Adapting to the Digital Age: Competitive Forces

Blog 2 of 7: Macroeconomic Forces

By CSBS Chief Economist Thomas F. Siems, Temple University Professor of Finance and CSBS Adjunct Research Scholar Jonathan A. Scott and Federal Reserve Bank of St. Louis Supervision Policy, Research and Analysis Manager Meredith A. Covington

Adapting to the Digital Age Series

- Blog 1: Macroeconomic Forces

- Blog 2: Competitive Forces

- Blog 3: Tech Usage

- Blog 4: Is Tech an Opportunity or a Threat?

- Blog 5: How are Core Services Providers Viewed?

- Blog 6: Tech Investment and Mergers and Acquisitions

- Blog 7: Community Bankers’ View of Technology

In this seven-part blog series, we explore how community banks are adapting to a changing digital landscape by analyzing banking and technology questions from the 2021 CSBS National Survey of Community Banks. Survey results are presented each fall at the annual Community Banking in the 21st Century Research and Policy Conference, sponsored by CSBS, the Federal Reserve and the Federal Deposit Insurance Corp.

In this blog, the second installment in this series, we examine how community bankers assess their main areas of competition.

Community Bank Competitors

Community bankers operate in an intensely competitive environment. In addition to 4,900 or so community banks and their large bank peers, bankers also compete with credit unions, savings institutions and a growing group of nonbank competitors (institutions that do not offer both lending and deposit services and include mortgage originators, payday lenders and fintech companies). Throughout this series, we use the FDIC definition for a community bank.

Competition on both sides of the balance sheet drives tech investment. Banks in smaller markets with less competition may face less pressure than those in metropolitan markets (including suburbs and exurbs), but even these banks face online competition for 1-4 family mortgages (e.g., from Rocket Mortgage) or for savings deposits (e.g., from Capital One). In larger markets, community banks that run up against the national banks (e.g., Citibank, JPMorgan Chase, Wells Fargo, Bank of America) or super-regional banks (e.g., M&T Bank, PNC Bank, US Bank, Zions) may need a strategy to provide more complete mobile banking platforms to attract both retail depositors and business customers, especially for commercial and industrial (C&I) loans.

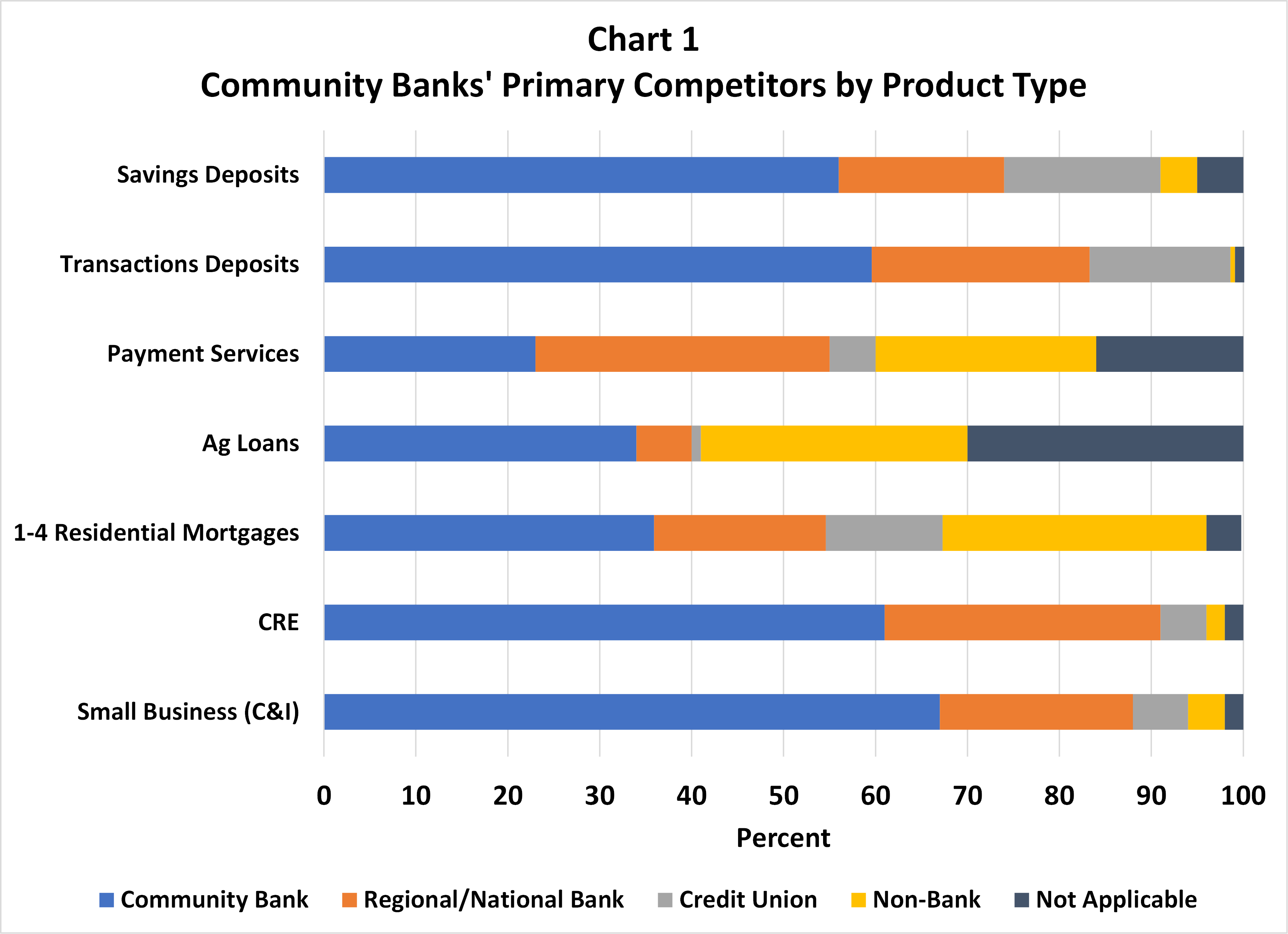

Chart 1 shows that responses to the 2021 Survey reveal a multi-faceted competitive landscape. Other community banks (blue bars) are the most important competitors for small business (C&I loans) and CRE loans as well as deposits, followed by regional/national banks (orange bars). Credit unions (grey bars) are a more important competitor for transactions and savings deposits and to a lesser extent for 1-4 residential mortgages. Nonbank financial institutions (yellow bars) are notable primary competitors for 1-4 residential mortgages (e.g., Rocket Mortgage by Quicken), agricultural loans (e.g., Farm Credit Administration) and payment services.

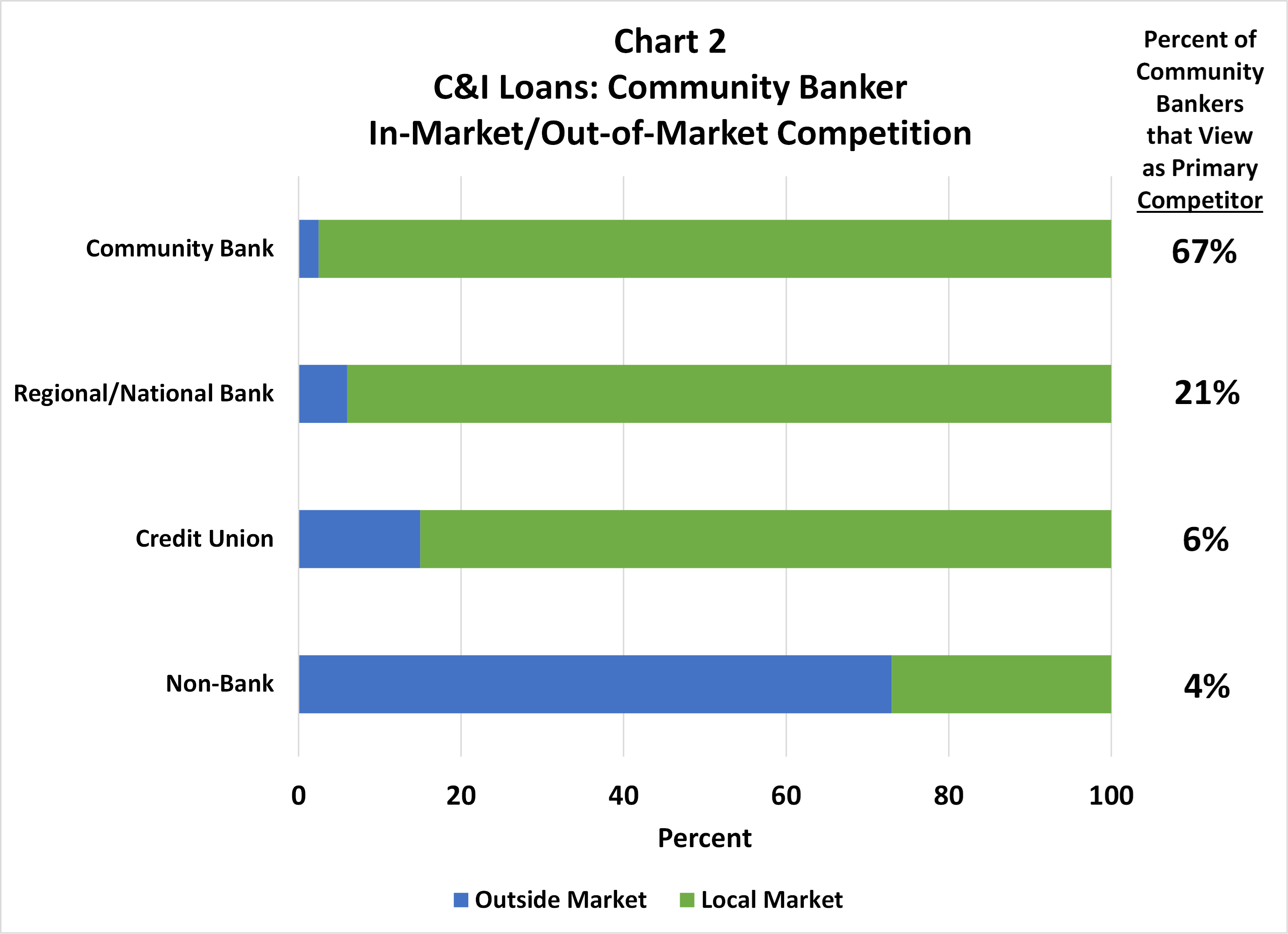

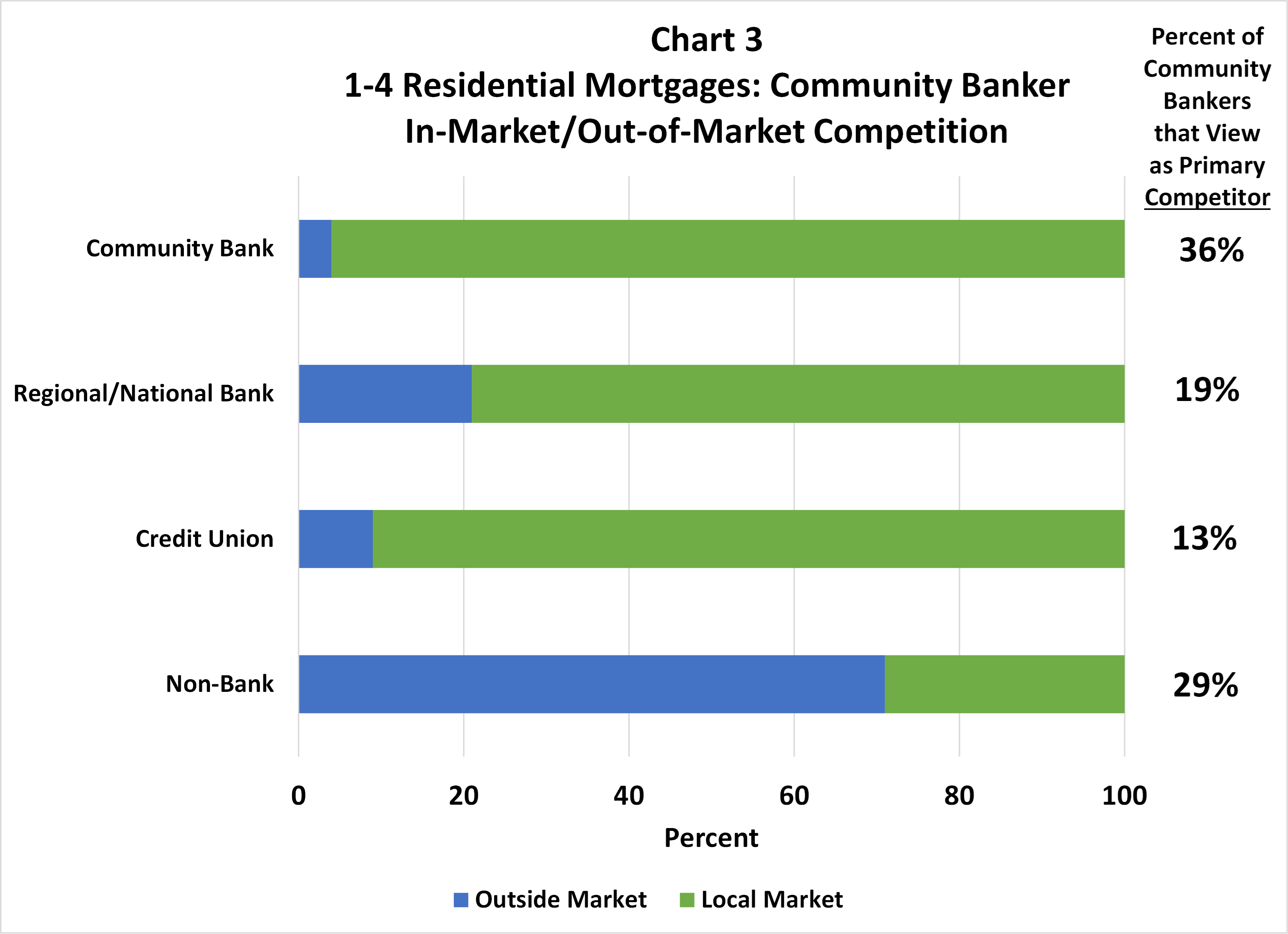

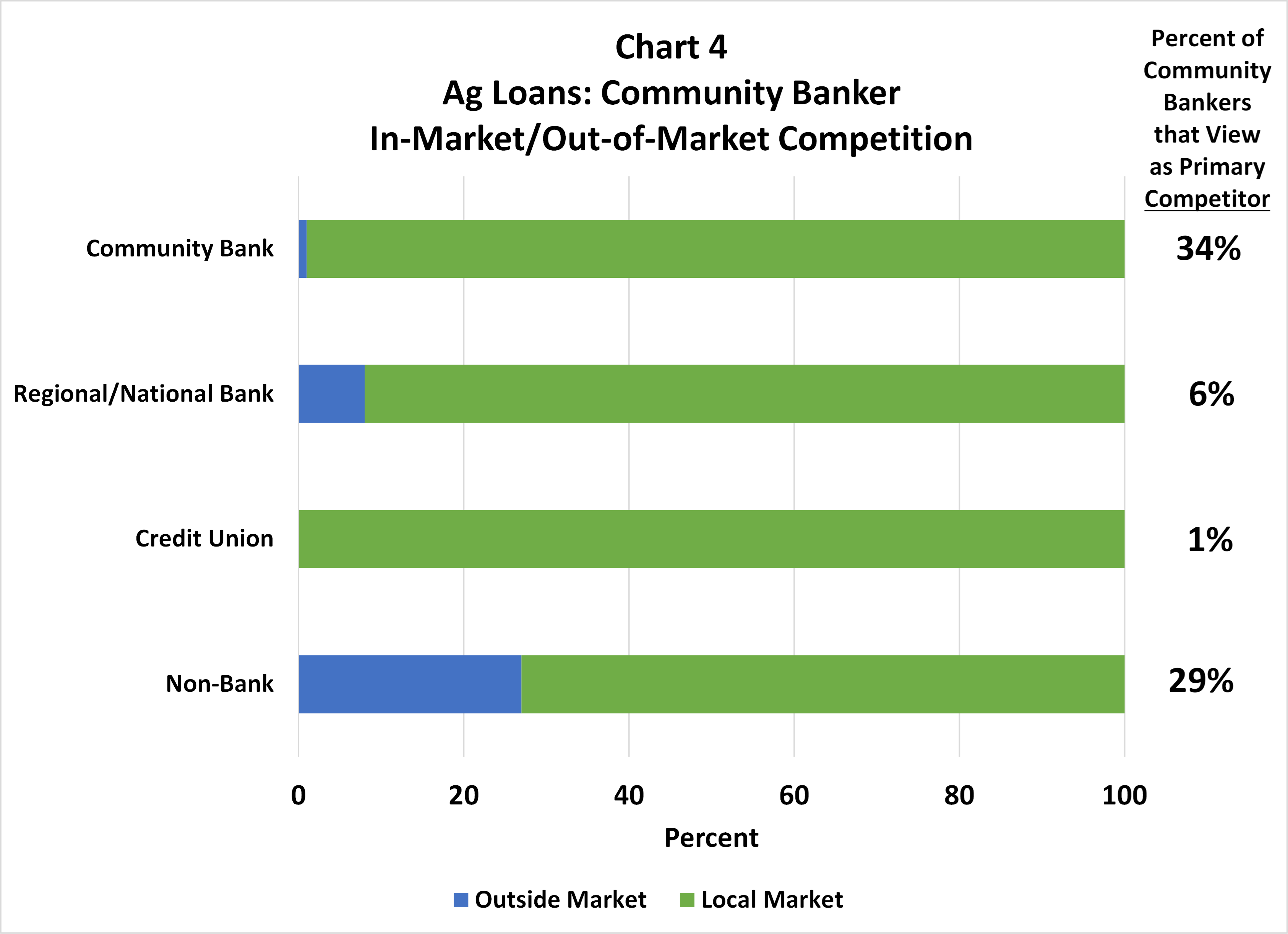

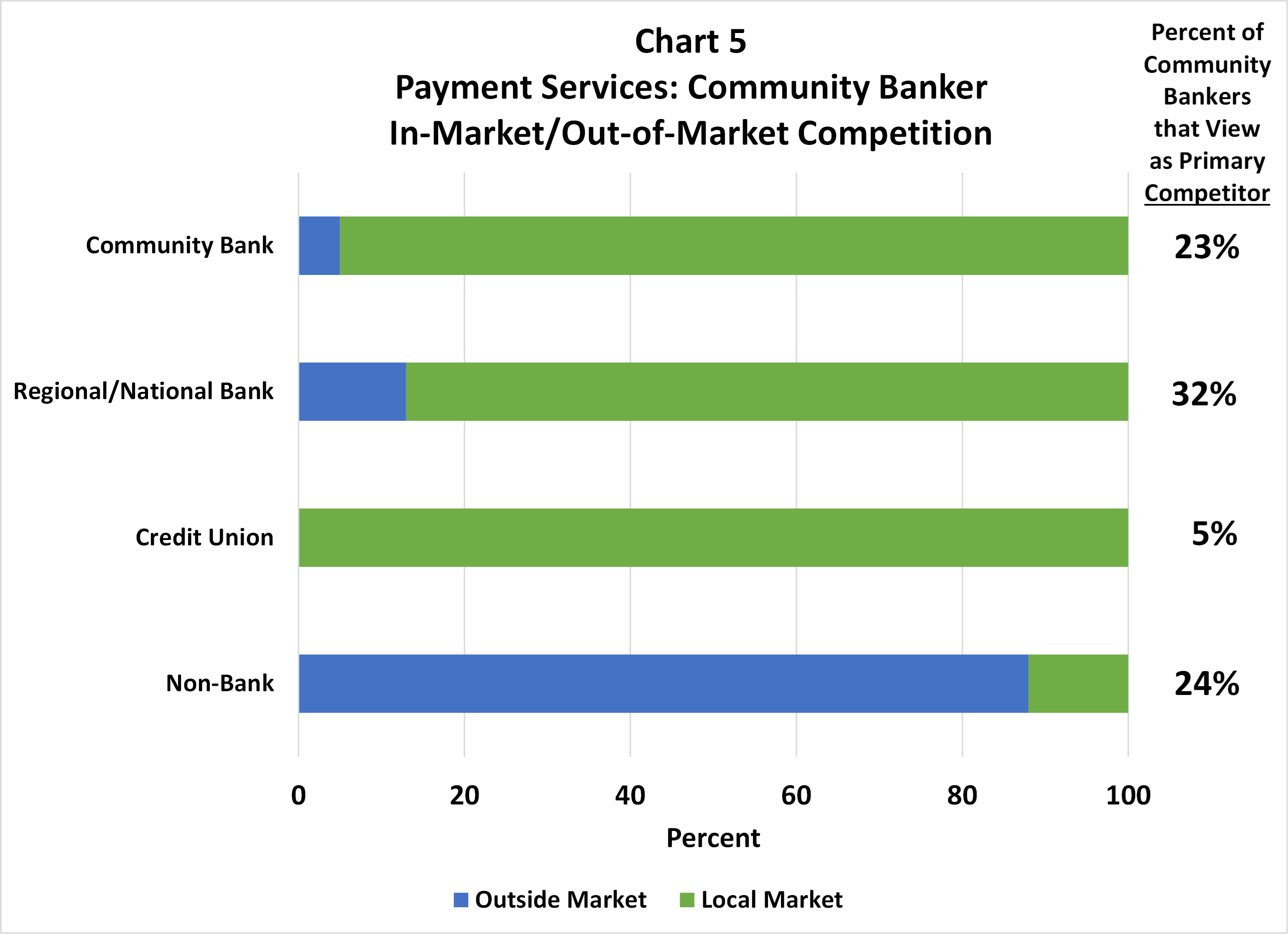

Charts 2-5 give a flavor of the in-market (a physical presence) versus out-of-market (no physical presence) for the primary competitors and some of the products shown in Chart 1.

For C&I loans (Chart 2), most of the competition comes from local markets, however, nonbank financial institutions―which may represent on-line fintech competitors―are significant out-of-market competitors. Note that the bars are not “weighted” for the primary competitors shown in Chart 1. For example, even though 73% of the nonbank loans are out-of-market competitors, only 4% of the respondents reported nonbanks as their primary competitor for C&I loans.

Residential mortgages (Chart 3) show a slightly different pattern with a higher presence of out-of-market regional/national banks. Agricultural loans (Chart 4) have mostly local competitors, including nonbanks that likely reflect a local Farm Credit Administration affiliate. And finally, payment services (Chart 5) show the highest percentage of out-of-market competitors, which likely includes Venmo, Paypal, and fintech business competitors such as Square.

Conclusion

In this second paper of our seven-part series on Adapting to the Digital Age: Community Bankers’ Perspectives on Technology, we show that community banks face competitive pressures from many directions: other banks, fintech companies, credit unions, government sponsored agencies, and more. These competitive pressures, combined with the challenging economic environment discussed in our first blog make it more difficult to grow franchise value. One path to reverse the trend is through investments in technology.

In our next blog, we will examine which tech-enabled products community bankers use as well as the intensity of usage.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter