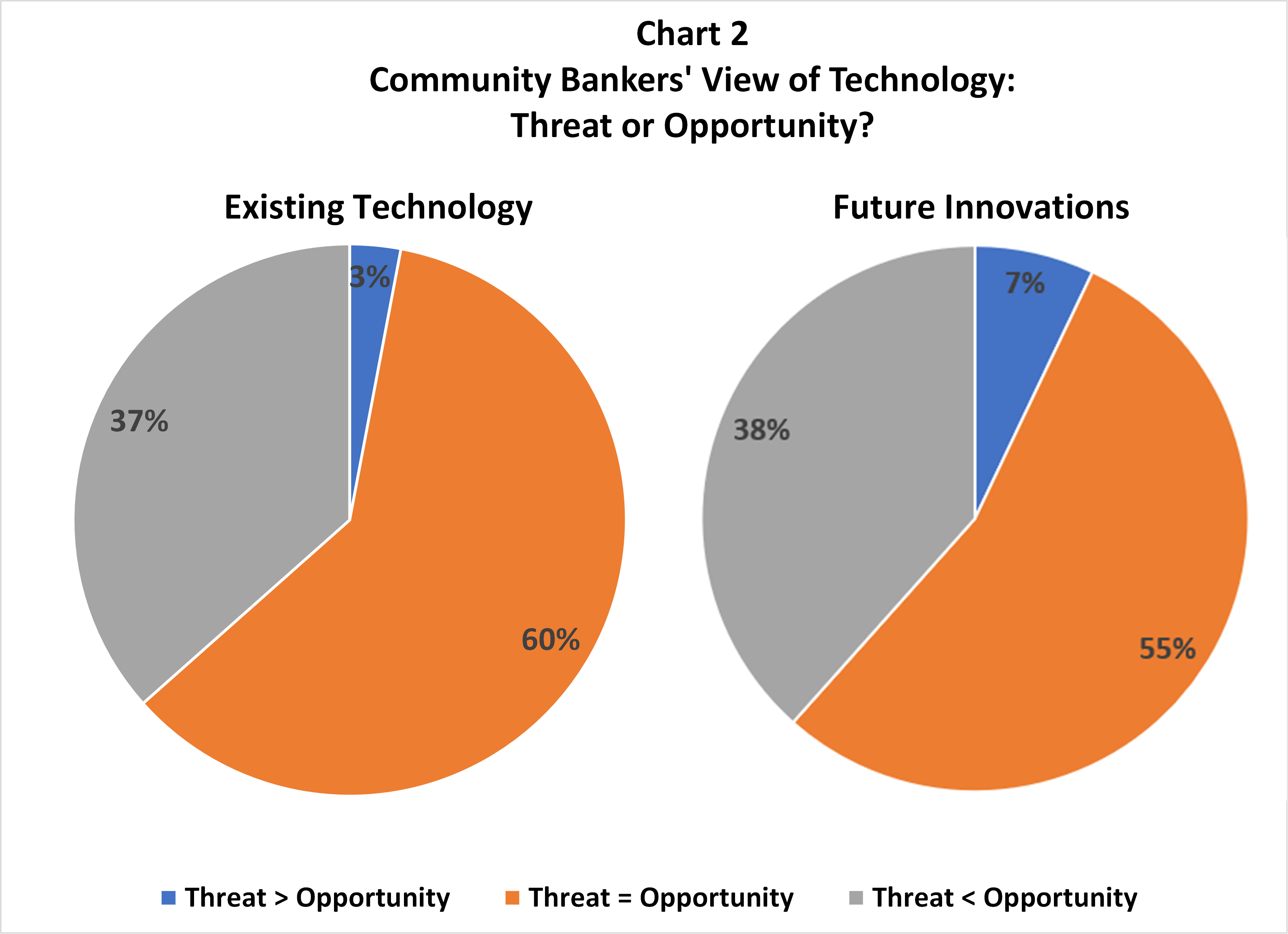

In the 2021 Survey, community banks were asked for the first time about their views of existing technology and future banking innovation through the lens of an opportunity and threat assessment. As shown in Chart 2, not much difference is found between those reporting “more an opportunity than a threat” between existing technology (37%) and future banking innovation (39%).

Tech usage was not related to the opportunities of existing technology but was strongly related to the view of future innovation. High tech-usage banks more frequently reported a view of future innovation as more of an opportunity than a threat (47%) compared to 26% of low tech-usage firms.

A similar pattern existed for size, with 55% of the largest banks reporting future innovation of more an opportunity than a threat compared to the smallest banks (30%).

Views on future innovation did not vary with market size or location.

Satisfaction with Tech’s Impact on Bank Operations

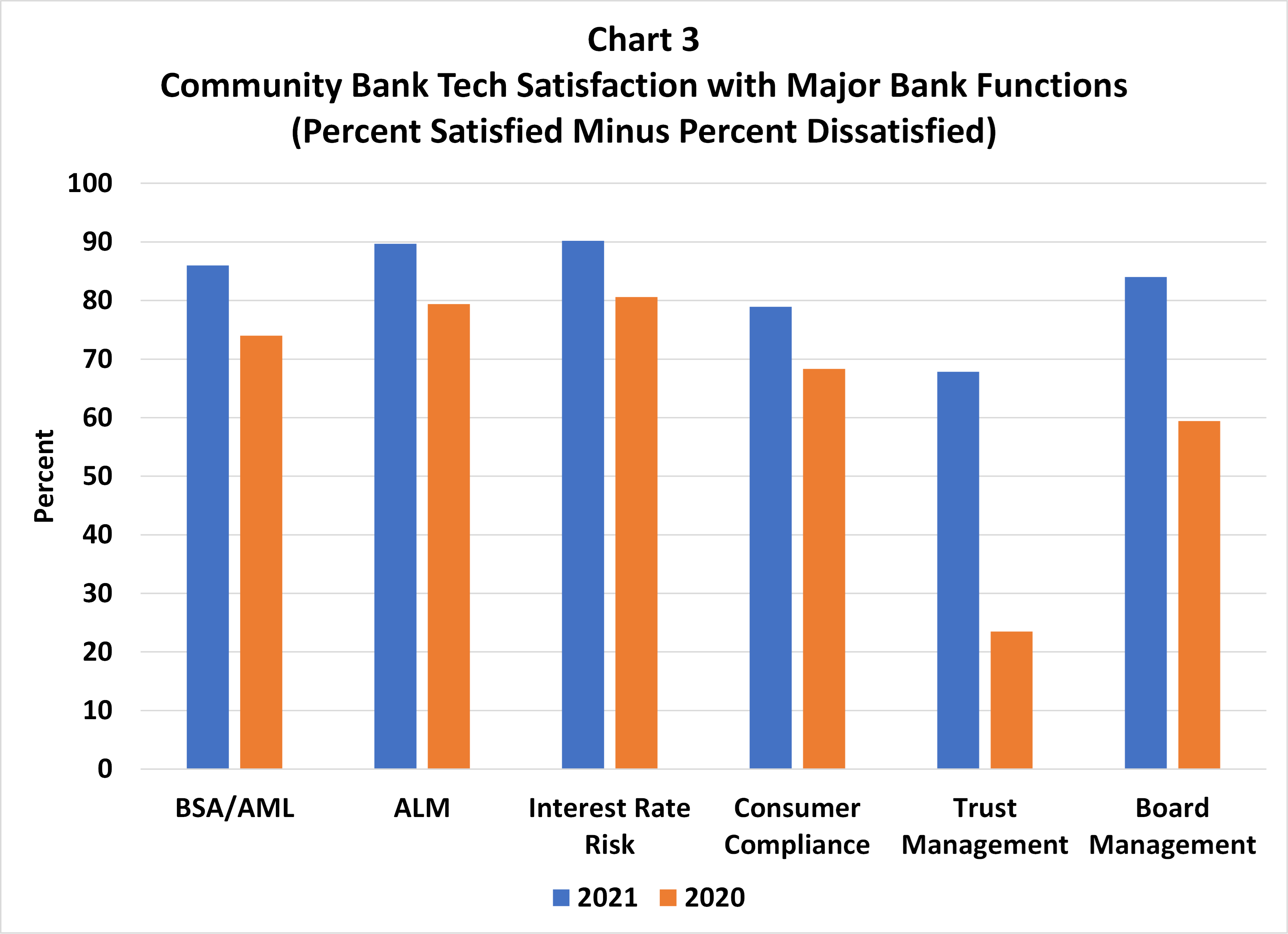

While only about one-third of the respondents view existing technology as more of an opportunity than a threat, banks are generally very satisfied with tech’s impact on major bank functions. We create the metric net satisfied banks by subtracting the percentage of responses that were “dissatisfied” and “highly dissatisfied” from the percentage of responses that were “highly satisfied” and “satisfied.” For each bank function ― Bank Secrecy Act/Anti-Money Laundering (BSA/AML) compliance, asset liability management (ALM), interest rate risk, consumer compliance, trust management and board management ― Chart 3 shows that satisfaction in 2021 improved across all functions compared to 2020.

Interest rate risk and ALM rated the highest. The lowest ratings were for trust management and consumer compliance. Ratings of tech satisfaction for major bank functions had no strong association with tech usage, asset size or location.

Promising Tech Supported Products

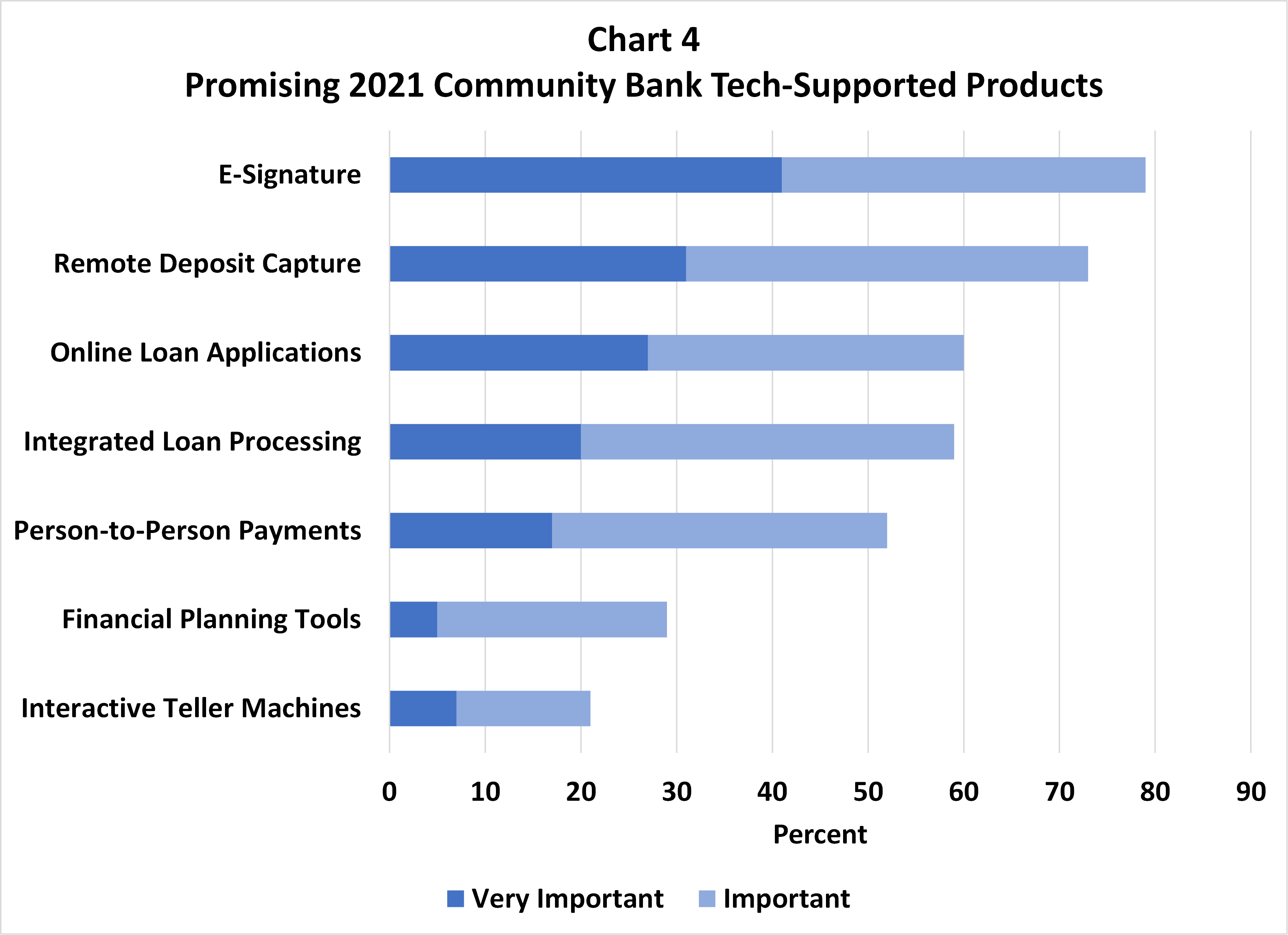

Banks were also asked about the importance of promising tech-supported product opportunities, including e-signature, remote deposit capture, online loan applications, integrated loan processing, person-to-person (P2P) payments, financial planning tools and ITMs. As shown in Chart 4, e-signature is viewed most positively with 41% reporting “very important,” followed by remote deposit capture (31%) and online loan applications (27%). Based on overall importance (combining “very important” and “important” responses), e-signature remains the most promising product (79%), followed by remote deposit capture (73%) and online loan applications (60%).

The ratings of importance are positively associated with tech usage and asset size for each product, but no association was found with market size, geographic region or profitability.

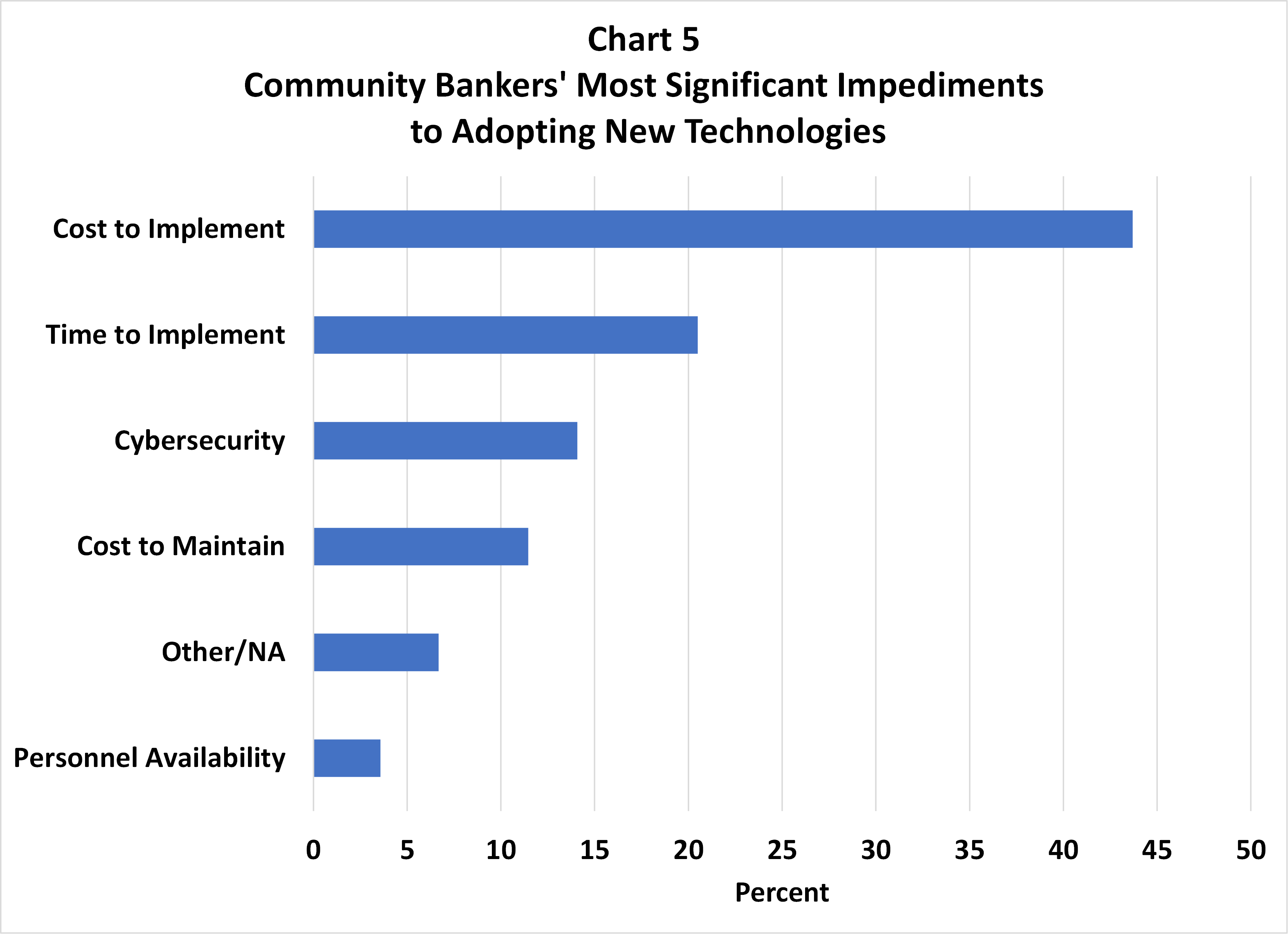

What are the most significant impediments to community banks adopting these products? Chart 5 shows that cost is the number one reason, followed by time to implement – which is also another cost. Interestingly, high tech-usage banks are less likely to report cost to implement (39% versus 44% overall) and cost to maintain (8% versus 11% overall) as the most significant impediment, whereas the opposite is true for low tech-usage banks. However, high tech-usage banks are more likely to report time to implement (26% versus 21% overall) as their most significant impediment.

These contrasting outcomes - less concern about cost and more concern about time to implement for high tech-usage banks - probably reflects a strategic commitment to investing in technology, but with underlying concerns about how quickly the benefits can be realized.

Conclusion

The 2021 Survey provides evidence that the adoption of technology is gaining importance, and even more so among high tech-usage banks and larger community banks. High tech-usage banks and larger banks view future technological innovation more as an opportunity than a threat.

On balance, community bankers are satisfied with technology’s impact on existing bank functions, and view promising tech-supported products favorably, especially e-signature, remote deposit capture, and online loan applications. Cost and the time to implement tech innovations are the greatest impediments to adopting new products, while low tech-usage banks are more concerned about cost, and high tech-usage banks are more concerned about the time to implement.

The Survey suggests that low cost, easy-to-implement technology products that improve the overall delivery of core bank products and services are most likely to be adopted by community banks. With many community bankers reliant on core processors for tech adoption and customer service, our next blog will use the 2021 Survey to look at how satisfied community bankers are with their core service providers.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter